Asset Allocation Bi-Weekly – Gold: An Update of Current Conditions (February 7, 2022)

by the Asset Allocation Committee | PDF

Gold moved steadily higher from the late summer of 2018 into August 2020. Prices then declined toward $1,700 and have since traced out a trading range between $1,700 and $1,900. In this report, we will update our views on the metal.

We have been holding gold in our asset allocation portfolios since 2018, although we have diversified our commodity holdings by adding a broader commodity ETF alongside our gold position.

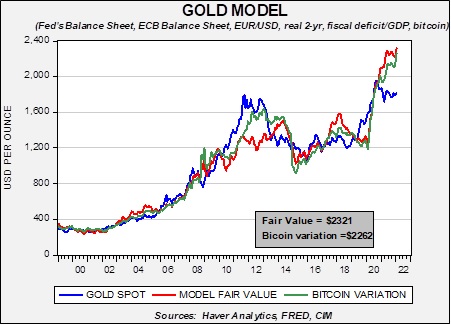

The long-term outlook for gold remains positive. Our basic gold model, which uses the balance sheets of the Federal Reserve and the European Central Bank, the EUR/USD exchange rate, the real two-year T-note yields, along with the U.S. fiscal deficit relative to GDP, suggests prices remain undervalued. To account for the impact of bitcoin, we have added a variation to our gold model to take the cryptocurrency into consideration. In both variations, gold remains undervalued.

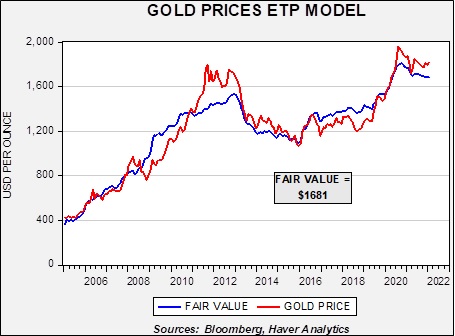

So, what is keeping gold undervalued? We believe it is mostly due to short-term factors. First, investor flows are not high enough to lift gold to our long-term models’ fair value. The chart on the left overlays the price of gold and the fair value based on flows to gold exchange-traded products. Flows suggest gold is actually overvalued. Why are investors shunning gold? Last year, it appeared crypto-currencies were siphoning off investor flows that traditionally would have gone to gold. But with cryptocurrencies falling in price, gold has not benefited, at least not yet. Most likely, fears of FOMC policy tightening are weighing on gold.

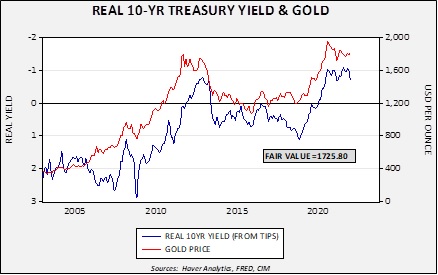

Second, real interest rates, measured by the TIPS spread, suggest gold is overvalued. Real 10-year yields have risen sharply recently, reducing the fair value of gold to $1,725.80.[1] So far, gold has not reacted to the rise in real yields, but it could pressure gold prices in the coming weeks.

In our most recent asset allocation rebalancing, we reduced our exposure to gold, using some of the allocation to increase our position in broader commodities. Concerns about short-term weakness in gold prices played a role in that decision. In addition, we expect some commodities, such as energy, to rally if a geopolitical event occurs in Europe or Asia. At the same time, we remain long-term gold bulls, and thus, we want to maintain an allocation to the metal.

[1] On the chart, the scaling for the real yield is inverted.