Daily Comment (February 19, 2026)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment opens with analysis of the latest Federal Reserve meeting minutes. We then turn to the upcoming Supreme Court ruling on tariffs, followed by updates on Iran, the US administration’s efforts to circumvent EU content restrictions, and the IMF’s push for China to reduce state subsidies. We also include a summary of key economic data from the US and global markets.

FOMC Pivot? Federal Reserve officials signaled openness to a rate hike following their latest meeting. Minutes from the discussion revealed concern that tariffs may have contributed to the recent rise in core goods prices. While some officials expressed optimism that these pressures could ease, most participants cautioned that progress toward the inflation target is likely to be slower and more uneven than previously anticipated. This caution has led some policymakers to consider further rate increases if inflation remains elevated for longer than expected.

- The decision to raise rates reflects the Federal Reserve’s growing confidence in the broader economy and its effort to closely monitor evolving conditions. Officials noted that, although hiring remains soft, there are emerging signs that the labor market may be stabilizing. They also expressed confidence in the economy’s underlying resilience, adding that productivity could strengthen further as more firms adopt artificial intelligence technologies.

- Although a few participants raised the possibility of increasing the federal funds target range, there was little evidence that a move is imminent. Most officials emphasized that policy is not on a preset course, favoring a steady approach at current levels. However, the more hawkish members advocated for language that recognizes a “two-sided” policy path, leaving the door open to additional rate hikes if inflation remains above target.

- The Fed meeting minutes suggest that policymakers view the current federal funds target as being within the range of estimates of the neutral rate, giving them flexibility to take their time before deciding on further rate cuts. The minutes also indicate that officials are paying closer attention to financial stability, with several members highlighting vulnerabilities in private credit markets and in the debt financing of AI-related infrastructure as areas that warrant ongoing monitoring.

- While the minutes indicate that the FOMC is unlikely to cut rates anytime soon and remains noncommittal about the timing of any potential easing, markets appear to expect the first cut as early as June, with two reductions currently priced in for the year. Whether the market’s expectations prove accurate will likely influence the dollar’s performance, as much of its recent depreciation has been driven by widening interest rate differentials with other major economies.

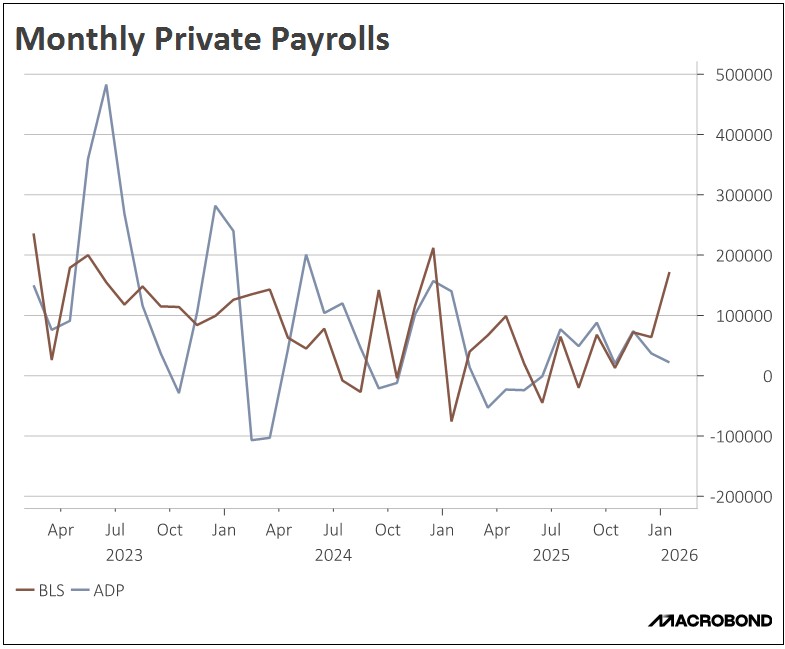

- At this point, we tend to side with the market’s view that the central bank is likely to cut rates more than the minutes suggest. For one, there are increasing signs that inflation is steadily moving toward the Fed’s 2% target. Additionally, while the latest BLS payroll report continues to show labor market strength, the ADP private payroll data points to emerging weaknesses. Taken together, these factors support our view that the Federal Reserve’s rate-cutting cycle still has room to run.

Supreme Court Tariffs: The US Supreme Court is expected to come out with a new set of rulings starting Friday focused on tariffs. Justices are set to give rulings on Friday, Monday, and Tuesday, which could potentially rule on whether or not the White House has the authority to impose tariffs without congressional approval. The impact of the ruling could potentially overturn tariffs that were previously imposed by the government and could lead to uncertainty regarding trade policy.

- There is growing speculation that the Supreme Court may ultimately curb the White House’s ability to impose tariffs unilaterally under emergency powers. During oral arguments, conservative-leaning Justice Neil Gorsuch warned that the White House interpretation would create a “one-way ratchet” of authority from Congress to the president. He cautioned that allowing such broad tariff powers could effectively leave the president with near‑unchecked authority in this area.

- The potential overturning of these tariffs would be a setback for the White House’s trade agenda, though it is unlikely to be a fatal one. The legal challenge at hand centers on the president’s use of the International Emergency Economic Powers Act (IEEPA) to enact his “reciprocal tariffs.” However, this represents just one pillar of his trade policy, which has also relied on Section 232 for national security tariffs and Section 338 to counter discrimination against US commerce.

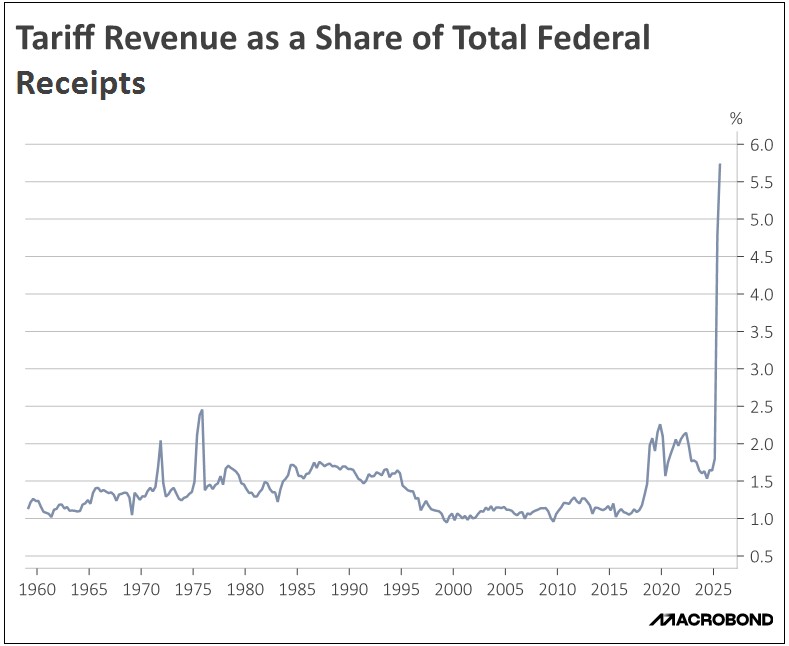

- However, the most significant challenge will likely concern how the government handles tariff revenues if those measures are ultimately ruled illegal. Numerous firms have already sued the government seeking refunds of duties paid under the contested tariffs, should they be invalidated. In addition, the loss of this revenue stream is likely to exacerbate concerns about the fiscal deficit, as tariffs have effectively functioned as an alternative source of federal income.

- Rolling back these tariffs would provide meaningful relief to the sectors most affected, particularly Consumer Staples and Consumer Discretionary, where margins have been under sustained pressure. This potential shift reinforces the case for diversification beyond AI‑related companies, as areas previously hurt by trade uncertainty may stand to benefit from greater clarity on policy direction.

Iran Conflict: Tensions between Tehran and Washington, which had previously appeared to be easing around potential nuclear talks, now seem to have stalled. Recent rhetoric has hardened on both sides, with Ayatollah Khamenei reportedly warning that Iran is prepared to target US ships and Washington responding by stepping up its military deployments in the region. While some of this brinkmanship likely reflects strategic posturing, the probability of miscalculation and a broader conflict has clearly risen.

Circumvent EU: The US appears to be taking steps that could undermine its allied governments in the EU. The White House is reportedly developing an online portal designed to allow users to bypass EU content restrictions, including those targeting material deemed by the bloc to be harmful — such as hate speech and terrorist-related content. The move comes as the US seeks to support the electoral appeal of right-wing parties in Europe. This development is likely to further strain transatlantic relations and could accelerate the EU shift toward strategic autonomy.

IMF Callout China: The International Monetary Fund has urged China to cut its industrial subsidies to 2% of GDP, roughly half of current levels. The organization criticized the excessive use of subsidies, warning that they may create spillover effects across the broader economy and contribute to China’s heavy reliance on exports. The IMF’s recommendation comes amid growing pressure from Western nations, particularly the United States, which argues that China’s industrial policies have created unfair market outcomes.