Daily Comment (November 6, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment leads with a critical analysis of the Supreme Court hearing on presidential tariff powers. Subsequent sections assess the economic implications of the latest PMI data and rising US household debt. Our international focus is Japan’s significant commitment to AI and semiconductor manufacturing, followed by a review of the Bank of England’s recent policy move. As always, the report includes a roundup of international and domestic data releases.

Supreme Court Tariffs: The US Supreme Court heard arguments challenging the president’s authority to impose tariffs. During the two-hour hearing, several conservative justices expressed skepticism that the International Emergency Economic Powers Act (IEEPA) could justify such unilateral action. The case was brought by a coalition of businesses and twelve states, all claiming economic harm from the tariffs. A ruling is not expected for some time, but the Supreme Court may potentially overturn the presidential action.

- Although the ruling is highly anticipated, its impact would not remove all levies. The lawsuit focuses exclusively on the legitimacy of the reciprocal tariffs from last April, a policy intended to mirror other nations’ duties. It does not, however, challenge the foundation of the broader, product-specific tariffs imposed under Section 232, which enjoy stronger statutory authority.

- A ruling against the administration would significantly hinder its trade strategy. The core of which relies on provisions that authorize tariffs against partners that do not uphold their obligations, a broad condition that encompasses both the removal of discriminatory regulations, trade barriers, and the fulfillment of promised investments.

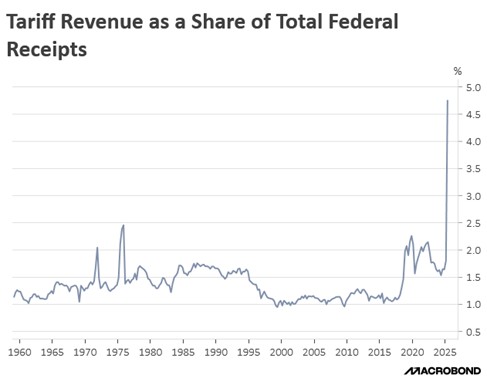

- That said, these tariffs have effectively served as an experiment for Washington. They have proven that the US government can collect massive amounts of revenue through import taxes without causing an economic collapse. Therefore, if the Supreme Court rules that they are illegal, that ruling might not be the end but simply a trigger for Congress to pass the tariffs into permanent law.

- The removal of the tariffs could have a mixed impact on the economy. On one hand, it should provide a stimulus as firms rebuild inventory, similar to the activity observed in the first quarter. However, the immediate downside is that refunding the collected tariff revenue to the paying firms will cause a corresponding increase in government debt.

Strong PMI: Rising Purchasing Managers’ Index (PMI) readings from two key surveys signal growing confidence among businesses. The S&P Global Services PMI rose from 54.2 to 54.8, while the ISM Services PMI increased from 50.0 to 52.4. The simultaneous rise in both indexes suggests the economy retains significant momentum. In the absence of other major economic data, these PMI reports serve as a crucial alternative barometer for assessing the economy’s health, particularly as markets evaluate the impact of recent tariffs on economic activity.

- A closer examination of the data reveals the drivers behind this growing confidence. A sharp rise in new orders points to strengthening demand for services, while a concurrent increase in business activity indicates that companies are becoming busier. However, these positive signals are tempered by persistent signs of rising price pressures and a declining willingness to hire new employees.

- Respondent comments offer valuable insight into firm sentiment regarding the economy. Most firms reported that tariffs have weighed on business activity, though the intensity of this pressure — particularly concerning costs — has begun to ease. Furthermore, there were growing signs that the government shutdown was also creating problems, prompting some firms to delay planned projects.

- Overall, PMI surveys suggest that while significant headwinds persist in the economy, firms are expressing greater confidence in their ability to operate effectively despite the tariffs. This renewed confidence is largely predicated on the expectation that policy will remain relatively stable over the next few months. Assuming this stability holds, the data suggests the economy could begin showing signs of acceleration.

Households Under Pressure: Despite a robust economy, signs of strain are emerging among some households. US household debt has reached a record $18.6 trillion, with delinquency rates holding steady at a level unseen since 2011. This rising debt burden is a hallmark of a K-shaped recovery, where the financial strength of high-income households masks broader weaknesses elsewhere. While we do not expect this to weigh on equity prices in the short term, it presents a longer-term risk

Japan AI Industrial Policy: Japan’s ruling Liberal Democratic Party plans to allocate an additional $6.5 billion annually to bolster its semiconductor and AI industries. Starting in April, this funding will be sourced from the regular budget rather than a supplementary one, signaling a long-term commitment. The move underscores the strategic importance of these sectors as nations worldwide act to shield their digital economies from foreign competition. While this policy aims to strengthen domestic industries, it also risks increasing government debt.

EU Backs Down: European officials have conceded they lack the strategic leverage to quickly persuade China to lift its restrictions on rare earth exports. This admission reflects a broader Western realization of China’s dominance in this critical sector. Although the EU is pursuing a separate deal with China to ease trade tensions, its limited negotiating power is now clear. Consequently, this reality is likely to accelerate efforts by Western firms to develop their own rare earth mining capabilities.

BOE Divided: The Bank of England held interest rates steady at 4.0% at its policy meeting on Thursday, with the decision passing by a narrow 5-4 vote. This pause reflects the central bank’s ongoing challenge in balancing slowing economic growth and labor market weakness against persistent inflationary pressures. Given the tight vote, there is a growing likelihood of a rate cut at the next meeting. Such a move would aim to boost growth but could also lead to a depreciation of the pound sterling (GBP) against the US Dollar.