Daily Comment (May 16, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are closely tracking the president’s latest trade announcement. In sports, the Carolina Hurricanes secured a victory against the Washington Capitals, advancing to the Eastern Conference Finals. Today’s Comment will discuss the administration’s recalibrating of its trade strategy, Friday’s stronger-than-expected economic data that still contained worrying signals, and other market news. As always, we’ll conclude with a summary of major domestic and international economic data releases.

Trump Rethinks Tariffs: The president has stated that he plans to set new tariff rates for countries due to the difficulty in securing deals with individual nations.

- The president has announced a shift away from previously set tariff rates, directing Commerce Secretary Howard Lutnick to notify trading partners of new requirements for doing business with the US. The move follows a series of deals by the Trump administration to lower tariffs from the levels set on April 2. It remains unclear whether this approach will involve eliminating some tariffs in favor of a more direct business tax or simply reducing overall tariff rates.

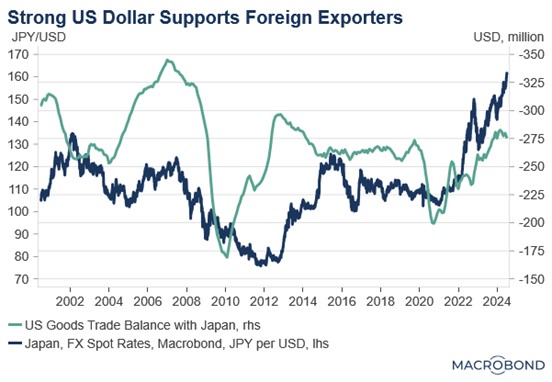

- The president’s policy shift coincided with US-Japan trade negotiations held the same day. Reports suggested the discussions might have expanded beyond trade to include currency exchange rates. However, negotiations reached an impasse when Japanese officials demanded the complete elimination of the 25% auto tariff as a prerequisite for any agreement, a condition the Trump administration ultimately rejected.

- However, his decision to reconsider tariffs offers stronger support for the “Trump put” hypothesis than market observers initially anticipated. This theory posits that the president is more likely to prioritize market performance over long-term policy goals, implying that any significant market downturn would prompt intervention to restore upward momentum.

- A notable trend in this trade war is the increasing influence of public sentiment. President Trump’s trade policies have fueled recession concerns, weakening his domestic approval ratings. At the same time, foreign leaders negotiating with the US face growing political pressure to hold firm in talks to avoid appearing overly conciliatory.

- In short, the political reality of the trade war has complicated negotiations. Many Americans now fear recession and rising inflation, while foreign voters increasingly resent US economic dominance. Faced with these pressures, the administration may need to recalibrate its approach — at least until it secures passage of its tax bill.

- We expect the current market rally to persist barring any unexpected tariff escalations. Investors have largely priced in the April 2 tariffs as the likely peak, with markets now anticipating potential reductions. This baseline scenario, if correct, would mitigate recession concerns and continue supporting equity valuations. However, any deviation from this expectation — particularly new tariff measures — could quickly reverse recent gains.

Mixed Data: The latest retail sales and PPI figures paint a mixed picture of the impact of tariffs, yet recent forecasts still point to strong GDP growth in Q2.

- While overall spending appears to be holding, there are subtle signs of weakness. Retail sales unexpectedly edged up 0.1% in April, defying forecasts of stagnation, as consumers ramped up auto purchases ahead of looming tariffs. But the headline gain masked underlying weakness as the retail sales control group (which excludes autos, gasoline, and building materials and directly feeds into GDP calculations) fell 0.2%, sharply missing expectations of a 0.3% rise.

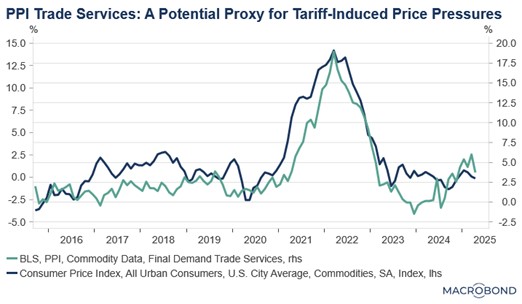

- April’s producer price index also painted a confusing picture of the economy. Defying expectations of a 0.2% gain, the headline PPI instead fell 0.5% month-over-month, a decline that reflects both moderating price pressures and businesses absorbing tariff costs. Most notably, the PPI trade services component, our key barometer for tariff impact, plummeted 1.6%, providing compelling evidence that trade intermediaries are bearing the heaviest burden from recent protectionist measures.

- Taken together, this data suggests the initial impact of tariffs on spending and prices may be less severe than anticipated. This could be attributed to firms strategically maintaining low prices to gain market share while competitors navigate adjustments. However, the sustainability of this trend remains uncertain. Even a major low-cost retailer like Walmart has indicated a willingness to raise prices in response to tariffs.

- Nevertheless, we believe this data reinforces the likelihood of a longer runway before a potential recession than many anticipate, which should support equities if this trend persists. The Atlanta Fed’s latest GDPNow forecast indicates a projected 2.5% growth rate for the second quarter, suggesting economic rebound. In essence, while tariffs are undoubtedly impacting the economy, their effects have not yet been significant enough to derail the economy’s current trajectory.

Putin Says No Deal: The Russian leader’s no-show for a planned meeting in Turkey aimed at securing a truce with his Ukrainian counterpart will delay a peace deal.

- The highly anticipated meeting between the leaders of the two warring nations did not unfold as planned. Originally intended to bring both sides together to finalize an agreement, the day descended into chaos instead. Putin sent a lower-level delegation instead of attending in person, and the groups landed in different cities, making face-to-face discussions nearly impossible. Although talks are expected to resume today, hopes for a final agreement remain slim.

- Putin’s lack of cooperation suggests he remains confident in his dominant position at the negotiating table. Reports indicate he is pushing for discussions based on the 2022 Istanbul draft agreements, terms initially proposed as Russian forces prepared to invade Ukraine. Those demands included drastic reductions in Ukraine’s military capabilities, strict limits on its armaments, and significant concessions on sovereignty — conditions that are almost certain to be rejected.

- The US maintains its mediation efforts between the warring parties, seeking to facilitate a rapid end to hostilities. President Trump has indicated he’s prepared for direct talks with Putin in hopes of altering Russia’s position. However, with key leaders absent from negotiations and no framework for finalizing terms, expectations remain low that the upcoming diplomatic meetings will produce substantive results.

- We remain optimistic that ongoing negotiations will ultimately produce an agreement between the two parties. Putin’s decision to abstain from attending appears primarily designed to demonstrate Russia’s dominant position in the talks. However, he likely understands that sanctions relief remains contingent upon reaching an arrangement. Consequently, we anticipate a settlement before year’s end that should provide support for European equities while exerting downward pressure on energy prices.

Fed Officials Reflect: The Fed is looking to change the framework that it uses to guide its policy decisions.

- Yesterday, Federal Reserve officials convened for the first day of their two-day conference to evaluate current monetary policy strategies. The discussions are part of the central bank’s regular framework review, ensuring its policy tools remain aligned with the Fed’s dual mandate of price stability and maximum employment. A key focus of this review will be evaluating how the pandemic has influenced the Fed’s policy decisions.

- The central debate focused on the Fed’s decision to prioritize maximum employment over inflation control, even as labor markets showed clear signs of tightening. Most notably, the strategy of tolerating above-target inflation to compensate for previous periods of persistently low inflation has emerged as a key area requiring revision in the upcoming policy framework.

- Additionally, discussions have emerged regarding current economic conditions and their implications for monetary policy. Fed Chair Powell has indicated that he anticipates persistent supply shocks and elevated long-term yields, signaling the central bank’s overall reluctance to return to the pre-pandemic normal of near zero interest rates. This shift means that bonds yields are likely to stay elevated.