Daily Comment (August 14, 2018)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] We are seeing some risk-on behavior this morning; the Turkish lira is higher but it looks more like a deceased feline rebound rather than anything of substance. Here is what we are watching today:

Turkey: As noted above, the TRY is higher this morning, rebounding about 6%, after Turkish President Erdogan gave a speech calling for a boycott of U.S. technology products. Erdogan reiterated a strong stance against the weak lira and rising inflation but offered nothing that would end the crisis. He continues to avoid orthodox measures, such as a jump in interest rates or going to the IMF for a bailout package. National Security Advisor Bolton met with the Turkish ambassador to the U.S., Serdar Kilic, at the White House at the request of the Turkish official.[1] According to reports, the meeting was over the detained U.S. pastor, Andrew Brunson. We suspect Turkey has concluded that the benefit of holding Brunson isn’t worth the cost but is struggling to hand him over to the U.S. without looking weak. At the same time, we doubt President Trump has any interest in allowing Erdogan a face-saving exit. Thus, the tensions continue. So, for today, we are seeing a respite but there is no sign of steps to resolve the crisis.

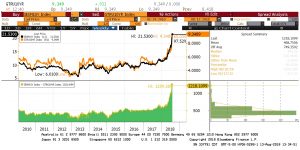

Turkey’s government issues bonds denominated in lira and U.S. dollars. We note that yields on both instruments have increased but, more importantly, the spread has widened well more than normal. As the chart below shows, for most of the past seven years, the spread between the two instruments was 500 bps. The spread is now out over 1,200 bps, a reflection of worries about the future path of Turkish policy.

A terrorist act at Parliament: It appears a man in the U.K. used his vehicle to strike several people in front of the Parliament building before crashing his car into protective barriers. There have been no reported fatalities but several injuries. Scotland Yard is treating the event as a terrorist act. This may have been a spur of the moment attack; we note Parliament is not in session and most MPs are off for the summer. Thus, the potential disruption to government was low.

The Iran standoff continues: Ayatollah Khamenei announced today that he is forbidding Iranian officials from any negotiations with the U.S.[2] Interestingly enough, Khamenei acknowledged the economy’s poor performance but blamed domestic mismanagement and corruption as the cause. In other words, sanctions are not really a problem but the Rouhani government is inept. We have recently discussed Iran’s options in a three-part series in our Weekly Geopolitical Reports.[3] We note that Khamenei said today that Iran would not start a war with the U.S. and he isn’t worried that the U.S. would attack Iran. Khamenei’s stance looks like he is betting that sanctions won’t be all that difficult to deal with and non-compliant nations, like Russia and China, will offer enough support to keep the Iranian economy going. The comments also suggest he is preparing the country for slower growth and appealing to nationalism.

China critical of defense act: Yesterday’s signing of the new defense act has drawn criticism from China as the Committee on Foreign Investment in the United States (CFIUS) has been strengthened as part of that new legislation.[4] The Chinese feel (correctly) that the investment scrutiny is targeted at them. In addition, the new law calls for strengthening Taiwan’s defense, which is seen as a direct threat against China.

Maduro recommends a risky step:According to reports,[5] Venezuelan President Maduro is calling for an end to gasoline subsidies due to their increased cost to the government’s budget. With rapidly rising inflation, the gasoline subsidy has led to severe distortions. Venezuelan gasoline costs about $0.01 per liter,[6] the lowest in the world. The going price in Colombia is $0.80 per liter, so naturally there is a brisk business in smuggling Venezuelan gasoline to its neighbor. Many OPEC nations subsidize gasoline prices; it is seen as a national perk. History shows that raising the price of gasoline can cause internal unrest. Given that conditions are already difficult, this action may lead to widespread problems. We don’t disagree with the action but see it as a major risk.

[1] https://www.reuters.com/article/us-turkey-security-usa-bolton/trump-aide-bolton-met-turkish-envoy-to-discuss-u-s-pastor-white-house-idUSKBN1KY278

[2] https://www.ft.com/content/b3e22fd6-9f16-11e8-85da-eeb7a9ce36e4?segmentId=a7371401-027d-d8bf-8a7f-2a746e767d56

[3] See WGRs, Iran Sanctions and Potential Responses: Part I (7/30/18), Part II (8/6/18), and Part III (8/13/18).

[4] https://www.cnbc.com/2018/08/14/china-angered-by-new-us-defense-act-says-to-assess-content.html

[5] https://www.reuters.com/article/us-venezuela-economy/venezuela-gasoline-prices-should-rise-to-international-levels-maduro-idUSKBN1KZ01Z

[6] https://www.globalpetrolprices.com/Venezuela/gasoline_prices/