Asset Allocation Bi-Weekly – The Warsh Doctrine (February 17, 2026)

by Thomas Wash | PDF

When Kevin Warsh, President Trump’s nominee to be the next Federal Reserve chair, last departed the central bank in 2011, it was more than a career move — it was an act of ideological dissent. He cautioned that the Fed’s post-crisis expansion of authority would erode its institutional independence and set the stage for future inflation. Now, nearly 15 years later, he will return with a clear mandate: to unwind those interventions and champion a leaner, less market-intrusive central bank built on a simplified monetary framework.

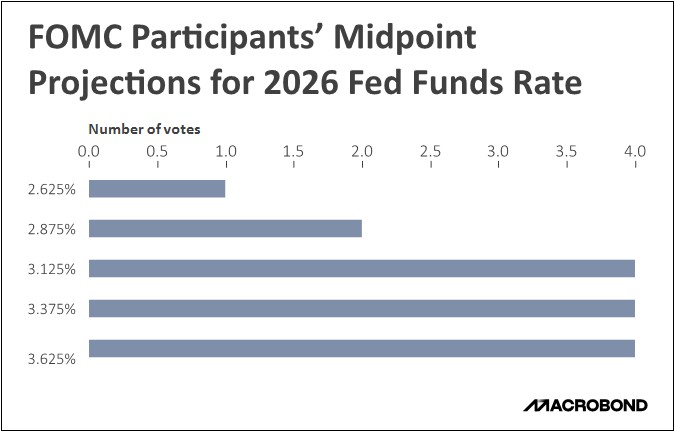

The institution he will rejoin, however, is profoundly transformed. The modern Fed has formalized its once-implicit 2% inflation target and fully embraced aggressive forward guidance. Through more frequent press conferences and the now-institutionalized Summary of Economic Projections, complete with its influential “dots plot,” the central bank has made transparency a core tool of policy. These measures aim to give markets a clearer sense of the Fed’s thinking and its likely policy trajectory.

Beyond the expansion of quantitative easing, the Fed has also entrenched its market presence by establishing permanent liquidity backstops. The Standing Repo Facility and the Overnight Reverse Repo Facility were created to reinforce the financial system’s plumbing, ensuring that the central bank can swiftly manage short-term interest rates and ease liquidity strains without resorting to ad hoc crisis measures.

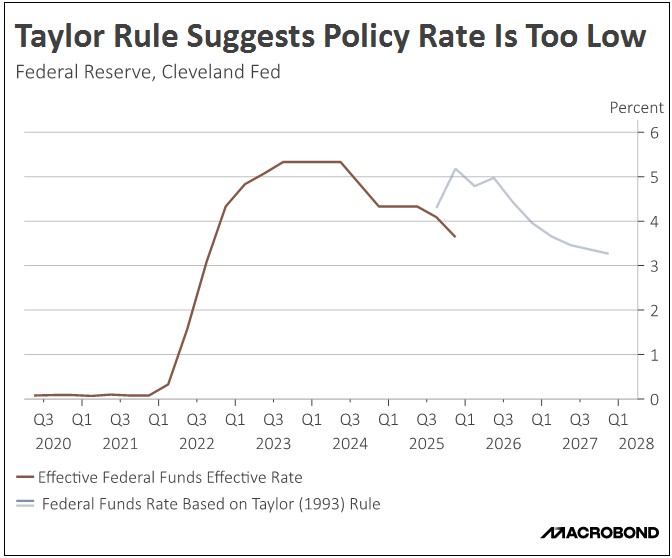

Under a Warsh-led Fed, we are likely to see a pivot toward operational simplicity aimed at reducing market uncertainty, though not without significant caveats. Warsh has historically championed a rules-based framework, where monetary policy is anchored to a transparent set of metrics. This would allow markets to more accurately self-price the direction of rates. However, in recent months, Warsh has moderated this stance, characterizing a “strict adherence” to rules as being more aspirational than absolute.

This evolution hints at a broader philosophical shift. A Warsh-led Fed may bring a chair (like Greenspan before him) willing to look beyond rigid economic models and instead rely on forward-looking judgment. Just as Greenspan saw transformative potential in the internet, Warsh sees it today in artificial intelligence, calling the current productivity surge “the most significant of our lives past, present, and future.”

This conviction clarifies why Warsh has hinted at temporarily overriding rules-based policy prescriptions in favor of lower interest rates, a tactical deviation based on his view of shifting productivity frontiers. His logic is that lower rates will stimulate corporate capital expenditure, thereby boosting investment to expand the economy’s productive capacity. This supply-side expansion could, in turn, help to lower inflationary pressures.

Furthermore, Warsh appears skeptical of a rigid 2% inflation target, having once dismissed it as “arbitrary.” Instead, he has advocated for a flexible inflation target band. Such a framework would grant the central bank greater operational leeway, providing a wider window to assess economic conditions before deciding the optimal course for rate adjustments.

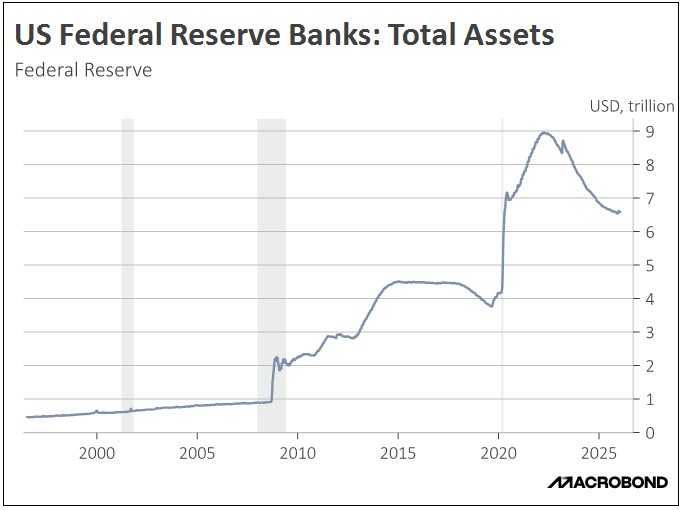

This does not mean Warsh would avoid pursuing a restrictive monetary policy. One area where he seems particularly focused is the normalization of the Fed’s balance sheet. Last May, he stated that if the balance sheet were to grow in line with the broader economy, it would stand at roughly $3.0 trillion. This suggests he might support allowing the current $6.6 trillion balance sheet to continue shrinking until it returns closer to that level.

As Warsh prepares to take the helm of the Fed, we anticipate a decisive but complex pivot. The guiding principle would be a return to a less transparent, more orthodox central bank, likely scaling back forward guidance to force markets toward greater self-reliance. The tension lies in the application. While being openly accommodative toward rate cuts to nurture AI-driven growth, he would almost certainly counterbalance this with a hawkish, determined campaign to shrink the Fed’s balance sheet.