Daily Comment (September 19, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment begins with an analysis of discrepancies in the weekly jobs data. We then examine the potential implications for US-China relations as the United States signals a desire to re-engage in the Middle East. Additional topics include a new fund for American manufacturing, the possibility of a government shutdown, and Germany’s reluctance to partner with a French defense firm. We also provide a summary of key recent global and domestic economic indicators.

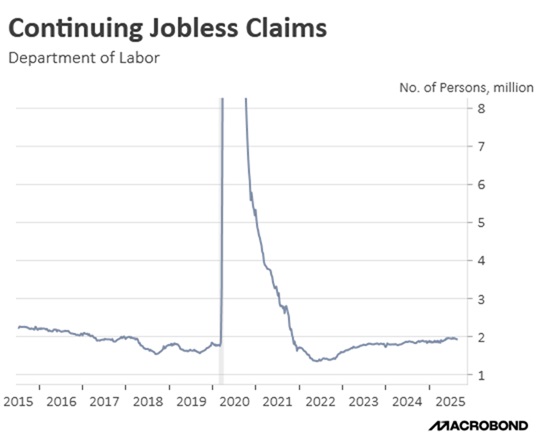

Low Hire, Low Fire? Expectations for Federal Reserve interest rate cuts rose on Thursday due to a data error that cast doubt on the labor market’s health. Although initial jobless claims fell significantly to 231,000, the reported drop in continuing claims to 1.92 million was largely an illusion. It was primarily caused by a major clerical error in North Carolina, which reported a mere 205 claims, a figure drastically lower than the 20,535 reported the previous week.

- This discrepancy in the data indicates that continuing claims may have actually experienced a slight increase from the previous week, despite the reported decline. This finding suggests that while companies are not yet accelerating layoffs, they are beginning to show hesitation in hiring, a trend that supports the narrative of a cooling labor market. Nevertheless, while continuing claims remain below the 3 million threshold often associated with a recession, the current level is nearing the peak for the expansion.

- The reporting error in continuing claims occurred shortly after a significant portion of the previous week’s spike in initial claims was attributed to an unemployment insurance fraud scheme in Texas, which is currently under investigation. It is noteworthy that this fraudulent activity did not prompt a downward revision of the prior week’s data; instead, the figure was revised upward from 263,000 to 264,000. This new error, therefore, calls the overall data quality into question.

- We continue to stress the importance of using multiple data sources to get a comprehensive view of the economy. Since the pandemic, we have seen significant data distortions that have made it difficult to pinpoint our position in the business cycle. We are concerned that the Federal Reserve’s over-reliance on this potentially flawed data may cause it to fall behind the curve. Therefore, we believe that implementing some portfolio protection may be a prudent measure at this time.

Back to Afghanistan? The US has signaled an interest in re-establishing a presence at Afghanistan’s Bagram Air Base, as indicated by a comment made by the president during a visit to the UK. While discussing plans to increase partnership, the president reportedly stated a desire to regain access to the base due to its strategic location. He specifically noted its proximity, describing it as “an hour away from where China makes its nuclear weapons,” suggesting the presence would be a form of deterrence.

- The US’s desire to position its forces near Chinese nuclear assets, coming just a day before the president’s meeting with his Chinese counterpart, Xi Jinping, suggests the two leaders will discuss more than just trade and technology. The agenda is likely to also include China’s allies, Russia and Iran, given their resistance to US efforts regarding Russia’s invasion of Ukraine and Iran’s nuclear ambitions.

- While officially maintaining a stance of neutrality, China is deepening its engagement in foreign affairs to align with US rivals. Its strategy involves capitalizing on the international isolation of Russia and Iran through discounted purchases of their energy resources. Furthermore, China is alleged to have supplied limited military assistance to both countries in the form of dual-use technology, enhancing their defensive capabilities.

- In the days leading up to the meeting with China, the White House has strongly hinted at its willingness to confront China’s foreign policy. The administration has urged allies, specifically the EU, to increase efforts to pressure China and India through sanctions, aiming to break their support for Russia’s invasion. While this strategy has not yet been effective, it demonstrates a clear desire to pressure China into changing course.

- The talks between US and Chinese leaders will likely set the tone for future relations as they try to navigate their differences. The US request to regain its former Afghan air base is likely a negotiating tactic; however, should the US follow through, it could lead to a significant escalation of tensions. While we do not believe a direct conflict is likely, the risks remain elevated.

American Manufacturing Fund: The White House is exploring how to use funds received from an investment deal that was struck with Japan. The plan is to use these funds for projects designed to support US ambitions in the chip and AI sectors. This strategy includes an expedited review process to allow for the rapid construction of factories and the development of mining operations, and it may also involve extending company leases to allow them to develop on public land.

Supreme Court Battle: The White House has requested that the Supreme Court allow it to fire Federal Reserve Governor Lisa Cook while her legal challenge to her removal is ongoing. The move is a test of the president’s authority to reshape the Federal Reserve, which has reportedly resisted his push to significantly lower interest rates. If the court rules in the White House’s favor, it would set a major precedent that could weigh on the dollar and threaten the central bank’s independence.

US Government Shutdown: Growing concerns of a government shutdown are mounting as both sides remain unable to agree on a budget. Democrats plan to hold out for restored Medicaid funding and ACA subsidies. However, Republicans have started the process of passing continuing resolutions that would fund the government through November 21. This growing partisanship raises the likelihood of a prolonged shutdown, which could temporarily impact markets and the economy until an agreement is reached.

German-French Feud: German officials are looking for alternatives to their French partner, Dassault Aviation SA, for the development of a next-generation fighter jet. This comes as Dassault has reportedly pushed for a controlling role in the program. As a result, the Germans are looking for alternative suppliers from the UK, Sweden, or even Spain. While this decision to find new partners could lead to friction between the two countries, we continue to believe that EU defense companies should benefit from the increased spending.

BOJ Policy Normalization: The Bank of Japan voted to hold rates unchanged but signaled a shift by announcing it is considering offloading a portion of its massive ETF holdings. The central bank currently holds a portfolio valued at approximately ¥70 trillion ($475 billion), with plans to sell at a pace of about ¥620 billion annually. While this will not lead to a quick unwinding of its positions, the move is likely to weigh on domestic equities and push up the value of the yen. The policy shift is another signal that the US dollar may have more room to fall.