Daily Comment (June 13, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are focused squarely on Middle East tensions. Today’s Comment analyzes the market impact of the Israel-Iran conflict, explores why recent inflation trends have bolstered calls from the president for rate cuts, and highlights other key developments moving global markets. We’ll wrap up with our regular overview of today’s most important international and domestic economic data releases.

Israel Strikes Iran: As expected, Israel has launched a military attack on sites in Iran as it looks to prevent the country from producing a nuclear weapon.

- The strikes targeted Tehran, with Israel destroying key military installations and killing two of Iran’s senior commanders. The operation aimed to cripple the heart of Iran’s nuclear program, with the campaign expected to continue for two weeks. Meanwhile, the US denied any involvement in the attacks. Still, it urged Iranian officials to proceed with scheduled nuclear talks on Sunday, seeking to prevent an all-out war from spreading into other parts of the Middle East.

- Iran appears to be in disarray as it scrambles to formulate an effective response. The regime launched over 100 drones in retaliation, many of which were intercepted by Israeli defenses. Meanwhile, reports suggested that the replacement of top military leaders were later retracted, highlighting Tehran’s leadership crisis following the attacks. Despite this turmoil, Iran and its proxy forces are planning retaliatory strikes, along with potential blockades of critical shipping lanes in the Red Sea and Strait of Hormuz.

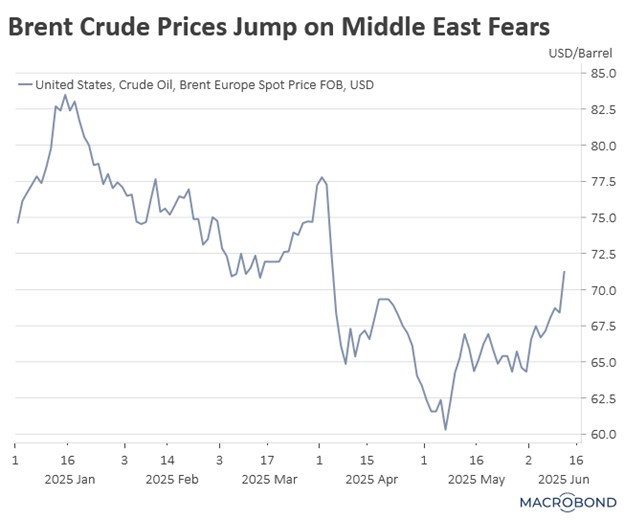

- The escalating conflict in the Middle East threatens to disrupt global trade, with Brent crude prices surging 10% in just five days amid mounting supply concerns. Shipping routes are being redrawn as vessels divert from contested waters, driving freight costs higher. This comes on top of existing supply chain pressures, as global shipping rates had already jumped 52% last week, and companies are racing to stockpile goods before the expiration of the 90-day tariff pause.

- The potential for this conflict to trigger significant global spillover effects hinges primarily on Israel’s strategic objectives. If its sole aim is to dismantle Iran’s nuclear program, market disruptions may prove temporary. However, should Israel expand its goals to include regime change, the resulting escalation could unleash sustained market volatility as a wider regional conflict would become increasingly likely.

- Current evidence suggests Israel is pursuing the more limited objective, having carefully targeted only key nuclear facilities. However, this restrained approach could shift if Iran refuses to back down despite the attacks. Should tensions escalate further, commodities would likely emerge as safe haven assets, poised to rally amid heightened geopolitical uncertainty.

Trump Fed Pressure: Softer inflation data has led the president to add further pressure on the Federal Reserve to implement rate cuts at its next meeting.

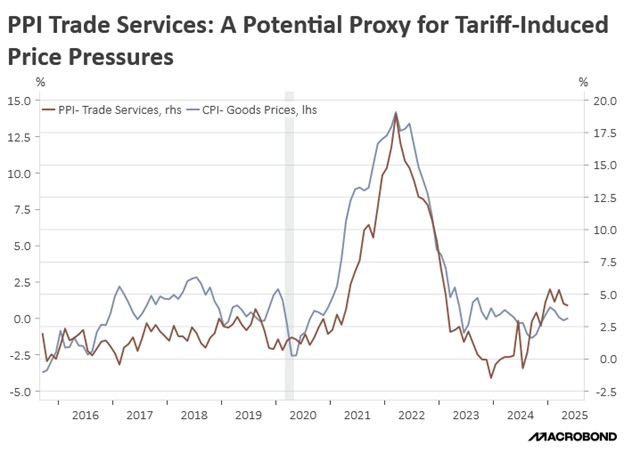

- Supply-side inflation remained subdued in May. The overall Producer Price Index (PPI) rose 2.6% year-over-year, narrowly exceeding estimates of 2.5%, while core inflation edged down from 3.2% to 3.0%. Moreover, key components feeding into the Federal Reserve’s preferred inflation gauge — the PCE price index — showed muted growth, indicating that the May reading will likely reflect further progress toward the central bank’s 2% target.

- The subdued inflation figures marked the second consecutive report this month showing progress toward the Fed’s inflation target, even as new tariffs took effect. The president has seized on these numbers to demand an aggressive 100 basis point rate cut at the Fed’s upcoming meeting. While he has stopped short of threatening to dismiss Chair Powell, he has hinted that the administration may have to “force something” if the central bank doesn’t act.

- The Federal Reserve has pointed to persistent uncertainty around inflation’s path as the primary reason for holding rates steady. Policymakers are split on whether businesses will fully pass through tariff-driven cost increases to consumers or partially absorb them, prompting the central bank to adopt a wait-and-see approach. Fed officials have emphasized the need for more time to assess the tariffs’ broader economic effects before considering any policy adjustments.

- Recent PPI inflation data suggests businesses have so far resisted passing on higher costs to consumers, instead absorbing the impact of tariffs. Trade services margins, which track wholesaler-to-retailer pricing, indicate firms are currently bearing these additional costs. However, this absorption capacity may stem from inventory stockpiles accumulated before the new tariffs took effect. Consequently, it remains uncertain whether companies can sustain this pricing restraint in coming months as inventories dwindle.

The Golden Share: The proposed acquisition of US Steel by Nippon Steel remains under review as the White House and the Japanese steelmaker continue negotiations.

- On Thursday, the president announced that the proposed Nippon Steel acquisition of US Steel would give the US government veto power over key corporate decisions, though he provided no further details. Nippon Steel swiftly pushed back, insisting it would not accept any deal that compromises its management control. With just days remaining before the June 18 deadline, the standoff underscores the significant gap between the two sides.

- Despite the disagreements, the two sides appear to have reached consensus on key provisions that would grant the US government certain oversight powers. As part of the deal, Nippon Steel is expected to sign a binding national security agreement requiring it to maintain US Steel’s headquarters domestically, with severe penalties for non-compliance. The Japanese firm has also committed to providing employee bonuses upon deal completion and investing billions to modernize American steel production.

- Despite ongoing negotiations, optimism remains high that a deal will be reached. The Trump administration has argued that the acquisition could help revitalize America’s steel industry, which has struggled against foreign competition in recent years. Meanwhile, Japan views US Steel as a strategic opportunity to diversify its holdings and gain stronger access to North American markets.

- The potential Nippon Steel-US Steel deal may establish important precedents for how the US handles foreign mergers amid rising trade protections. This acquisition could demonstrate whether partnerships and mergers will become viable strategies for foreign firms to navigate America’s tariff regime. The terms of this deal may ultimately shape how Washington regulates foreign investment in other strategic domestic industries.

New Tariffs: The president announced new tariffs as he looks to drive more manufacturing back to the US.

- The Trump administration announced that it would expand tariffs to include not only steel products but also steel derivative products, effective June 23. The new tariffs — set at 50% — will apply to goods such as home appliances. This move comes just a week after Trump declared he would increase steel tariffs, aiming to shield American manufacturers from foreign competition by discouraging imports of cheaper steel-based goods.

- The new tariffs are likely to raise concerns, as trade restrictions could force firms to either accept lower profit margins or pass costs on to consumers through higher prices. Additionally, the move suggests that the president may consider additional tariffs in the future. So far, these measures have not disrupted supply chains, and if this stability continues, it should help maintain economic resilience.