Daily Comment (July 18, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with escalating Ukrainian drone attacks on Moscow, St. Petersburg, and other areas of Russia that could potentially prompt Kremlin retaliation against the US. We next review several other international and US developments with the potential to affect the financial markets today, including a new US anti-dumping tariff against Chinese graphite materials used in electric vehicles and the latest in the Trump administration’s angling to fire Federal Reserve Chair Powell.

United States-Ukraine-Russia: The Ukrainian military yesterday staged aerial drone attacks against Moscow, St. Petersburg, and other areas around Russia, suggesting that President Trump’s apparent greenlighting of the concept may have encouraged Kyiv to become more aggressive. As we reported in a Comment earlier this week, Trump urged Ukrainian President Zelensky to attack Moscow and St. Petersburg to help force the Kremlin into peace talks. The risk is that Russia could decide to retaliate, in some way, directly against the US.

United States-China: The Trump administration yesterday said it will set a 93.5% anti-dumping tariff against Chinese graphite and other anode-active materials used to make electric-vehicle batteries. As an anti-dumping tariff, the graphite duty is unrelated to Trump’s “reciprocal” tariffs, sectoral tariffs, and national security tariffs. In response, the share prices of non-Chinese graphite producers are surging so far this morning.

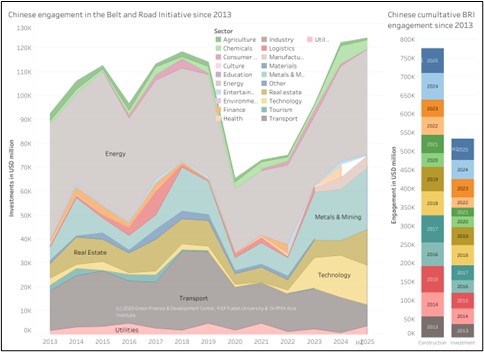

China: New research by Griffith University in Australia shows China is once again spending lavishly on its “Belt and Road Initiative” to build ports, railroads, and other infrastructure in less developed countries around the world in what is likely an attempt to curry good will and facilitate greater trade with China. The report says Chinese BRI spending in the first half of 2025 was higher than in any other six-month period in history, driven largely by new energy-related investment.

- China’s renewed BRI spending comes after bad loans and bad publicity led to a sharp pullback in the program from 2020 to 2023.

- The rebound in BRI spending could spur economic growth in a number of emerging markets, albeit with the risk that the countries are again becoming overly indebted to China.

(Source: Griffith University)

Japan: Excluding the volatile fresh foods category, the June “core” consumer price index was up 3.3% from the same month one year earlier, matching expectations and cooling from the 3.7% gain in the year to May. Nevertheless, inflation remains well above the Bank of Japan’s target, so the data is not expected to stop the central bank from hiking rates further. Persistent inflation is also expected to hurt the ruling Liberal Democratic Party in this weekend’s elections for the upper house of parliament.

Israel-Syria: Israeli forces continue to operate in Syria today as they implement Tel Aviv’s new policy to help protect the Druze Christian minority group there and establish a demilitarized zone along the Israel-Syria border. The Druze community in Israel numbers about 150,000 and has played an active role in the Israeli military. That has made Tel Aviv sensitive to the community’s demand to support the fellow Druze in Syria who have been attacked amid the political chaos following the fall of Syrian dictator Bashar al-Assad late last year.

Iran: Officials in Lebanon, Syria, and Yemen say they have recently intercepted multiple weapons shipments sent by Iran to allied militants in the region, including Hezbollah. Despite the military setback that Iran suffered from Israeli and US strikes in June, the shipments suggest Tehran has not yet been pacified. That raises the risk that Iran will directly or indirectly launch new, destabilizing attacks against its enemies in the future.

Argentina: Moody’s yesterday hiked its sovereign foreign-currency debt rating on Argentina to Caa1, up from Caa3 previously, with a stable outlook. As justification, the firm cited Argentina’s recent macroeconomic reforms, such as removing distortive exchange controls and cutting public spending, which have helped stabilize the economy. Moody’s also said it couldn’t hike the credit rating further until Buenos Aires addresses other needed reforms, such as removing barriers to investment, but yesterday’s move is still likely to be positive for Argentine stocks and bonds.

US Monetary Policy: Federal Reserve Chair Powell yesterday sent a letter rebutting the Office of Management and Budget’s accusation that he has grossly mismanaged the on-going renovation at the Fed’s headquarters and misled Congress about it. Nevertheless, as we’ve said before, the project — essentially rebuilding the headquarters — is so big and complex that Trump officials could probably find some cost overrun or other problem to justify firing Powell, if they’re willing to accept the likely disruption in the financial markets.

US Cryptocurrency Industry: The House yesterday passed a bill that would establish the first comprehensive set of rules for the US cryptocurrency industry. The vote was 294-134, signaling bipartisan support, but passage by the Senate is nevertheless considered less certain. In any case, the “Digital Asset Market CLARITY Act” lays out a new category of registered digital assets and establishes the government’s regulatory responsibilities for them, all aimed at spurring rapid growth in privately developed digital assets.

- Separately, the House yesterday also approved the Senate-passed GENIUS Act to regulate stablecoins, sending the bill to President Trump to sign it into law. The act establishes the US’s first-ever regulatory framework for issuers of stablecoins, aiming to spur development of that industry.

- Yet another report says Trump, as early as today, will sign an executive order directing regulators to let 401(k) plans invest in cryptocurrency assets, gold, private equity, and other nontraditional assets. If true, the order would likely force investment managers to adjust to a much broader set of investment possibilities, while introducing new risks for investors and the broader economy.

US University Endowment Funds: Even as Trump preps to let 401(k) investors take positions in nontraditional assets like cryptocurrencies and private equity, the University of California’s endowment board has voted to exit its remaining 10% allocation to “absolute return portfolios,” which are essentially made up of hedge funds. The UC investment manager lambasted hedge funds for not providing an effective hedge against volatility and providing far worse performance than traditional stocks and bonds in recent years.