Asset Allocation Bi-Weekly – Where’s the Recession? Examining Employment (August 14, 2023)

by the Asset Allocation Committee | PDF

In August of last year, our yield-curve indicator signaled an inversion, which implies that a recession is set to occur within 16 months, on average. And so, we are still within range of a recession occurring by year’s end. However, the economic data continues to show improvement, raising hopes that the economy will avoid a full downturn. In our May 22 report, we noted that new home sales were doing quite well, mostly because existing home sale listings were unusually low. Essentially, the fact that most homeowners have a mortgage rate well below the current market is dampening home sales. This improvement in housing has lowered the odds of recession.

In this report, we will discuss another aspect of why the recession has been avoided thus far—the labor markets continue to remain tight. In Walter Scheidel’s book, The Great Leveler,[1] he postulated that inequality rises over time and that there are only four consistent factors that cause inequality to retreat: mass industrial war, revolution, the breakdown of civil society, and pandemic. Scheidel noted that after the Black Death, the loss of workers due to the plague led to a dramatic decline in workers, causing wages to rise. Fortunately, the COVID-19 pandemic was not nearly as lethal as the Black Death, but it did have an impact on older workers’ participation in the labor force.

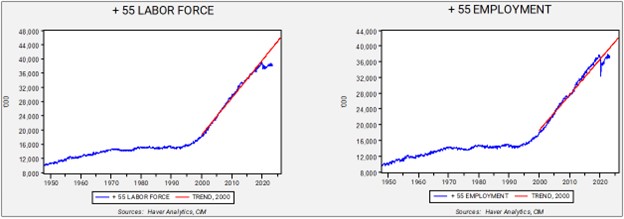

The chart on the left shows the over-55 labor force, while the chart on the right shows employment for the same cohort. We have regressed a time trend through both series starting in 2000. Note the onset of the pandemic led to a notable drop in both the labor force and employment for this age bracket. How important is this development? If the pre-pandemic trends had remained in place, the current unemployment rate would be 4.9% instead of 3.6%.

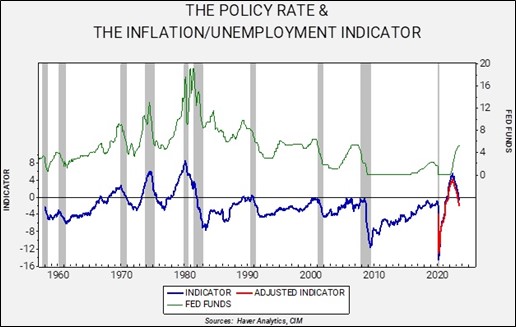

Using our Fed indicator, which subtracts CPI from the unemployment rate, if we use the pre-pandemic trends for employment in the labor force, then the indicator would be reading -1.94 instead of the current -0.63. This reading would be consistent with at least steady policy and would likely be signaling the need to ease policy.

Overall, this study suggests that the labor market is tight because of older workers exiting due to the pandemic, an unusual circumstance. Since the lethality of COVID-19 increased with age, it made sense that older workers left the workforce. There has been speculation that they will eventually return, and they have, according to the data, but not to the pre-pandemic trend levels. This analysis doesn’t mean the labor markets are not tight, but the tightness is partially due to the circumstances surrounding the pandemic. Labor market tightness has tended to support wage growth which, in turn, has supported economic growth. Although we still expect a recession in the coming months, there is a clear case that the lack of existing home supply and the exodus of older workers have reduced the economy’s sensitivity to rate hikes. If inflation continues to decline (as we expect), then there is a chance that the U.S. can avoid a formal downturn.

[1] Scheidel, Walter. (2017). The Great Leveler: Violence and the History of Inequality from the Stone Age to the 21st Century. Princeton, NJ: Princeton University Press..