Daily Comment (June 6, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is closely watching the latest jobs data as a key driver of sentiment. Today’s Comment begins with an analysis of rising tensions within the Republican Party over the new tax legislation, explores why the ECB may have finished its rate-cutting cycle, and covers other key market developments. As always, the report will also include a summary of recent domestic and international data releases.

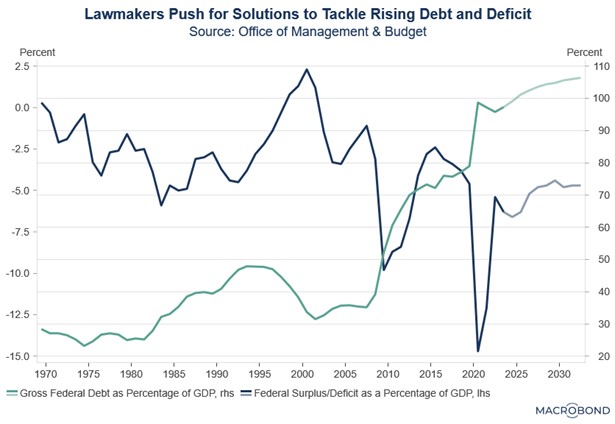

Budget Dispute: Divisions over the president’s Big, Beautiful Bill have erupted publicly as Republican lawmakers grapple with the legislation’s complex policy trade-offs.

- Much of the media coverage has centered on the highly publicized rift between President Trump and Tesla CEO Elon Musk, once dubbed his “Bro-in-Chief,” who has emerged as a vocal critic of the bill. Musk has denounced the legislation as fiscally irresponsible and urged Republican lawmakers to block its passage. His remarks coincided with the president’s meeting with the Senate Finance Committee where he attempted to rally support for the bill.

- In response to Musk’s criticism, the president threatened to terminate federal contracts with Musk’s companies, sparking an immediate sell-off in Tesla shares. The billionaire retaliated by floating the possibility of launching a third-party political movement as an alternative to the Republican Party. However, tensions have since eased following intervention by presidential aides, who arranged a conciliatory call between the two figures to resolve their differences.

- Behind the scenes, congressional Republicans may be moving toward significant concessions to advance their tax legislation after negotiations with President Trump. In closed-door meetings with GOP lawmakers, the president reportedly supported measures to achieve Medicare savings while indicating an openness to reducing the planned SALT deduction cap increase.

- Nevertheless, the bill remains far from finalized, with several controversial provisions still under debate. Two lesser-discussed but significant items include a proposed 10-year moratorium on state-level AI regulation and making the 2017 corporate tax cuts permanent. These divisions threaten to complicate the bill’s path through the House following Senate revisions. Despite these headwinds, we maintain our projection that the legislation will ultimately pass within the next month.

A Hawkish Cut: The European Central Bank has cut rates but signaled that it is nearing the end of its easing cycle.

- The ECB cut its benchmark policy rate by 25 basis points to 2.00%, matching market expectations, as it steps up efforts to shield the eurozone economy from escalating US trade tensions. The move cements the ECB’s status as the most aggressive easing force among major central banks this year. The decision was not unanimous, however, with Governing Council member Robert Holzmann dissenting in favor of holding rates steady, citing lingering data uncertainties.

- The ECB’s decision to cut rates comes amid signs of economic recovery in the eurozone, with inflation finally easing from elevated levels. First-quarter GDP growth accelerated to 0.6%, doubling the previous quarter’s pace, and was driven primarily by stronger investment activity. While headline inflation in the region fell below 2% in May for the first time since 2021, underlying price pressures remain persistent, with services inflation still running significantly above pre-pandemic levels.

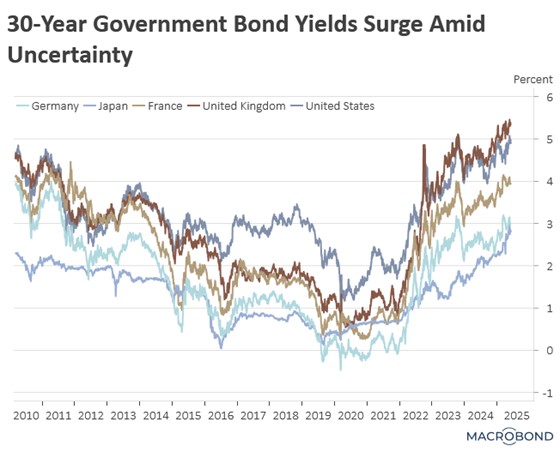

- During the press conference, ECB President Christine Lagarde described current monetary policy as being in a “good place,” while suggesting the central bank may be approaching the end of its easing cycle. These remarks triggered an immediate sell-off in global bond markets, as investors recalibrated expectations for long-term interest rates amid growing recognition that the ultra-low-rate environment of recent decades may not return.

- The ECB’s decision to halt further monetary easing appears partially driven by escalating US-EU trade tensions. Washington has repeatedly criticized accommodative policies by foreign central banks, accusing them of deliberately maintaining lower interest rates than the US to weaken their currencies and gain unfair trade advantages. This criticism intensified recently when the US Treasury explicitly urged the Bank of Japan to hike its policy rates to strengthen the yen in its semi-annual currency report.

- Global bond yields appear to be undergoing a structural shift, with markets increasingly pricing out any return to the historic lows seen following the 2008 financial crisis and the pandemic. This suggests the global economy may be entering a period of tighter financial conditions and more restrictive trade policies, potentially creating headwinds for economic growth. In this environment, we favor a quality bias, as financially stable firms are better positioned to weather these challenges than their more leveraged counterparts.

Trump and Xi Speak: Tensions between the two largest economies appear to be easing following a phone call between their leaders.

- After a period of escalating tensions, Chinese President Xi and President Trump have finally connected via phone to address their ongoing trade disputes. President Trump indicated that the productive conversation sets the stage for a new series of high-level trade negotiations between the two nations. This breakthrough follows mutual accusations of failing to honor the recent trade agreement made in Geneva.

- Trump’s decision to hold talks stemmed from his efforts to persuade Beijing to resume exports of rare earth minerals, following China’s move to tighten restrictions in retaliation for US limits on software sales. While there was no public discussion of either side easing their trade barriers, signs of potential concessions did emerge. China, for its part, suggested that the talks should facilitate the return of Chinese students to US universities.

- The talks come as both economies face mounting pressure from trade tensions. Recent factory data in China reveals that manufacturing activity contracted at its fastest pace since September 2022, driven largely by a sharp drop in export prices. Meanwhile, purchasing manager surveys indicate that manufacturers are grappling with rising input costs, which may force businesses to raise prices. Additionally, there are signs that the labor market may be showing signs of cooling.

- While talks between the two sides are a positive development for the market, lingering uncertainty over future trade policy will likely fuel further volatility. Both countries stand to lose significantly from a potential decoupling, yet they acknowledge that their relationship is unsustainable in its current form. We expect negotiations to drag on for months as both sides seek to mitigate the economic fallout of an eventual separation. That said, any meaningful breakthrough in talks could trigger a sharp equity rally.