Daily Comment (July 28, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with the big news of a trade deal between the United States and the European Union. We next review several other international and US developments with the potential to affect the financial markets today, including more trade tensions between the EU and China and a brief overview of this week’s Federal Reserve policy meeting.

United States-European Union: The US and the EU yesterday said they had reached a trade deal in which the US will impose a 15% tariff on most EU imports, including automobiles, while the EU drops its tariffs against US goods. However, the US would still impose a 50% tariff against EU steel and aluminum. The deal provides some certainty for US and EU businesses, but the new tariffs will likely disrupt trade supply chains and create inefficiencies over time, as well as potentially raising costs for US firms and consumers.

- President Trump said the EU also committed to spend an additional $750 billion on US energy products and “hundreds of billions of dollars” on US military equipment. He also said the EU had agreed to invest $600 billion in the US.

- The EU commitment to invest in the US appears similar to the Japanese government’s commitment to invest under its trade deal with the US. These investment promises are important because they appear to give Trump an extraordinary opportunity to intervene in the US economy by influencing where those funds are invested.

- In any case, investors are reacting positively to the news. The S&P 500 price index for large cap US stocks at this writing is up about 0.5%, while the Stoxx Europe 600 is up about 0.9%. The US Dollar Index has also increased, up 0.6% so far today.

United States-China: Over the weekend, the Financial Times said White House officials told the Commerce Department to freeze new export controls on US technology going to China to avoid spoiling President Trump’s trade negotiations with General Secretary Xi. The report is consistent with the way the administration has backtracked over its springtime threat to further clamp down on sensitive exports to China. The news suggests Trump is prioritizing his trade talks over the national security goal of keeping advanced US technology away from the Chinese military.

European Union-China: Brussels today issued preliminary findings that Chinese e-commerce platform Temu has breached the EU’s new Digital Services Act by failing to prevent fake and harmful products from being sold on its platform. If confirmed as guilty, Temu could face a fine of up to 6% of its global revenue. The move will probably further poison EU-China relations after Brussels and Beijing held a tense, cool summit late last week.

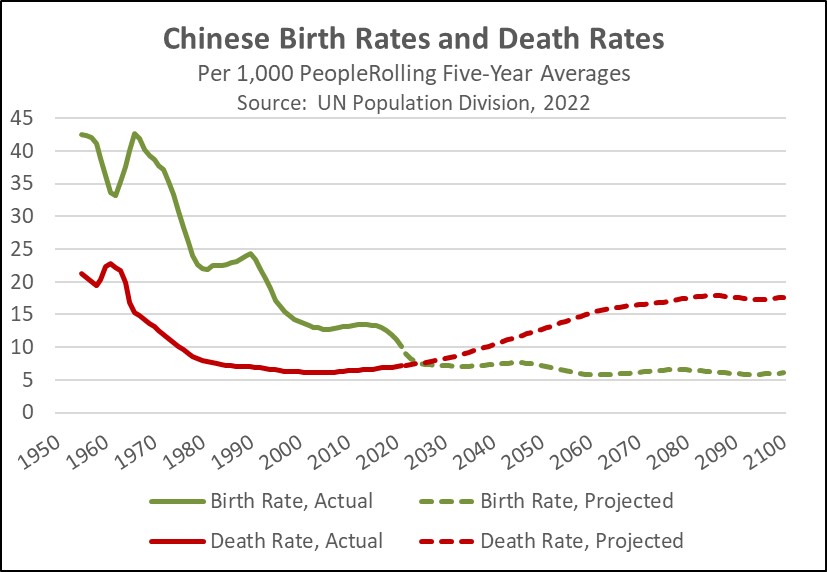

China: In its latest effort to boost the country’s birthrate and arrest its population decline, the Chinese government has launched a program that will annually give families the equivalent of about $503 for each child under the age of three. However, the program is already being panned by demographers and other observers, who believe the sum is much too small to encourage more births.

Taiwan: Over the weekend, voters cast ballots in the recall election of 24 lawmakers from the opposition Kuomintang Party (KMT), with recall elections on seven more planned for late August. Preliminary results indicated that voters rejected the recall in every single constituency, leaving the China-friendly KMT in control of the legislature. That means China-Taiwan tensions will likely be contained in the near term.

Thailand-Cambodia: Border clashes continued into the weekend, with Thailand deploying naval ships near the Cambodian border and President Trump threatening to stop talks toward a US trade deal with each country if they keep fighting. The two countries today agreed on a ceasefire to start tonight, but it remains to be seen if it will really be implemented. For US investors, the conflict is especially concerning with regard to Thailand, which has a relatively large stock market capitalization and is popular with emerging market investors.

United States-Israel: A report by SpyTalk last night said multiple hedge funds have bankrolled a private investigation into the source of pedophile Jeffrey Epstein’s wealth, evidently to clarify whether Epstein was indirectly funded by Mossad, the Israeli intelligence service, to blackmail President Trump and other powerful US business people and politicians. While Trump’s past association with Epstein has already been an irritant to Trump and angered his political base, any link to Israel would likely threaten to further strain US-Israeli relations.

US Monetary Policy: The Federal Reserve this week will hold its latest policy meeting, with the decision due out on Wednesday at 2:00 PM ET. Based on current interest-rate futures trading, investors are virtually unanimous in expecting the policymakers to hold the benchmark fed funds rate steady at its current range of 4.25% to 4.50%. Traders don’t expect the next rate cut until the September meeting.

- In the meantime, since the policymakers won’t be releasing their “dot plot” of economic projections at this meeting, investors will be closely watching the policy statement and press conference for any sign that Chair Powell is ready to succumb to the Trump administration’s pressure for aggressive, near-term rate cuts.

- Assuming that Powell is not forced out before the end of his term in May, we continue to expect only a limited number of rate cuts over the coming year. However, we expect President Trump to then replace him with someone he perceives to be much more dovish, raising the risk of aggressive rate cuts and overly loose monetary policy later in 2026.

US Lumber Industry: The Wall Street Journal today carries an article on how President Trump has directed the US Forest Service to develop a five-year plan to contribute to a 25% increase in the overall volume of timber harvested from national forests. The Agriculture Department has also begun to ease regulations limiting timber cutting. Along with tariffs on imports from Canada and other countries, the moves could potentially mean that more of the wood used in US home construction will be domestic, boosting the domestic lumber industry but possibly raising costs.