Daily Comment (June 11, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning. The market’s primary focus today is the latest Consumer Price Index release. Today’s Comment will delve into a new contender that President Trump might consider to succeed Federal Reserve Chair Jerome Powell, discuss signs of progress in US trade negotiations, and review other key market-related news. As always, we will conclude with a summary of today’s domestic and international economic data releases.

Bessent Fed Chair? While the Trump administration has abandoned the idea of ousting the Fed chair, it has not stopped its attempt at influencing monetary policy decisions.

- Treasury Secretary Scott Bessent has emerged as a potential nominee to succeed Fed Chair Powell when his term expires in 2026. The administration has reportedly begun considering candidates well in advance, aiming to shape market expectations for future policy rates. This move comes amid the Fed’s reluctance to cut rates in 2025, following a 100-basis-point reduction the previous year.

- Bessent has long been one of the most trusted and loyal figures in the Trump administration. While investors have viewed him as a steady hand, his potential nomination as Fed chair could face skepticism given his proximity to the president. Although Bessent has publicly downplayed interest in the role, he was reportedly the architect of the so-called “shadow Fed” strategy.

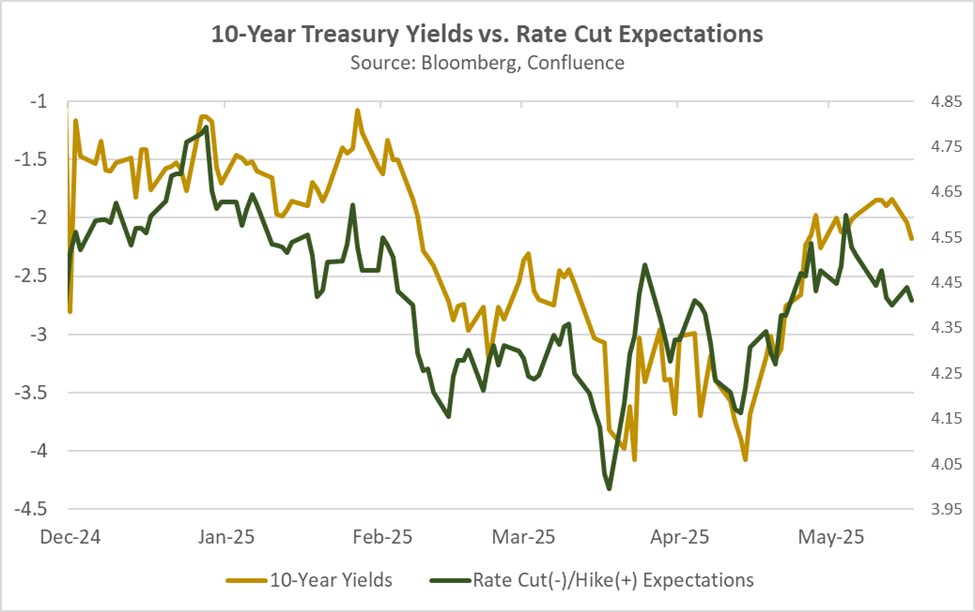

- Since the start of the year, the 10-year Treasury yield has been highly sensitive to shifting expectations around Fed rate cuts. The yield has largely fluctuated within a range of 4.20% to 4.50% as investors attempt to gauge the Fed’s next moves. When economic data signals weakness, markets price in more aggressive rate cuts, pushing the yield lower. Conversely, signs of resilience have led traders to scale back rate-cut bets, driving the yield higher.

- That said, it would be disingenuous to claim that the Fed is the only factor influencing the 10-year yield. Concerns over the national debt and shifting expectations around US Treasury demand have also played a role. For instance, even after the Fed cut rates by 100 bps last year, the 10-year yield reached peaks higher than any level seen in 2024, and unlike last September, it has yet to dip comfortably below 4%.

- The potential nomination of Bessent — or, as we’ve previously noted, former Fed Governor Kevin Warsh — to Fed chair could raise concerns about the central bank’s independence. While this might clear the path for lower short-term rates, we believe it could also increase volatility in long-term rates. Ultimately, the push to appoint a new Fed chair may lead to more accommodative monetary policy but at the cost of heightened bond market instability.

Trade Progress: The Trump administration has advanced trade framework negotiations to de-escalate tensions before the critical July 9 deadline.

- China and the US have reached a tentative agreement aimed at easing bilateral trade tensions amid a row over compliance with the “Geneva Deal.” While details have not been released, trade talks seem to focus on export restrictions as opposed to import tariffs. Particularly, the Trump administration has agreed to relax some technology export controls in return for accelerated shipments of critical rare earth minerals from China.

- Building on its China negotiations, the administration has achieved parallel breakthroughs in other trade talks. Most notably, US-Mexico negotiations have yielded a proposed steel agreement establishing duty-free access within defined limits on imports. Additionally, the US and India are close to a “phased trade deal,” which will include market access in India and reduced non-trade barriers such as quality control.

- However, mounting evidence suggests several key trading partners may fail to meet the administration’s July deadline. European negotiators are currently advocating for an interim agreement to maintain negotiations beyond the cutoff date, while preserving ongoing dialogue. This follows South Korea’s formal request earlier this month for an extension to its bilateral trade terms.

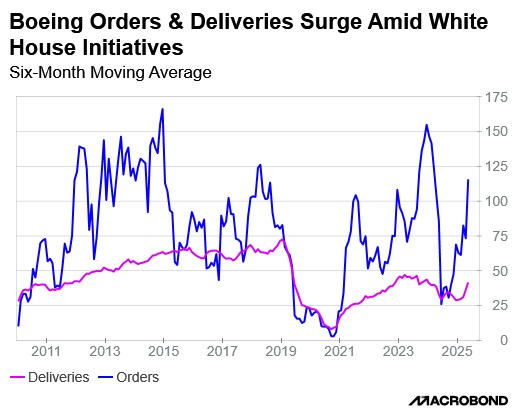

- While the president is focused on long-term trade deals, he is also securing short-term economic boosts. For instance, recent Boeing sales solidified during his trip to the Middle East are expected to further stimulate growth. In May, Boeing secured 303 new bookings and delivered 38 new 737 MAX jets, marking its sixth-highest monthly order tally in company history. As one of the nation’s largest exporters, Boeing’s performance can have a significant impact on overall economic growth.

Gold Climbing: Central banks are accumulating gold at a pace not witnessed since the post-war Bretton Woods era.

- A significant shift in global reserve holdings has occurred, with gold now officially ranking as the second most important reserve asset for central banks, surpassing the euro. This increased accumulation of gold is a strategic move by central banks to diversify their portfolios, given the perceived heightened risk of dollar-denominated assets due to recent US trade and political measures.

- According to the report, gold currently comprises 20% of global official reserves, significantly exceeding the euro’s 16% share but still well below the US dollar’s dominant 46%. In 2024, central banks collectively acquired over 1,000 tons of gold for the third consecutive year, representing approximately one-fifth of total global production. This accumulation has increased global gold reserves to 36,000 tons, nearing the record 38,000-ton peak last seen in the mid-1960s.

- Notably, the largest gold buyers included India, Poland, Turkey, and China — countries that have often faced US and EU sanctions or penalties, particularly in response to alleged human rights abuses. We suspect this surge in gold acquisition is largely driven by the dollar’s weaponization against Russia post-Ukraine invasion, alongside a broader ambition to diminish trade dependence.

- The accumulation of gold by central banks likely signals potential weakening for the dollar. While strong indicators suggest the US will maintain its role as the dominant reserve currency, supported by its robust, diverse economy and deep, liquid markets, it is evident that markets may begin exploring alternative options. Although it is premature to predict a dollar bear market, this trend clearly suggests a potential softening of demand.

Netanyahu in Trouble? The Israeli parliament may dissolve over disagreements about military exemptions.

- A vote is scheduled for Wednesday regarding the exemption for religious students from military service. An ultra-Orthodox party, allied with Prime Minister Netanyahu’s Likud Party, has threatened to dissolve parliament if the measure fails. This development risks exacerbating political uncertainty as the nation simultaneously navigates tensions with its territorial rivals.

- It appears that lawmakers are seeking to postpone any final vote until after the parliamentary session concludes in July. However, it is widely believed that a new vote could significantly complicate PM Netanyahu’s efforts to establish a governing coalition. This political uncertainty could, in turn, hinder efforts to reach a resolution in the two ongoing conflicts in which the country is involved.