Asset Allocation Bi-Weekly – The Great Divergence (June 20, 2023)

by the Asset Allocation Committee | PDF

The S&P 500 is up 10% year-to-date and briefly reached the 4,200 level in late May. The recent rally in equity markets has been driven by the rise of generative artificial intelligence (AI), which has bolstered tech stocks. In fact, much of this strong performance has come from the five largest tech companies, which now account for 24.7% of the index’s value, a record high. This concentration has led some investors to fear that a bear market similar to the dot-com bubble burst of 2000 may be on the horizon. The pessimistic outlook is related to concerns that the underperformance of the broader index has generally followed previous periods of high market concentration.

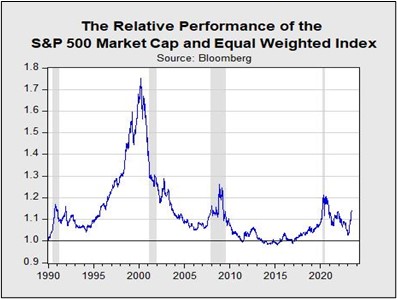

The chart above shows the relative performance of the S&P 500 Market Capitalization and Equal Weight indexes over the past 30 years. During times of uncertainty, investors tend to pile into established companies with large market capitalizations. These firms are typically better positioned to weather a downturn as they have more resources and access to capital. In this environment, the Market Cap index generally outpaces its Equal Weight counterpart. However, this outperformance does not usually last long. When the market recovers, investors often go bargain hunting as the lesser names are likely to offer more value. Thus, the Equal Weight index can outperform the Market Cap index over an extended period. That said, the recent unevenness is different than in previous market rallies.

The 2020 tech rally was driven by monetary and fiscal stimulus. The Federal Reserve injected billions of dollars into the financial system, which lowered interest rates and encouraged investors to take on more risk. Additionally, many households had excess savings due to the COVID-19 pandemic stimulus, which increased the number of retail investors. Overall, tech stocks benefited as investors looked for better returns. However, the rally was not sustainable.

As the Federal Reserve began to tighten monetary policy in 2022, interest rates rose and investors became more risk-averse. This led to a sharp decline in tech stocks, which continued until early 2023, when people began to focus on the investments that Microsoft (MSFT, $346.10) had made in machine-learning company OpenAI. The investments signaled the company’s commitment to artificial intelligence and its potential to usher in a new technology wave.

The craze for AI reached new heights in May after chipmaker Nvidia (NVDA, $431.33) forecasted that strong demand for AI chips could help the company generate $110 billion in revenue in 2024. The news led to one of the biggest tech rallies in two decades as the tech-heavy Nasdaq Composite Index rose by more than 7% in May.

Analysts have compared the release of AI-related products such as ChatGPT to the advent of the internet browser, calling it a game-changer. Although still under development, the product has a wide range of potential uses, from content creation to task automation. The technology’s diverse applications have encouraged investors to purchase AI-related stocks at a premium as they are willing to pay for AI-related companies based on their future cash streams as opposed to current earnings.

Unlike the dot-com boom of the early 2000s, many of the companies developing AI technology are not startups. The major movers in AI are established tech giants, such as Microsoft, Amazon (AMZN, $126.50), Alphabet (GOOG, $124.77), Meta (META, $280.34), Baidu (BIDU, $148.19), Tencent (TCEHY, $45.55), and Alibaba (BABA, $92.13). These companies have proven track records of success, and they are unlikely to fail if the AI bubble goes bust. As a result, the recent rally in tech stocks poses significantly less risk than the internet mania of the early 2000s because the firms driving the rally are more stable and have better track records of profitability.

While the Market Cap index has outperformed recently, this outperformance is unlikely to last. Economic growth is expected to slow in the second half of the year, which could lead to a new down-leg in the market. As demand decreases, earnings will likely be negatively impacted, leading to a decline in stock prices. However, we do not expect the repricing of major tech companies to lead to a market crash. Instead, we believe other stocks within the S&P 500 will be less affected. Consequently, the Equal Weight index may recover against the Market Cap index toward the end of the year. Additionally, these companies could be very attractive once economic growth begins to pick up.