Daily Comment (November 19, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with a preview of Nvidia’s key earnings release after market close today, as well as some related news involving the company and infrastructure investor Brookfield. We next review several other international and US developments that could affect the financial markets today, including a move to ease Dutch-Chinese tensions and a new European Union body to shore up the bloc’s access to critical minerals.

US Artificial Intelligence Boom: AI chip giant Nvidia will release its quarterly earnings after market close today, setting the stage for either continued investor enthusiasm for the sector or, potentially, a major selloff if the results are disappointing. Given that Nvidia accounts for such a large share of US stock market capitalization — about 10% of the NASDAQ 100 — a significant upside or downside surprise would likely have a major impact on the broader stock market in the coming days.

- Separately, reports say Canadian investment giant Brookfield Asset Management is raising $10 billion for a new fund dedicated to AI infrastructure, with Nvidia and sovereign-wealth fund Kuwait Investment Authority as founding partners. Utilizing additional co-investments and debt, Brookfield plans to build and acquire as much as $100 billion worth of AI infrastructure

- It isn’t clear how much Nvidia is investing in Brookfield’s new fund. Nevertheless, the news could exacerbate growing investor concerns about circular investments in the AI space, where major players essentially invest in their customers to help fund their own sales.

US Technology Industry: A federal judge yesterday ruled that tech giant Meta didn’t break antitrust laws by illegally stifling competition through its purchases of Instagram and WhatsApp. The ruling means the company won’t have to divest the two apps, which should be positive for the broader tech sector.

Netherlands-China: The Dutch government today overturned its recent seizure of Nexperia, the Netherlands-based manufacturer of automotive semiconductors owned by Chinese company Wingtech Technology. Officials said the return of control to Wingtech was an act of “goodwill” toward Beijing, which had retaliated by banning the export of chips from Nexperia’s operations in China. The decision should be a relief to major automakers, which had warned of major chip shortages that could disrupt global car production, weigh on sales, and hurt profits.

China: In a little noticed report at the end of October, the Chinese government mandated that on-line influencers must possess recognized degrees or demonstrate relevant training before discussing professional topics such as law or medicine. The regulation is designed to stamp out misinformation, but it has sparked opposition over concerns about freedom of speech. In any case, given global concerns about misinformation undermining everything from politics to health, a key question is whether the rule might spark copycat regulations in other countries.

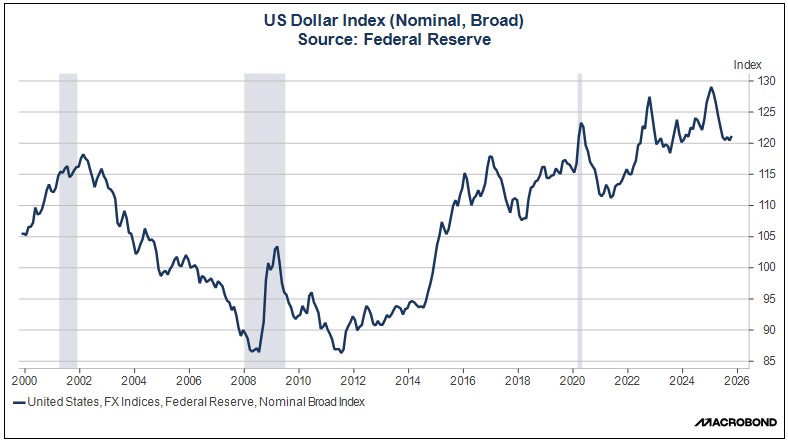

Singapore: At a Bloomberg event today, the chief of Singapore’s sovereign wealth fund, Temasek, said the dollar’s depreciation this year has hurt its returns from US assets compared with foreign assets, which will likely prompt the fund to increase its non-US allocations. The statement is consistent with our view that the falling dollar is making it more attractive to invest in foreign stocks than in US stocks. Indeed, we have recently increased our exposure to foreign stocks in our Confluence Asset Allocation strategies.

European Union: Stéphane Séjourné, the EU’s executive vice president for industrial strategy, said today that the bloc will set up a central body to coordinate the purchasing and stockpiling of critical minerals. One key aim of the new organization will be to stop the US from buying up and hoarding the assets. The plan is consistent with our view that amid today’s geopolitical tensions and economic issues, countries and companies will have greater incentives to hoard key resources. In turn, we think that will buoy commodity prices going forward.

United States-Venezuela: President Trump has reportedly approved a CIA plan for covert measures inside Venezuela to pave the way for a potential US military attack on the country. At the same time, the president has authorized a new round of back-channel negotiations that at one point resulted in President Maduro offering to step down after a delay of a couple of years, a proposal the White House rejected. If either strategic prong is successful, the result could ultimately mean a resurgence of Venezuelan oil production and exports.