Daily Comment (May 15, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is currently focused on analyzing the latest slew of economic data. In sports news, fans are celebrating as the Minnesota Timberwolves secured their spot in the NBA Western Conference Finals. In today’s Comment, we’ll examine the sources of the market’s growing optimism, the underappreciated strategic depth behind Trump’s negotiation tactics, and other notable market developments. We’ll conclude with our regular roundup of international and domestic data releases.

Market Optimism: The initial shock from the tariffs appears to be fading, with the market increasingly reflecting a risk-on sentiment.

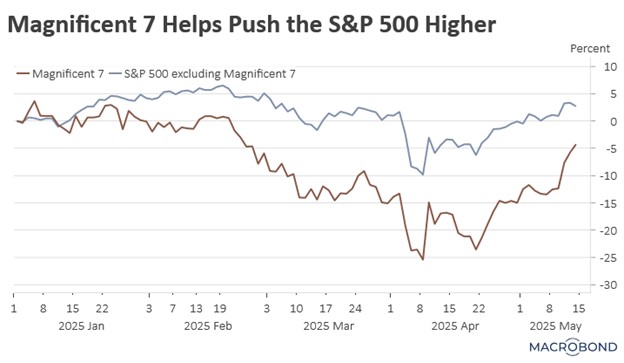

- Since the president’s controversial Liberation Day announcement, which imposed steep tariffs on key trading partners, the S&P 500 has not only fully recovered its initial losses but has now climbed above its 200-day moving average. This rebound reflects improving market sentiment, as investors grow increasingly confident that the administration may adopt a more flexible approach than initially feared when the tariffs were introduced.

- Following progress in trade negotiations with the UK and China, the US announced on Thursday that additional countries have shown willingness to engage on some of the president’s key trade concerns. On Thursday, he revealed that India is considering eliminating all tariffs on US goods. Meanwhile, there have also been discussions suggesting that EU officials are increasingly confident about reaching a deal with the Trump administration.

- Following progress in trade talks, we have seen investors return to the momentum trade that drove the S&P 500 higher in 2023 and 2024. Notably, investors have rushed back into AI-related firms amid optimism that demand for new technology will fuel strong earnings growth over the coming years. The most significant gainers have been Tesla and Nvidia, which both have surged roughly 23% since April 2.

- Investors increasingly believe the president will adopt a more pragmatic approach to tariffs moving forward — a shift many interpret as a sign that the worst may be over. As a result, markets have begun pricing in the prospect of future trade progress, which could significantly benefit US firms. While it is still too early to confirm whether this optimism is justified, sentiment is likely to hold as long as the administration signals no further escalation in tariffs beyond current levels.

- Consequently, we believe it may be prudent to begin cautiously testing the market, particularly by targeting companies with minimal supply chain risks and strong earnings potential. These firms are likely to show the most upside risk as long as the economy continues to grow. That said, there are still risks that are hard to quantify; therefore, a wait and see approach is still the safest.

Trump’s Strategy: While the president’s trade policies may appear volatile, there may be more strategy at play than many realize.

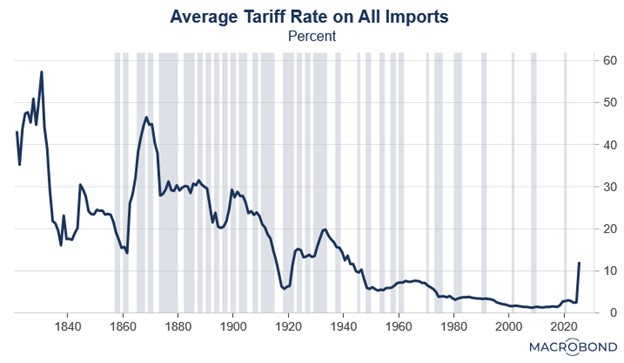

- His decision to impose steep tariffs on fentanyl-related imports from allies and China caught markets by surprise. At the time, many had underestimated his willingness to escalate a trade war due to the impact it would have on equities. As a result, the tariff led to an immediate market sell-off. This move put other countries on notice that he meant business but also forced companies to stockpile goods and brace for further disruptions.

- Next, he imposed sky-high tariffs on nearly all major trade partners, redefining a “trade cheat” not as a country exploiting the system, but simply as any nation running a surplus with the US. By pushing tariffs to extreme levels, he reshaped market expectations of how high tariffs could go, while reinforcing his broader goal of fundamentally restructuring US trade relationships.

- Then, in a tactical pivot, he slashed tariffs to a flat 10% — still triple pre-trade war levels but significantly below his initial demands. This triggered another round of inventory hoarding while boosting government tariff revenues and showcasing their viability as a fiscal tool. More importantly, it delivered an unambiguous warning to trade partners that access to the US market now comes with strings attached.

- Meanwhile, China’s tariffs were maintained at effectively prohibitive levels, compelling Chinese exporters to divert goods to alternative markets. This deliberate oversupply strategy served a dual purpose as it demonstrated the disruptive consequences of Chinese export dominance while creating economic incentives for other countries to align with US efforts to restrain China’s trade practices.

- The US strategically reduced Chinese tariffs to triple the standard rate applied to other nations in a calibrated move that maintained China’s status as the primary trade-policy target. This triggered two key effects: (1) an immediate surge in imports as companies raced to rebuild inventories, boosting tariff revenues; and (2) sustained pressure on US firms to accelerate supply chain diversification away from Chinese manufacturing hubs.

- While this breakdown omits many nuances and certain events, the key takeaway is clear: The president’s tactics, though unorthodox, serve deliberate goals. The trade war is unlikely to end soon, but the volatility itself has secondary benefits such as generating revenue through inventory surges, which could sustain growth longer than many realize. While the ultimate outcome of these policy shifts remains uncertain, there are strong indications of a broader, calculated strategy at work.

Tax Bill Gets Uncomfortable: Republican lawmakers are expected to have a tax bill by July; however, there still seems to be a lot of disagreement over the details.

- Republican lawmakers from high-tax states are set to gain a significant tax concession, with a proposed bill raising the State and Local Tax (SALT) deduction cap to $80,000. This compromise follows threats from several Republicans to block extensions of Trump-era tax cuts unless the deduction — capped at $10,000 since 2017 — was increased. The negotiated change, if enacted, would represent a notable win for moderates in high tax states.

- The House has advanced a bill that would impose steep cuts to Medicaid. Key provisions include imposing work requirements (with specific exemptions) for childless adults aged 19 to 64, eliminating states’ ability to tax healthcare providers for Medicaid funding, and penalizing states offering Medicare access to individuals without legal status. While some conservative lawmakers have expressed concerns about these changes to social programs, it remains unclear whether they have sufficient votes to block the bill.

- The proposed increase in the SALT deduction cap, combined with spending restrictions on Medicaid, will likely result in a narrow passage in the House but spark a more contentious debate in the Senate. While the legislation is still expected to pass, further amendments may be introduced to mitigate its political fallout. That said, the bill’s enactment would likely be supportive for equities.

Trump Deregulation Push: The White House is set to start rolling back bank rules in a win for the financial industry.

- Regulators are expected to lower capital requirements for banks in a move that could affect their lending capacity. Specifically, they plan to reduce the supplementary leverage ratio (SLR), a rule mandating that large banks maintain a minimum level of high-quality capital relative to their leverage. This ratio acts as a buffer against liquidity shortages during periods of financial stress.

- The financial industry has consistently opposed the rule, arguing that its capital requirements not only constrain lending to households but also discourage banks from acting as stabilizers in the Treasury market. By including Treasury securities in the leverage ratio calculation, the rule limits banks’ ability to absorb shocks during periods of bond market stress — a weakness starkly exposed during last month’s volatility.

- The easing of financial regulations is expected to provide a meaningful boost to economic activity. By reducing capital constraints on banks, the policy shift should expand credit availability, enabling households to secure financing more easily and supporting a rebound in consumer spending. This rule change should help support the broader economy.