Daily Comment (June 12, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market’s attention is firmly on the latest Producer Price Index data. In today’s Comment, we’ll analyze the implications of the recent inflation figures, discuss new developments in Trump-era trade policies, and cover other key market-moving stories. As always, we’ll also provide a concise summary of today’s domestic and international economic data releases.

CPI Cool Streak: Inflation continues to trend lower, as many tariffs have yet to fully impact consumer prices.

- According to the BLS, consumer price growth in May fell short of expectations, signaling ongoing caution among businesses in raising prices. While many had forecast an uptick in inflation, both headline and core inflation slowed month-over-month, declining from 0.2% to 0.1%. The modest increase pushed the annual inflation rate up slightly, from 2.3% to 2.4%. Meanwhile, core inflation held steady at 2.8% year-over-year, unchanged from the previous month.

- The subdued price pressures were primarily driven by ongoing moderation in services inflation. Shelter prices, which account for over a third of the index, continued to normalize, having fallen to fresh post-pandemic lows. Meanwhile, energy prices remained a downward force on overall inflation as consumers benefited from lower gasoline prices.

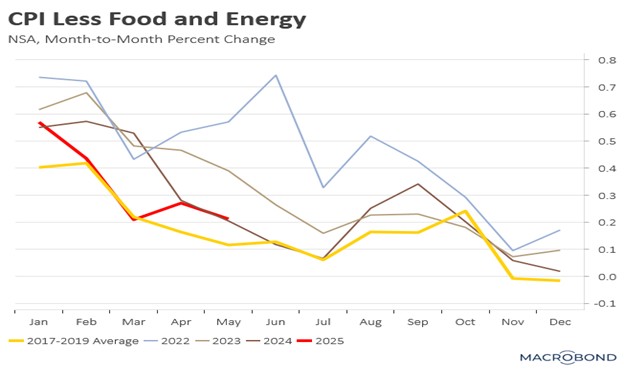

- While most of the inflation report was positive, there were some signs of emerging price pressures. The month-over-month percentage changes compared to the previous year suggest inflation momentum may be building. Although January saw an acceleration driven by rising insurance costs, inflation had largely stabilized at pre-pandemic levels before the tariff announcement. Since then, however, inflation appears to have accelerated to match last year’s pace.

- The continued moderation of the rise in inflation remains a welcome surprise, though it may be too early to tell whether this trend will persist. As noted in previous reports, much of the recent moderation appears attributable to inventory accumulation ahead of tariff implementations. While we expect this effect may soon fade, we believe a structural downward trend in services inflation should help prevent a return to the peak seen following the pandemic.

Trump’s Trade Tactics: The president’s trade truce with China eased fears of resource shortages but sparked speculation about potential new tariffs.

- During yesterday’s briefing, the president has confirmed a trade truce that will enable China to resume shipping critical rare earths and magnets for another six months. This agreement, however, requires the final go-ahead from Chinese President Xi Jinping. Although the precise concessions made by the US haven’t been fully disclosed, the president indicated that reinstating student visas for Chinese nationals attending American universities might have been a component of the deal.

- While markets welcomed signs of easing tensions between the US and its largest trading partner, the president reaffirmed his commitment to maintaining tariffs regardless of any new arrangements. After announcing what he called a “done deal” with China, he suggested that Chinese imports could still face total tariffs of 55% — a combination of the 30% imposed under the new agreement and the existing 25% from before his term.

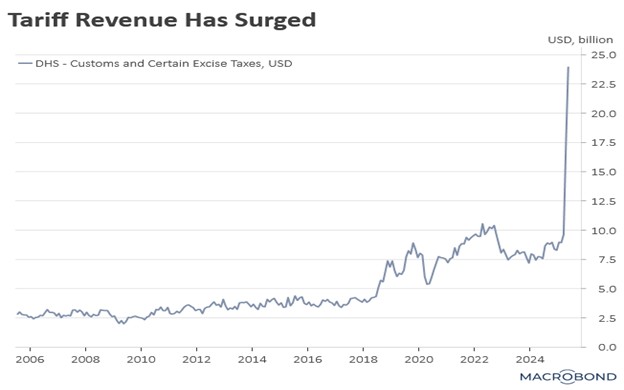

- The president’s economic strategy of consistently leveraging tariffs as a dual-purpose tool to influence trade policy and generate revenue for deficit reduction may be paying off. A record $23 billion in tariff revenue last month played a significant role in narrowing the budget deficit from $341 billion to $316 billion, representing a 17% year-over-year decrease. This substantial increase in government receipts was primarily the result of tariffs enacted in April, showing that tariffs are a legitimate revenue tool.

- That said, the president is preparing to issue unilateral tariff notices to multiple trading partners within the next one to two weeks, reinforcing his stance against complacency in trade negotiations. This move echoes his mid-May ultimatum that yielded only partial progress, and critical disagreements are still blocking deals with Japan and the EU.

- With the trade deadline approaching, we anticipate the president will escalate his rhetoric to strengthen his negotiating position. Thus far, markets appear confident that the worst of the trade war has passed, with investors pricing in expectations that tariffs will remain at current levels or decrease. However, should this sentiment shift, we could see a rapid reduction in risk exposure from market participants.

Iran Defies Calls: The Islamic republic appears poised to advance its nuclear expansion plans, disregarding renewed diplomatic pressure and raising the prospect of war with Israel.

- Tehran has announced plans to establish a new uranium enrichment facility following its censure by the International Atomic Energy Agency (IAEA) for noncompliance with nuclear safeguards. The covert site will operate alongside the ongoing modernization of centrifuges at the Fordow nuclear plant. This development, particularly the refusal to disclose the facility’s location, constitutes a further violation of Iran’s nonproliferation obligations.

- Iran’s move to accelerate its nuclear program comes amid a collapse in diplomatic efforts to address its nuclear activities. Although Washington and Tehran maintain open channels for dialogue, negotiations have stalled without meaningful breakthroughs. The prospects for Sunday’s planned talks now appear uncertain after President Trump denounced Iran’s negotiating stance as “unacceptable,” casting doubt on whether discussions can proceed productively.

- The lack of diplomatic progress has led to concerns that Israel may launch an attack on Iran in the near future. In response, Iran has warned it could retaliate by targeting US military assets across the Middle East. These escalating tensions prompted Washington to order partial evacuations at its Baghdad embassy amid security concerns. Israel’s resolve was further demonstrated by parliamentary proceedings following the controversial elimination of military conscription exemptions, a move that nearly triggered the government’s collapse.

- The risk of conflict over Iran’s nuclear program has risen significantly, and will more so if Israel launches a full-scale attack. A major regional war would likely spill over into global markets, driving up commodity prices. A key factor will be Iran’s response. If Tehran adopts a “now or never” approach, the conflict could escalate dramatically, potentially drawing in neighboring countries.

Boeing Problems: The aircraft manufacturer is likely to face renewed scrutiny after one of its planes crashed in India.

- An Air India Boeing Dreamliner crashed shortly after takeoff, killing an unknown number of people. The aircraft was carrying 242 passengers and plunged into a residential area, raising fears of a high death toll. The incident is likely to fuel further skepticism about aviation safety, particularly Boeing’s aircraft quality, following a series of mishaps over the past six years — most notably the 737 Max crisis in 2019.

- Boeing aircraft are among the most valuable US exports, and orders for these planes have often been leveraged in trade negotiations to secure favorable terms. However, the public relations fallout from this incident could have far-reaching consequences if countries grow hesitant to purchase Boeing jets due to mounting safety concerns.