Daily Comment (October 30, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment begins with our key takeaways from the October 28-29 FOMC meeting. We then assess concerns over elevated tech spending and explain why it is unlikely to derail near-term sector momentum. Additional analysis covers the newly agreed US-China trade truce and the implications of stronger-than-expected economic growth in Europe. We conclude with our regular summary of critical international and domestic data releases.

Fed Division: The FOMC’s widely anticipated 25 basis point rate cut at its October meeting laid bare a deepening rift on the committee. The vote revealed a sharp division, with dissents coming from both sides of the debate. Kansas City Fed President Jeff Schmid argued for no cut at all, while Governor Stephen Miran championed a deeper 50-point reduction. This rare public split underscores the central bank’s fundamental challenge of navigating the conflicting demands of its dual mandate to foster both maximum employment and price stability.

- The division was further reinforced at the press conference when Fed Chair Jerome Powell bluntly stated that a December rate cut was not a “foregone conclusion.” This clear, direct remark — a contrast to his usual guardedness and hedged approach regarding policy — suggested he intended to aggressively rein in market expectations as Fed officials themselves still grapple with the proper direction for monetary policy.

- Investor sentiment shifted decisively following the Fed’s announcement as the S&P 500 relinquished its advances and the dollar strengthened. This market move was a direct response to the hawkish undertones of the rate cut, underscored by internal dissent and Chair Powell’s uncharacteristically blunt communication, which together signaled a potential extended pause in the easing cycle.

- Adding significant risk to the policy outlook, the government shutdown is effectively blinding the Federal Reserve, undermining its commitment to being data dependent. The halt to official statistical releases means the central bank must now operate without its most reliable economic indicators. Though Fed officials are referencing private and survey data, these sources are demonstrably less robust and statistically noisier than timely government reports.

- That said, Wednesday’s market decline likely reflects growing conviction that the Fed will not cut rates in December. This shift is clear in the CME FedWatch Tool, which now shows a 70% probability of rates holding steady through year-end, up sharply from 30% just a week ago. Should these rate expectations reverse, it would likely boost equity prices broadly, with particularly significant gains for interest-rate-sensitive sectors.

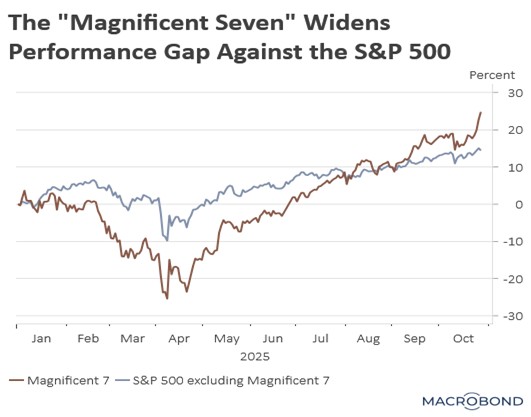

Big Tech Tests Investors: While this year has seen a surge in AI-related capital expenditures, firms expect this high level of spending to continue into next year. The trend is driven by continued heavy investment in data centers and infrastructure from tech giants like Meta, Microsoft, and Alphabet. Although these companies maintain that the spending is necessary to meet rising demand, there are growing concerns that it could be fueling a market bubble.

- Investor anxiety over soaring capital outlays sparked an immediate pre-market retreat in tech stocks. The trigger seemed to be the staggering scale of AI-related investment: Alphabet, Meta, and Microsoft collectively poured $78 billion into capital expenditures last quarter, an 89% jump from a year earlier. Meta’s guidance for “notably higher” spending further fueled bubble concerns, especially since it is not a major cloud provider serving external clients, making its investments appear riskier.

- That said, drawing a comparison to the tech bubble of the1990s may be premature, given fundamental differences in corporate health. Crucially, the major companies driving the current AI boom — unlike their dot-com predecessors — possess verifiable profits, diversified revenue streams, and massive cash reserves. This robust financial foundation provides a strong buffer against any sharp market downturn, lending momentum and stability to these stocks, at least over the immediate horizon.

US-China Trade Deal: The US and China have agreed to a one-year trade truce, though it falls short of the comprehensive deal many anticipated. The agreement includes a suspension of new trade and investment restrictions. Key concessions included the US agreeing to reduce fentanyl tariffs to 10% and lift certain corporate restrictions, while China committed to resuming soybean purchases and rare earths exports. While this alleviates immediate pressure, it sets the stage for potential renewed tensions next year.

- Although this falls short of the comprehensive deal that markets were anticipating, it serves as a strategic pause. This interim period will likely be used by the US to accelerate the diversification of its critical mineral supply chains away from China, and by Beijing to advance its campaign for technological self-reliance, particularly in chips.

- The truce is likely to sustain equity market support, as it alleviates supply chain strains and safeguards the resilient earnings trajectory seen in recent quarters. However, the underlying uncertainty in US-China trade relations is expected to re-emerge as a major investor concern in 2026.

Eurozone Resiliency: Third-quarter GDP for the eurozone came in stronger than forecast, growing by 0.2% against a 0.1% consensus. The outperformance was largely due to a surprisingly strong 0.5% expansion in France — its fastest pace since 2023 — which more than offset a stagnation in Germany. France’s resilience amid political uncertainty is likely to bolster investor confidence, supporting the view that the region’s strong equity performance can continue.

Centrist Win in Netherlands: The centrist-liberal D66 party is projected to win the most seats in the Netherlands, narrowly defeating the far-right Freedom Party. This outcome represents a rare setback for right-wing populists in Europe, a movement that has largely gained popularity in recent years. While some speculate this result could inspire similar shifts across Europe, we believe the Dutch vote reflects a deeper trend of rising income inequality eroding loyalty to any specific parties, creating a more volatile political landscape.

Nuclear Testing: The White House has announced plans to resume nuclear weapons testing, a move aimed at modernizing US defenses and countering advancements by strategic competitors China and Russia. This decision follows the recent authorization for South Korea to build nuclear submarines and reflects a broader pivot in the administration’s foreign policy. Despite a stated agenda of conflict resolution, President Trump is simultaneously adopting a more hawkish stance to address rising global tensions.