Asset Allocation Bi-Weekly – The Japan Problem (June 2, 2025)

by Thomas Wash | PDF

Just one day after Prime Minister Shigeru Ishiba likened Japan’s debt situation to that of Greece, the country faced its weakest demand for 20-year bonds since 2012. The auction’s tail — the excess of its highest yield over its average yield — widened to 1.14, the largest since 1987. His timing could hardly have been worse, coming as investors were already scrutinizing government fiscal sustainability following Moody’s downgrade of the US credit rating.

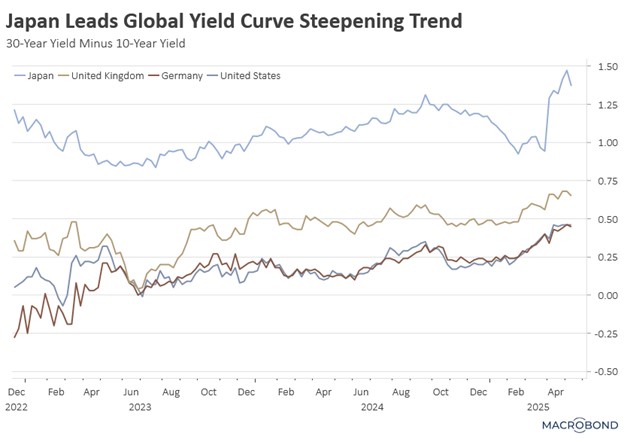

The market reaction was swift and severe, with yields on 30-year and 40-year Japanese government bonds (JGBs) climbing to record highs. This dramatic shift caught many by surprise, considering that JGBs had been in strong demand just one month earlier. Global investors had been accumulating ultra-long JGBs at a record pace, with holdings reaching new highs for three straight months through April.

The bond market turmoil in Japan reflects mounting economic strains, with inflation at multi-decade highs and US tariffs threatening export growth. Rising rates have intensified concerns over servicing the world’s largest public debt burden at 200% of GDP, which is double the US’s ratio. These pressures are testing Japan’s fiscal stability as investors question long-term sustainability amid shrinking policy options.

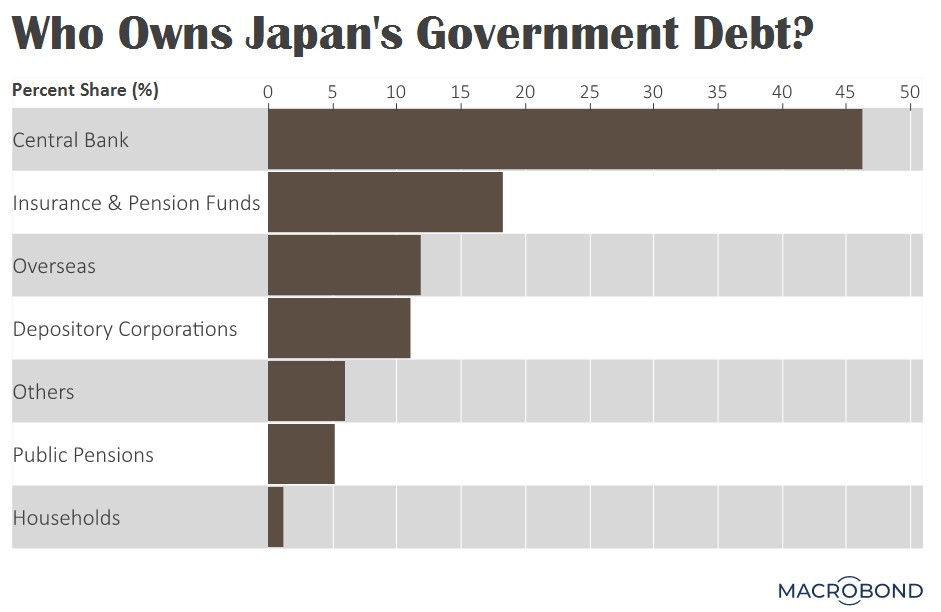

The Bank of Japan’s (BOJ) quantitative tightening program has emerged as another key concern. With the BOJ currently holding approximately 46% of Japan’s outstanding government bonds, the central bank’s gradual reduction of bond purchases by roughly 400 billion yen ($2.77 billion) per quarter aims to cut monthly buying to 3 trillion yen ($20.7 billion) by March 2026. This planned withdrawal has created a significant supply-demand imbalance as traditional buyers such as pension funds and life insurers have failed to fill the void.

A key systemic risk lies in the potential global contagion from Japan’s bond market turmoil. Surging JGB yields may prompt large-scale capital repatriation by domestic investors, draining liquidity from overseas markets. This threatens US Treasury markets disproportionately as Japanese institutions — the largest foreign holders — could reduce their substantial holdings, potentially tightening financial conditions stateside.

If surging Japanese yields also spark a sustained appreciation of the yen, it could also spark a disorderly unwind of carry trades, with potential spillovers across global markets. The classic “short yen, long dollar” trade, which sparked volatility during last summer’s abrupt reversal, could face renewed pressure if the BOJ intervenes to support its bond market. Such a scenario might force leveraged investors to cover short positions, potentially triggering cascading margin calls and fire sales across equities, credit, and emerging markets.

In the current climate of bond market volatility, we believe precious metals, particularly gold, offer an effective hedge against uncertainty. Diversification into non-correlated assets remains the most prudent strategy to mitigate risks in global fixed income markets. Gold’s historical role as a safe-haven asset makes it especially compelling during periods of bond market stress. We also see high-quality equities as another potential defensive allocation, providing both capital preservation and growth potential amid turbulent conditions.