Daily Comment (December 17, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment opens with the implications of the Venezuelan shipping blockade. Next, we discuss why weak labor data might not trigger a Fed rate cut in January. We then highlight critical market events, including US pressure on Russia for a peace deal, France mediating EU-China tensions, and US efforts to roll back European digital regulations. Finally, we include a roundup of essential domestic and international data releases to monitor.

Venezuelan Blockade: The US president has announced a total blockade of sanctioned oil tankers entering and leaving Venezuela, alongside the formal designation of the Maduro regime as a Foreign Terrorist Organization (FTO). This move marks a sharp escalation in tensions following months of friction between the two nations. The blockade appears to be part of a broader trend in US foreign policy, characterized by a renewed effort to exert influence over South America and a need to project power to the rest of the world.

- These recent White House actions represent a significant and dangerous escalation in a months-long campaign against Venezuela. This strategy has already included lethal strikes on vessels accused of drug trafficking and provocative incursions by US fighter jets into Venezuelan airspace. Additionally, the administration has also signaled its willingness to expand these operations to include land-based strikes.

- While the blockade of Venezuela is the most visible sign of increased US engagement in South America, it is not an isolated case. The administration has intervened both punitively and supportively across the region. For example, the US imposed tariffs on Brazilian goods and sanctioned a Brazilian Supreme Court justice in response to their treatment of former President Jair Bolsonaro. Conversely, the US has acted as a financial backstop for Argentina, following concerns about its currency.

- We believe the United States’ intensified focus on South America — what we term the “Modern Monroe Doctrine” in our 2026 Geopolitical Outlook — is primarily driven by the perception that expanding Chinese influence constitutes a direct national security threat. A central concern is the region’s deepening integration into China’s supply chains, especially through investments in mining for the critical resources required for China’s technological advancement.

- Moreover, Washington’s assertive posture toward Venezuela is a strategic signal to the global community, demonstrating its readiness to employ military force to secure its foreign policy objectives. This confrontational approach has a tactical similarity to both Russia’s military aggression in Ukraine and China’s coercive actions against Taiwan, underscoring a troubling pattern of using power to resolve international disputes.

- While our baseline forecast does not anticipate direct military conflict between the United States and its rivals within the next 12 months, the recent escalation of tensions has significantly increased that risk. We assess that rising instability in this region, in particular, will likely provide support for commodity prices — most notably for oil — and should create a bullish environment for precious metals.

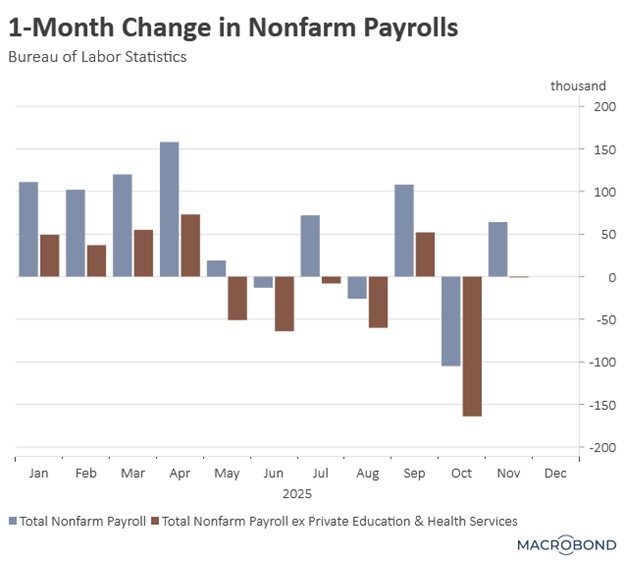

Labor Market: Recent employment data suggests a labor market that has cooled significantly but has not collapsed. Over the past two months, the economy lost 41,000 jobs while the unemployment rate rose sharply to 4.6%, its highest level since 2021. This marked deterioration has likely strengthened the argument for the Federal Reserve to keep the possibility of an imminent rate cut on the table, even as some officials continue to signal a preference for maintaining the current policy stance.

- The latest payroll figures underscore a period of high volatility, as the labor market bounces between expansion and contraction. Although November saw a gain of 64,000 jobs, recovering from October’s job loss of 105,000, the broader trend remains inconsistent. In fact, we haven’t seen sustained growth for two consecutive months since May.

- A greater concern is that recent job creation has been overwhelmingly concentrated in a single sector. When private education and healthcare are removed from the calculation, the data reveals that the broader private sector has contracted, posting net job losses in five of the last six months.

- Although current labor market indicators are weak, optimism persists for a broader improvement next year. This expectation is one reason some Fed officials remain hesitant to commit to further rate cuts. As Atlanta Fed President Raphael Bostic noted, he anticipates the economy will benefit from the end of the government shutdown and supportive new tax legislation, both of which should bolster conditions.

- While the Federal Reserve’s current projection signals only one rate cut next year, we believe its ultimate decision will likely hinge on labor market conditions. Should the job market show further signs of deterioration, we expect the Fed will be compelled to enact more cuts than are currently signaled in order to support the faltering economy.

Putin Ultimatum: The White House is preparing a fresh round of sanctions against Russia should it reject a peace agreement with Ukraine later this week. These new measures will primarily target the energy sector by cracking down on “shadow fleet” tankers — vessels used to disguise the origin of cargo to evade international authorities. This move comes as the US nears a potential breakthrough in ending the regional conflict.

France Plea: French President Emmanuel Macron has attempted to ease EU-China tensions, cautioning Brussels against imposing tariffs and quotas on Chinese goods. He warned that such measures would undermine cooperation on building balanced trade. This move follows Macron’s visit to China last week, where he discussed the bilateral relationship. While talks were positive, no final agreement was reached. His latest remarks signal a clear preference for a softer, more diplomatic approach toward Beijing.

US Digital Grievance: The White House has threatened to impose new restrictions and fees on EU firms in an effort to pressure the bloc to drop its regulations on Big Tech, which Washington views as being unfairly targeted toward US companies. The administration is preparing a Section 301 investigation under the Trade Act of 1974, a tool that would allow it to pursue trade remedies against perceived unfair practices. This escalation is likely to further strain transatlantic relations.