Daily Comment (July 11, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is focused squarely on new tariff developments. Today’s Comment will give our thoughts on President Trump’s latest trade threats. We’ll also explain the escalating US stance on Russia, focusing on the proposed “Sanctioning Russia Act of 2025.” The report will also cover other market-moving news and key domestic and international economic data releases.

Tariff Broadening: The president continues to broaden his trade fight, threatening higher tariffs for countries and materials.

- President Trump has threatened to impose steep tariff hikes, raising duties on most trading partners to 15–20%. This follows an earlier warning of a potential 35% levy on Canadian goods not covered by the USMCA. Additionally, the existing 50% tariff on copper is expected to be expanded to include semi-finished products. The president also signaled a willingness to escalate tariffs further if deemed necessary.

- This escalation in trade tensions coincides with the administration’s push to secure negotiated agreements before the August 1 deadline, when the president is expected to formalize new tariff rates. The president faces mounting pressure to deliver concrete trade deals after his controversial decision to extend negotiations beyond the original July 9 cutoff date.

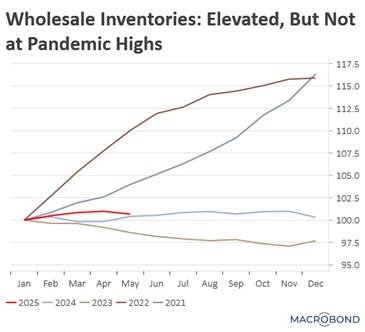

- While markets have largely priced in the “Trump Always Chickens Out” (TACO) trade, growing evidence suggests that the president faces mounting pressure to deliver on trade deals. Many businesses have so far avoided passing higher costs on to consumers, having stockpiled inventories ahead of potential tariffs in anticipation of more favorable terms that could prevent sharp price hikes.

- The primary challenge for firms will be navigating new tariffs if they remain in place at current levels or increase after August 1, while also attempting to replenish inventories. Current stock levels sit modestly above figures from a year ago but elevated costs could drive them lower. We anticipate businesses may offset these pressures through price increases, production cuts, or potential workforce reductions.

- That said, the president has consistently employed a pattern of Friday market warnings followed by Monday resolutions — a tactic we’ve dubbed FAME (Friday Alarm, Monday Excitement). Historically, he uses end-of-week volatility to amplify pressure, only to announce negotiated deals at week’s start. If this pattern holds, we may see another round of agreements announced Monday.

Tough on Russia: President Trump is expected to make a major statement on Monday about Russia as he pushes to end the war in Ukraine.

- The president has grown increasingly frustrated with the Kremlin’s persistent obstruction of peace negotiations with Ukraine. This frustration comes amid reports that Russia has adopted an uncompromising stance in talks, with the Trump administration dismissing Moscow’s demands as unrealistic. In response to Russia’s intensified aerial attacks on Ukrainian cities, the White House has authorized new missile shipments to strengthen Ukraine’s defensive capabilities.

- President Trump’s forthcoming policy announcement coincides with rising bipartisan pressure to take stronger action against Russia. This sentiment is reflected in new Senate legislation, the Sanctioning Russia Act of 2025, which would impose unprecedented 500% tariffs on nations purchasing sanctioned Russian goods. The bill, introduced by Senators Lindsey Graham (R-SC) and Richard Blumenthal (D-CT), would specifically target countries like India and China.

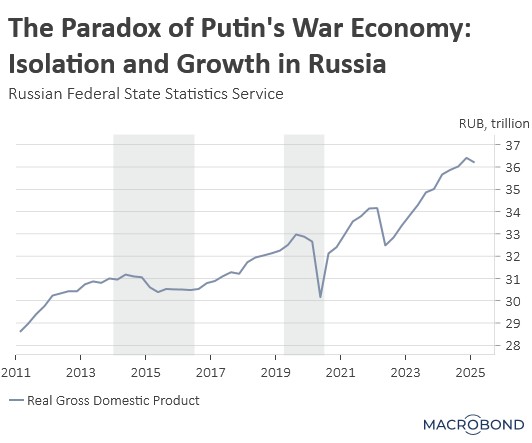

- Russia’s war persistence stems largely from domestic political calculus, as leaders look to maintain the appearance of control while avoiding any perception of defeat. After three years of devastating conflict, the war has paradoxically boosted military-dependent industries while leaving Russia increasingly isolated, making a settlement without tangible gains politically risky for the Kremlin.

- We anticipate a negotiated settlement in the coming months, likely extracting further Ukrainian concessions while offering tentative discussions on restoring European ties. The outcome hinges on Russia’s need for face-saving terms against Ukraine’s sovereignty demands, with Western support remaining the decisive factor.

Treasury Auction Success: There has been strong demand for long-dated securities; however, global-debt burden remains a problem.

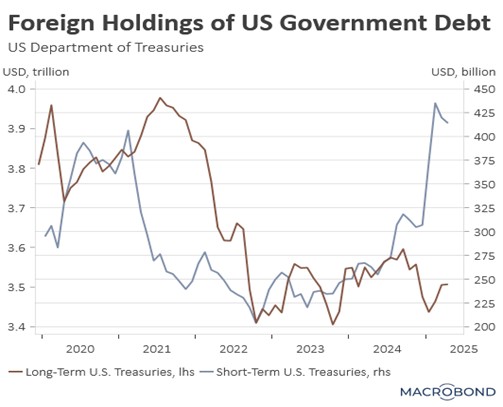

- The US Treasury’s $22 billion 30-year bond auction cleared at a high yield of 4.889%, closely aligning with the pre-auction “when-issued” rate. The solid bid-to-cover ratio of 2.38 demonstrated healthy investor appetite, a significant test following last week’s passage of expansive fiscal legislation. This outcome suggests that the market remains capable of absorbing the increase in long-dated supply, at least for now.

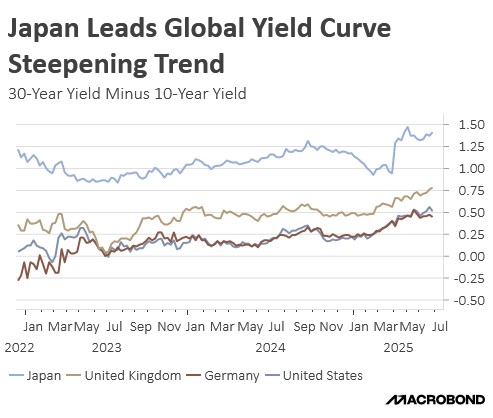

- Sovereign bond issuance is drawing intense scrutiny as governments ramp up fiscal stimulus worldwide. Facing upward pressure on long-term yields, many central banks, including the US Treasury and the Bank of Japan, are strategically shifting issuance toward shorter maturities to alleviate yield curve strain.

- While increased sovereign debt issuance may provide short-term economic stimulus, it risks tightening global financial conditions through upward pressure on interest rates. This tension could compel central banks to deploy unconventional measures, including rate cuts or renewed quantitative easing, as they navigate the dual challenges of supporting growth while preserving debt sustainability.

ECB Under Pressure: As US lawmakers push for additional fiscal cuts this year, European governments are urging their central banks to maintain accommodative monetary policies.

- While the ECB has cut rates three times this year, French Prime Minister François Bayrou is pushing for more accommodative monetary policy to shore up the economy. This comes as European nations face the dual challenge of a slowing economic environment, growing budget deficits, and the need to adjust to an increasingly protectionist and less dependable US ally.

- This rare criticism coincides with US lawmakers’ efforts to pressure Fed Chair Jerome Powell for an interest rate cut at the upcoming meeting. They argue a cut would help offset the rising budget deficit and promote domestic growth. Adding to this, Ohio Senator Bernie Moreno has reportedly initiated efforts to garner GOP backing for Powell’s resignation.

- The imperative to lower interest rates in the face of burgeoning budget deficits will likely compel the market, particularly foreign investors, to favor shorter-duration government securities. This diminished appetite for longer-dated bonds could consequently exacerbate interest rate volatility.