Asset Allocation Bi-Weekly – The Fed’s Employment Surprise (April 24, 2023)

by the Asset Allocation Committee | PDF

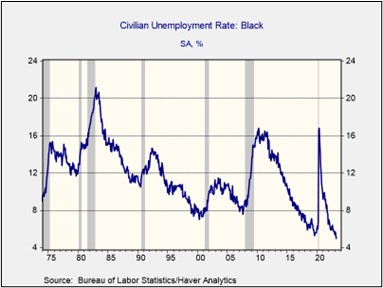

This is the tightest labor market for Black Americans in U.S. history. The Black unemployment rate fell to an all-time low in March unsurpassed since the Bureau of Labor Statistics began a separate calculation for Black workers in 1972. Meanwhile, the labor force participation rate for Black Americans hit a two-decade high, and the employment/population ratio for Black people exceeded the ratio for white people for the first time since the Labor Department started tracking the data. The improved employment conditions for Black Americans will be cheered by policymakers at the Federal Reserve, which has long pushed for an inclusive recovery. However, this doesn’t make the Fed’s future interest rate decisions any easier.

In March 2021, the Federal Reserve reframed its maximum employment goal mandate to include minority unemployment. At the time, the Black unemployment rate stood at 9.6% and the Hispanic unemployment rate was 7.7%, both well above the national rate of 6.1%. The disparity led to concerns that the Fed’s tightening would disproportionately impact minority groups. To help justify why he was not ready to lift rates, Fed Chair Jerome Powell argued that high unemployment in minority groups is a sign of slack within the labor market.

Powell’s reluctance to tighten policy made him a target of criticism. Annual inflation as measured by the consumer price index reached 7.5% before the Federal Reserve finally decided to raise rates in March 2022. Powell’s lack of response led to complaints that the central bank had allowed inflation to get out of control. During his renomination hearing, politicians accused Powell of allowing economic inequalities distract from the central bank’s mandate of maintaining price stability. As a result, Powell reassured lawmakers that the Fed was ready to increase borrowing costs as needed to address the rising price pressures.

In contrast to Fed expectations, labor market conditions improved for Black workers even as the central bank tightened policy. In just over a year, the Fed increased its policy rate by 475 bps, its fastest hiking cycle in history. During the period between February 2022 and March 2023, Black unemployment fell from 1.339 million to 1.114 million, for a decline of 16.8%, while total unemployment fell from 5.979 million to 5.839 million, for a decline of 2.3%. In other words, the number of Black unemployed workers fell more than seven times faster than the national rate. Tight policy with lower Black unemployment has added to speculation that the labor market is overly tight.

The improvement in employment conditions for Black workers reflects a secular demographic trend. The white civilian labor force participation rate has steadily declined since 1997, when it peaked at 67.6%. The pandemic accelerated this trend as older white males were reluctant to return to the workforce after being sidelined during lockdowns. Their exit reflects the age divide among racial groups. At 58 years old, the median age for white workers is more than twice that of minority workers, suggesting that many of the white workers likely left the market for good.

The participation gap shows that the Fed may need to rethink its view on minority employment. The lack of white workers means that minority groups will have more job opportunities than in previous generations. Additionally, the shortage of workers should lead to a lower overall unemployment rate and higher wage gains for minority workers. These labor market conditions suggest that the Fed could tighten policy without hurting marginalized groups. As a result, the Fed may now keep rates higher for longer.

However, the recent change in the labor market implies that the Fed’s full employment target may be too high. Its labor tightness gauge, known as the non-accelerating inflation rate of unemployment (NAIRU), currently sits at 4.42%, although this may not be accurate. NAIRU is calculated using the historical relationship between the unemployment rate and changes in the rate of inflation. This relationship likely does not account for the acceleration of white workers exiting the labor market due to the pandemic. The actual NAIRU may be lower, so it is possible that the Fed may need to lower rates sooner than the NAIRU would suggest.

The major dropout of white male workers from the job market has benefited minority workers but may complicate Fed policy. Because the drop in Black unemployment reflects a demographic shift, it may not be a valid tool for measuring employment slack in the labor market. That said, employment conditions for Black Americans suggest that the Fed will likely not return rates to zero any time soon. This market environment should be favorable to “value” assets as higher interest rates should dissuade investors from holding riskier, longer-duration securities.