Daily Comment (May 9, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are digesting the latest trade developments this morning. In sports news, the Edmonton Oilers secured a commanding 2-0 series lead against the Vegas Golden Knights. Today’s Comment will focus on the UK’s positioning in trade negotiations with the US and India, progress in US-China trade talks, and other key market-moving developments. As always, we’ll provide a comprehensive roundup of domestic and international economic data releases.

Starmer the Dealmaker: The Brits have been able to secure better trade treatments with two key partners as the UK looks to boost its economy.

- On Thursday, the UK became the first country to secure trade concessions from the US following President Trump’s decision to impose tariffs on imports. The agreement ensures a reduction in US tariffs on British automobiles, covering up to 100,000 vehicles — an amount that aligns with the UK’s historical annual exports to the US. Furthermore, the deal eliminates all tariffs on UK steel and aluminum. In return, the UK has committed to allowing greater imports of American beef and has agreed to purchase Boeing aircraft.

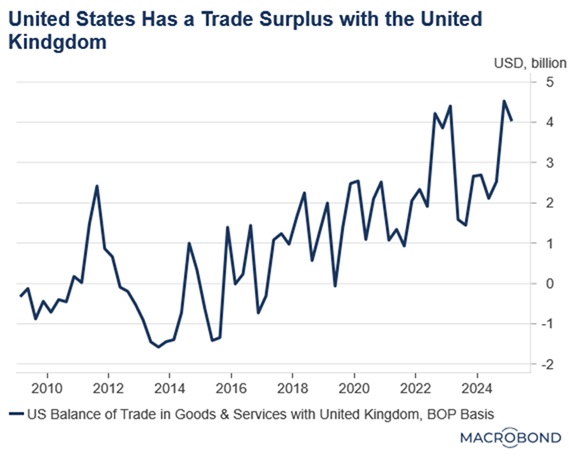

- Although a 10% tariff remains on British exports to the US, the UK secured favorable terms without significant concessions. It avoided demands to lower its digital services tax, open healthcare markets to American firms, or relax food standards — all key priorities for the Trump administration. With negotiations ongoing, the deal demonstrates how running a trade deficit with the US can provide leverage in securing flexible terms.

- Progress in US-UK trade negotiations coincided with the finalization of a landmark UK-India trade agreement. The deal grants India tariff-free access for 99% of its exports to the UK, while India will cut duties by 90% on British goods, with most tariffs gradually removed over the next 10 years. The agreement is particularly advantageous for the automotive sector as India’s affluent consumers will gain access to luxury British vehicles at significantly lower prices.

- While the UK’s trade agreements with the US and India may appear unrelated, they offer valuable insights into how nations are adapting to the new global economic landscape. The UK’s experience demonstrates that securing a swift deal with the US may be less disruptive than anticipated and that businesses can mitigate declining US exports by forging compensatory partnerships elsewhere.

- As the US turns inward, countries are forging new trade alliances and reshaping the global economic order into one less centered on American dominance. While this shift could gradually erode the dollar’s primacy in trade, its status as the world’s reserve currency remains secure for now. The more immediate effect, however, will be a redirection of capital toward foreign firms as businesses adapt to this evolving landscape.

US-China Trade Talks: The two sides are scheduled to hold talks this weekend, marking the start of formal trade negotiations between the longtime rivals.

- As a goodwill gesture, President Trump has announced plans to reduce punitive tariffs — currently as high as 145% — in exchange for substantive progress in trade talks. The Trump administration is reportedly considering cutting tariffs to 80%, a move China is expected to reciprocate. The proposal comes after repeated demands from Chinese negotiators who have insisted that any agreement must include tariff relief.

- In the lead-up to the meeting, both sides engaged in posturing, unwilling to appear weak ahead of negotiations. Beijing has sought to project strength despite the trade war’s toll on its economy. Since the conflict began, Chinese firms have struggled to replace lost American buyers, with bankruptcies expected to rise sharply as a result. China’s decision to withhold wage data further suggests an effort to conceal the economic damage inflicted by the trade war.

- Meanwhile, the US has faced increasing pressure to de-escalate trade tensions. There is speculation that a prolonged trade war could lead to summer supply shortages as firms and households struggle to secure alternatives to Chinese imports. These economic anxieties have depressed both consumer and business confidence, while dragging down the president’s overall approval ratings.

- Recent progress in trade talks between the world’s two largest economies suggests tensions may be easing, a development likely to bolster market optimism. This shift could reignite risk appetites as investors cautiously re-enter the markets following earlier volatility. However, the longer-term economic impact of tariffs on corporate profits and consumer spending remains a critical concern.

Trump Backs Taxing the Rich: Initially opposed to raising taxes on high-income earners making $1 million or more, the president now seems to have reversed his stance.

- The president has formally endorsed a plan to restore pre-2017 tax rates for individuals earning over $2.5 million annually. This move follows other progressive tax initiatives, including closing the carried interest loophole that has long been exploited by private equity firms, as part of a broader effort to fund middle-class tax relief. By supporting higher taxes on top earners, the president has made a decisive break with traditional Republican orthodoxy, which has historically rejected all tax increases as a matter of principle.

- The president’s proposed tax increases have deepened internal divisions as lawmakers attempt to balance his promised “big, beautiful” tax cuts with spending cuts. Although officials have pursued deficit reduction through eliminating redundancies and targeting fraud, these measures have yet to generate sufficient savings to offset the legislation’s projected costs. Meanwhile, it is still unclear whether tariff revenue will also be enough to offset the spending increases.

- Further exacerbating the issue are internal party disagreements regarding the SALT deduction, a provision the president has characterized as largely favoring blue states. The current point of contention involves lawmakers’ efforts to increase the SALT deduction limit in the new bill from $10,000 to a potential $30,000, a substantial jump from the originally suggested $20,000.

- While the bill is expected to pass by summer, several key details remain unresolved. Nevertheless, we anticipate that provisions like reduced corporate tax rates will deliver the most significant benefits for investors. Additionally, the proposed income tax cuts should help offset financial pressures on households grappling with higher costs from tariffs on everyday goods.

India-Pakistan Conflict Grows: The rivals continue to fight as concerns about an expanding war grow.

- The conflict has now expanded beyond the Kashmir region, with hostilities escalating across both nations. India has conducted airstrikes targeting Pakistan-administered Kashmir as well as mainland Pakistani territory. In retaliation, Pakistan has struck Jammu, an Indian-controlled city within Kashmir. Neither side shows signs of de-escalation, with both increasingly relying on drone warfare — a development that has already resulted in civilian casualties on both sides of the border.

- Although the two nations have engaged in multiple wars throughout their history, the current confrontation represents their most serious escalation to date. While President Trump has offered to mediate the conflict, India has firmly rejected third-party intervention. The growing tensions threaten to destabilize the Indo-Pacific region if left unchecked, with significant potential to negatively impact global risk assets.