Daily Comment (June 2, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with more evidence that geopolitical and economic tensions may be heating up again between the US and China. We next review several other international and US developments with the potential to affect the financial markets today, including a right-wing victory in Poland’s presidential run-off election and a Federal Reserve policymaker’s suggestion that any rise in price inflation because of President Trump’s tariffs could be short-lived enough to allow the central bank to resume cutting interest rates later this year.

United States-China-Asian Allies: At the Shangri-La Dialogue in Singapore on Saturday, Defense Secretary Hegseth warned that China “seeks to become a hegemonic power” in Asia and is now a real and potentially imminent threat to Taiwan and other US allies in the region. Hegseth pledged US support to help the allies counter China’s threat, but he also argued that they should boost their defense spending to 5% of gross domestic product, as many European countries are now aiming to do in response to the threat of aggression from Russia.

- Investors have naturally focused on trade policy over the last few months, but Hegseth’s statement is a reminder that the US — the reigning global hegemon — still faces a big geopolitical challenge from China.

- China continues to strengthen militarily, economically, and technologically, and we believe that it seeks to become the dominant power not only in Asia but probably globally. President Trump is sensitive to growing isolationist sentiment among many in his base, but some in his administration are still focused on defending US hegemony.

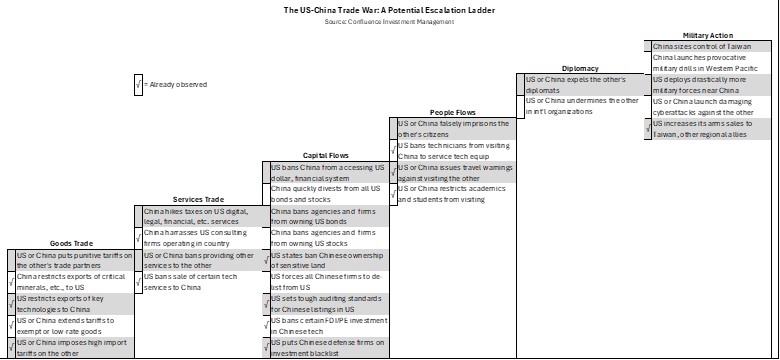

- We still believe that the US and China are in a spiral of increasing tensions. While investors rightly worry about the impact of Trump’s trade policies, they should also keep in mind the risk of geopolitical conflict and the many ways in which US-China tensions could increase, as shown in our US-China Escalation Ladder.

United States-China: Speaking of the US-China trade war, President Trump on Friday accused the Chinese government of violating the 90-day truce reached on May 12. Although Trump didn’t say how Beijing had violated the deal, US Trade Representative Greer later revealed that the violation involved moving too slow to reverse its ban on Chinese rare earth exports.

- In a previously unreleased letter from May 9, global auto firms representing the likes of General Motors, Ford, Toyota, Volkswagen, and Hyundai warned the administration that China’s rare-earths export ban could force the shutdown of auto factories within weeks. Other industries ranging from aerospace and defense to semiconductors would also be at risk.

- Further statements by administration officials confirm that last week’s new ban on sending US aerospace and semiconductor technology to China was to retaliate for China’s continued restriction on rare-earth exports, as was the administration’s vow to revoke the visas of Chinese students studying in the US.

- The Chinese government today accused the US of “seriously violating” the 90-day trade truce with its actions on technology and visas. It vowed to retaliate strongly, signaling a continued spiraling of tensions between Washington and Beijing.

United States-Taiwan: In a little-noticed statement to Congress recently, retired Navy Adm. Mark Montgomery revealed that the US now has about 500 military trainers in Taiwan, more than 10 times the number previously known. Although he didn’t say whether the trainers were active-duty troops, reservists, or civilian contractors, Montgomery argued the US should double the size of the team to help Taiwan develop “a true counter-intervention force” that could resist any attempt by China to take control of the island.

- Montgomery’s statement suggests the Trump administration has ramped up military support to Taiwan, just as it has for other allies in the region, such as the Philippines.

- To reiterate, US-China geopolitical frictions continue to worsen, even beyond the economic issues involved in their current trade war.

Poland: In the second and final round of the country’s presidential election yesterday, Karol Nawrocki of the right-wing nationalist Law and Justice Party narrowly won with 50.9% of the vote, beating the liberal mayor of Warsaw, Rafał Trzaskowski, with 49.1%. Poland’s president can veto legislation or refer it to the Constitutional Court, so Nawrocki’s win ensures that Law and Justice can keep blocking aspects of Prime Minister Tusk’s centrist agenda. Nawrocki’s win also points to continued gains by Europe’s right-wing parties.

Russia-Ukraine War: In a surprise drone attack on several key air bases across Russia’s territory over the weekend, Ukraine appears to have destroyed or damaged dozens of Russia’s 100 or so long-range Tupolev bombers. The attack apparently involved sneaking large numbers of drones into Russia by truck, hiding them in crates that doubled as launching platforms once they got close to the targeted bases.

- The loss of the bombers is expected to crimp both Russia’s ability to bomb Ukraine and its ability to project power beyond its borders.

- We also think the Ukrainian attack echoes aspects of Israel’s 2024 attack on hundreds of Hezbollah fighters using hidden explosives in their pagers. Kyiv’s tactic of hiding and launching the drones using crates carried by truck is a further sign that countries are now willing to compromise common, everyday products to deliver weapons for long-range, remote attacks outside their borders.

Global Oil Market: Saudi Arabia, Russia, and some other members of the OPEC+ grouping on Saturday said they would boost their collective oil output by 410,000 barrels per day, starting in July. That would mark the third straight month of increased production. The increase reflects pressure from President Trump, the Saudis’ intent to win back market share, and the group’s optimism about future global demand. However, if demand comes in softer than they anticipate, the production increase would likely help keep oil prices near their current modest levels.

US Monetary Policy: At a conference in South Korea today, Fed board member Christopher Waller said any rise in consumer price inflation because of the Trump administration’s new tariffs could be short-lived, given that there is less fiscal stimulus and the labor market isn’t as tight as in 2022. According to Waller, that could still allow the Fed to cut interest rates further in late 2025, not because of economic weakness but because of renewed disinflation.

US Fiscal Policy: In a television interview yesterday, Treasury Secretary Bessent insisted the US “is never going to default,” despite continuing large budget deficits putting it on track to hit its legal debt limit in August. Bessent’s comment was a response to JPMorgan CEO Dimon’s warning on Friday that the US bond market could buckle if the federal government doesn’t contain its debt soon.

- We believe Congress will raise the debt limit in time to avoid a default this summer. Still, Dimon’s statement helps underline the risk that growing federal debt could increasingly hamstring fiscal policy and potentially prompt investors to abandon US obligations.

- It is extremely difficult to predict when investors might decide to dump US debt. Nevertheless, rising long-term yields suggest at least some investors may be getting more concerned.

US Trade Policy: Visiting a United States Steel plant on Friday, President Trump said he would further hike the US tariff on steel and aluminum imports to 50% on June 4, compared with 25% currently. According to Trump, the higher tariff would help protect US steelworkers and support the expected “partnership” deal between Japan’s Nippon Steel and US Steel, in addition to helping the domestic aluminum industry.