Asset Allocation Bi-Weekly – America’s AI Buildout and Its Market Risks (January 5, 2026)

by Thomas Wash | PDF

The construction of data centers has come to define the US economic narrative of 2024 and 2025. This unprecedented buildout reflects the urgent need to adapt national infrastructure to the rapid proliferation of artificial intelligence (AI). While the surge in investment has provided a powerful boost to economic activity, it has also sparked growing concerns that the boom may be veering toward excess. The sheer scale of spending — financed by a rising mix of cash and leverage — has begun to crowd out other sectors, leaving the broader economy increasingly exposed to any slowdown in AI momentum.

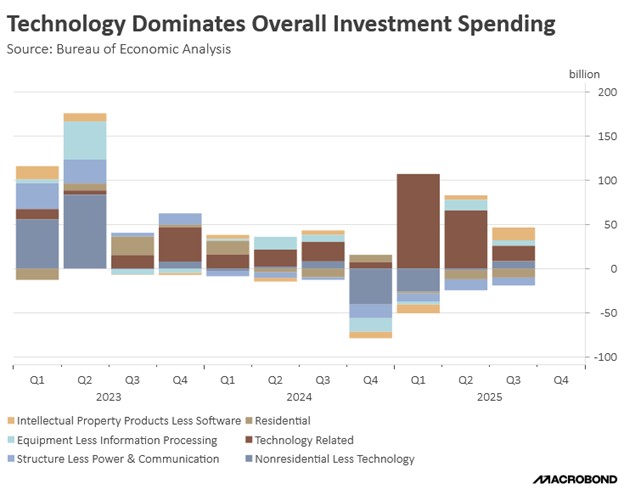

In 2025, a renewed wave of AI investment played a critical role in stabilizing growth amid escalating trade uncertainties. During the first quarter, fixed investment spending acted as a key buffer, offsetting a pronounced deceleration in household consumption and other cyclical sectors as sentiment softened. Technology-related investment expanded at an annualized pace of nearly $100 billion in the first three months of the year, which eclipsed the roughly $25 billion increase in personal consumption and lifted total fixed investment growth to approximately $50 billion. In effect, AI infrastructure became the economy’s primary growth engine at a moment of mounting fragility elsewhere.

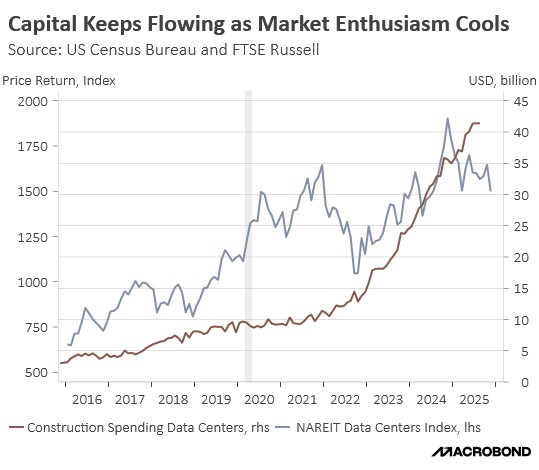

This divergence between investment in technology and broader economic activity was not a first quarter anomaly. Rather, it marked a sharp acceleration of a trend that first emerged in late 2023. The catalyst was the so-called “ChatGPT moment,” which triggered a dual-track surge across financial and physical capital. Beyond inflating valuations in AI-adjacent equities, the breakthrough ignited a historic infrastructure race as firms scrambled to build the computing capacity required to meet surging demand. What began as a technological inflection point quickly evolved into a macroeconomic force.

Over the last two years, data center construction has become one of the largest sinks for global liquidity, and the scale of these projects has pushed even the largest technology firms toward their financial limits. According to Apollo Global Management, hyperscalers are now reinvesting roughly 60% of operating cash flow into capital expenditures — the highest level on record. To sustain this pace, companies have increasingly turned to debt financing, opting to preserve balance sheet flexibility while locking in relatively favorable long-term borrowing costs to fund infrastructure with multi-decade horizons.

While debt financing has fueled the tech sector’s expansion, it has inadvertently strained other parts of the economy. As financial institutions concentrate their lending on AI infrastructure, affordable capital has become increasingly scarce for other sectors, producing a “crowding out” effect that is now impacting Main Street. In 2025, a rising number of non-tech firms were forced into bankruptcy. These businesses cited a toxic combination of rising input costs and tightening credit conditions as the primary drivers of their insolvency.

Moreover, this lack of diversification has left the financial system and the broader economy susceptible to shifts in AI sentiment. While current data centers operate at high capacity, mounting evidence suggests that the pace of construction may far exceed sustainable demand, leading to fears of speculative overcapacity. These concerns have fundamentally called into question the credit quality of the debt issued to fund these projects, as investors worry that the underlying cash flows may not materialize in time to service these record-breaking obligations.

Signs of caution are already emerging. In December 2025, IBM CEO Arvind Krishna warned that the economics of the AI infrastructure race may prove untenable, estimating that the industry would require nearly $800 billion in annual profits merely to keep pace with interest obligations. At the same time, Blue Owl Capital’s withdrawal from a planned $10 billion data center project in Michigan underscored a shift in lender sentiment. As financing partners grow more wary of high leverage and uncertain returns, speculation is rising that the data center boom could face a reckoning within the next two years.

Still, the outlook is not uniformly pessimistic. Despite the economy’s growing reliance on AI-driven investment, there is little evidence of an imminent downturn. Consumer spending remains resilient, business sentiment is showing tentative signs of improvement, and early gains in AI-enabled productivity are beginning to diffuse beyond the technology sector. These dynamics suggest that meaningful opportunities persist for investors, even as the initial speculative fervor surrounding AI fades.

In this environment, diversification is prudent. A strategic pivot toward value-oriented equities offers a way to reduce exposure to concentrated AI risk while maintaining participation in broader economic growth. Such a shift may entail a modest sacrifice in short-term upside, but it provides a critical safeguard should the AI infrastructure cycle prove less durable than current investment levels imply.