Daily Comment (July 1, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with the latest on US trade policy. Specifically, we note that the Trump administration has apparently shifted tactics as the president’s July 9 deal deadline approaches. We next review several other international and US developments with the potential to affect the financial markets today, including a rebound in eurozone price inflation and the latest on the fate of Trump’s “big, beautiful” tax-and-spending bill in the US Senate.

US Tariff Policy: With it looking increasingly unlikely that the Trump administration will meet its July 9 deadline to strike comprehensive trade deals with dozens of countries, officials are now reportedly shifting gears to focus on achieving only narrow “agreements in principle” on specific trade issues, with the hope of striking broader deals later.

- As we’ve noted in the past, it was always a stretch to think the administration could finalize so many big trade deals in just a few months. If Trump officials really are prepared to accept that, trade tensions between the US and some countries could cool.

- All the same, it would not be a surprise for Trump to ratchet up threats this week against major trading partners such as the European Union and Japan. Talks with both economies have proven tough and given how significant they are for the US trade balance, Trump may well decide to focus his guns on them.

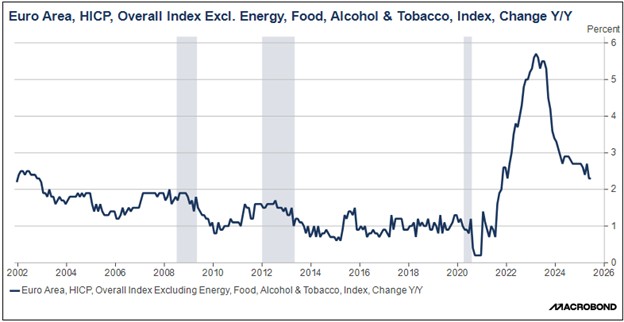

Eurozone: The June consumer price index was up 2.0% from the same month one year earlier, matching expectations and bringing inflation back to the European Central Bank’s target after the rise of 1.9% in the year to May. However, excluding volatile categories such as food and energy, the June “core” CPI was up 2.3% on the year, matching its annual rise in May. The data supports the idea that the ECB will soon stop reducing its interest-rate cuts out of fear that core inflation won’t fall to target.

China: The Communist Party late last week removed the Chinese military’s top ideology officer, Miao Hua, from his role on the powerful Central Military Commission. Miao had been ousted from the National People’s Congress earlier this year, after the government said he was being investigated for corruption last November. Separately, the Party also kicked the navy’s chief of staff and a top nuclear scientist out of the NPC. The moves suggest the Chinese military remains in the grip of corruption, which is a problem some observers think has hurt military readiness.

China-Japan: The Chinese government yesterday said it will allow the partial resumption of seafood imports from Japan. Beijing had banned all Japanese seafood imports in mid-2023, after Tokyo’s release of wastewater from the wrecked Fukushima No. 1 nuclear power plant. Given that fishing and aquaculture are important industries in Japan, the partial lifting of the ban is likely an effort by Beijing to curry favor with Japan and discourage it from cooperating with the US’s effort to isolate China militarily and economically.

Thailand: The Constitutional Court today suspended Prime Minister Shinawatra from power as it considers her handling of a border crisis with neighboring Cambodia. As we noted in an earlier Comment, the country’s powerful royalist-military elites have targeted Shinawatra after a leaked recording of a phone call with former Cambodian leader Hun Sen showed her castigating the Thai military. In its final decision, the court could well force Shinawatra from power, adding to the political uncertainty in the country.

United States-Iran: According to the Washington Post, the US intelligence agencies have intercepted a communication between senior Iranian officials in which they are heard saying the US military attacks on Iranian nuclear sites last month were not as devastating as they expected. The Trump administration admitted the existence of the intercept but continues to insist that the attacks largely “obliterated” key sites related to Iran’s nuclear program. The report adds to the evidence that the attacks did not destroy Iran’s program but merely disrupted and delayed it.

US Fiscal Policy: As of this writing, the Senate is still trudging through the voting on its version of President Trump’s “big, beautiful” tax-and-spending bill. Most of the floor amendments voted on so far have failed, but the senators have voted to strip the bill of its moratorium on the states regulating artificial intelligence. As we’ve noted before, the Republican majority is struggling to limit defections, and passage of the bill is not yet ensured.

- Of course, if the bill does pass the Senate, it will then need to go back to the House. The two chambers would then have to quickly negotiate a reconciled bill and have it pass both chambers if the Republican leadership is to meet its goal of sending the bill to Trump by July 4.

- Although more amendments could still alter the bill, the results so far suggest any legislation that is finally signed into law will significantly expand the federal budget deficit over the next decade. That will likely provide some stimulus to the economy in the near term, but bond investors could well look askance at the rising deficits, become even less avid in their purchases of Treasury debt, and drive interest rates higher over time.

US Housing Policy: The California legislature last night approved two bills reining in the state’s stringent environmental regulations, and Governor Gavin Newsom promptly signed them into law. Newsom, who is considered a likely Democratic candidate for president in 2028, had demanded the bills be passed to help spur real estate development and address the state’s critical shortage of housing. If the legislation achieves that, California’s large size means that homebuilders and related firms could see a noticeable increase in future business.