Asset Allocation Bi-Weekly – Have Policymakers Solved the Tinbergen Problem? (March 27, 2023)

by the Asset Allocation Committee | PDF

Central banking was initially created to address commercial bank runs. Commercial banks engage in a liquidity transformation, where they accept deposits, which are mostly available on demand, and turn that liquidity into less-liquid assets, usually loans or securities. Bank revenue comes from capturing this liquidity premium as less-liquid assets tend to pay a higher return than liquid ones—the advantage for giving up immediate access to the funds. A bank run occurs when depositors demand their cash back en masse but the bank cannot liquidate its loan and security assets quickly enough or at a high enough price to meet the demands of depositors. Central banks were created to accept the loans and securities from the banks in return for cash, which would allow them to address the liquidity demands of depositors.

Over time, central banks have been given additional roles. For example, during WWII, the Federal Reserve facilitated Treasury borrowing for the war effort by fixing interest rates along the entire yield curve. In the U.S., the Fed has been given the additional mandate of conducting monetary policy to achieve full employment and stable prices. As part of its financial stability mandate (described above), the Fed is also a bank regulator. At the present time, the Federal Reserve has three main mandates: financial stability, stable prices, and full employment.

Jan Tinbergen was a Dutch economist who was awarded the first Nobel Prize in economics. He formulated a rule stating that policymakers need an equal number of policy tools for an equal number of problems. If the Fed has three mandates, the Tinbergen Rule would suggest that it needs at least three policy tools. If it has less than three tools, then it may be forced to choose which mandate is the most important.

The Fed’s most important policy instrument is the fed funds rate, which (directly or indirectly) sets short-term borrowing costs for the economy. Although it has regulatory tools as well, for most of its history the interest rate tool has been its primary method for meeting its mandates. Clearly, this situation violates the Tinbergen Rule, and as such, this means the FOMC will occasionally find itself facing the Tinbergen Problem, which requires that it must choose one mandate over the others.

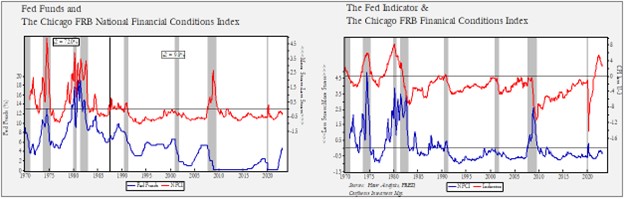

The key question we will try to address is, what does the FOMC do when faced with the Tinbergen Problem? More specifically, what does the Fed do if it faces a conflict between its financial stability mandate and its inflation mandate? To measure the financial stability mandate, we use the Chicago FRB’s National Financial Conditions Index (NFCI). This index of 105 financial market variables is the longest-running index of its type.

The chart on the left shows the fed funds rate along with the aforementioned NFCI. From the index’s inception in 1973 until July 1987 (when Paul Volcker’s term as Fed Chair ended), the correlation between the two series was 72%. After August 1987, it fell to 9.8%. When the FOMC changed rates during the earlier period, there was a nearly immediate response seen in financial conditions. In the later period, the correlation declined. What changed? In the earlier period, the FOMC was dealing with a persistent inflation problem. The chart on the right shows our Fed indicator, which is the yearly change in the CPI less the U-3 unemployment rate. After Volcker, monetary policy appeared to have been aimed at keeping the Fed indicator below zero. The Fed would raise the policy rate when the indicator approached zero, essentially treating a negative Fed indicator as having met the inflation/full employment mandates. Note that when the NFCI rose during this period, the policy rate was usually reduced. This is how the Fed resolved the Tinbergen Problem. By preemptively keeping prices stable (and arguing that price stability led to full employment in the long run), the Fed could directly address threats to financial stability.

Financial markets began to expect that when financial stress rose, monetary policy would be eased. Investors would suffer through the declines in risk assets during stress events but would also assume that easier policy was on the way, which would support an eventual price recovery. In other words, when faced with the Tinbergen Problem, policymakers would opt to reduce financial stress. Since this policy has been in place for over 35 years, it makes sense that investors would expect easier policy when “something breaks” in the financial markets.

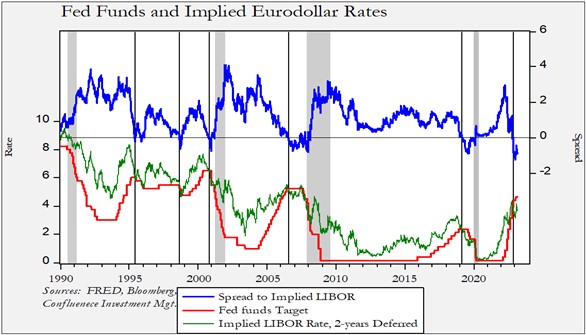

The recent bout of financial system problems has raised expectations that the FOMC will stop raising rates. Financial markets have been signaling for some time that the Fed should end this tightening cycle.

This chart above shows the fed funds target rate compared to the implied three-month LIBOR rate from the two-year deferred Eurodollar futures market. Because LIBOR lending isn’t government guaranteed, the rate usually exceeds the fed funds rate. However, there are occasions when the spread inverts; we show this on the chart with vertical lines. Usually, the inversion leads to at least an end in the tightening cycle. That hasn’t been the case thus far, and we suspect the Fed has continued tightening due to elevated inflation.

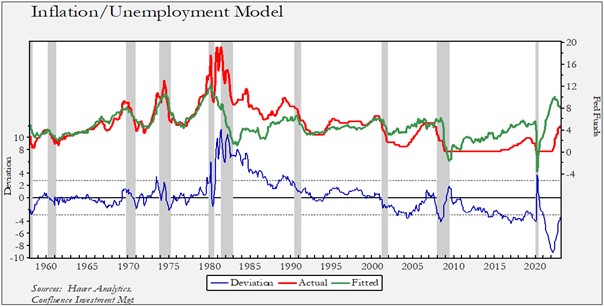

The key question is, now that we have seen a financial stress event, will the FOMC follow the pattern of the past 3.5 decades and end its tightening cycle? We suspect the Fed is close to the end, but, as the chart below shows, cycles don’t usually end until the policy rate is at least within the model’s lower standard error band.

This model projects the fed funds rate using the Fed indicator as the independent variable. Since 2000, the FOMC has tended to hold the policy rate around the lower deviation line. The current deviation is about 40 bps below the lower standard deviation line, suggesting that the Fed is 15 bps short of “neutral.” We note that the rate was raised to fair value during the tightening cycle in 2004-2006, but we would not expect that to occur in this cycle.

Since the Fed has created a backstop for bank deposits called the Bank Term Funding Program, policymakers may be less inclined to lower rates due to the recent financial concerns. If so, the Fed may keep raising rates until inflation falls to an acceptable level. Given that market participants mostly expect tightening to end when the financial system comes under stress, further rate increases may be an unwelcome surprise. But, in any case, we suspect we are near the end of this tightening cycle.