Daily Comment (May 8, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are digesting yesterday’s pivotal Fed rate decision, while also keeping an eye on an exciting NBA playoff series where the New York Knicks have surged to a 2-0 lead against the Boston Celtics. In today’s Comment, we’ll analyze the implications of the Fed’s latest move, examine the Trump administration’s evolving foreign policy vision, and cover other key market developments. As always, we’ll also provide our signature roundup of critical domestic and international economic data releases to keep you fully informed.

Fed Patience: The Federal Reserve vowed that it will not cut rates without solid evidence that the economy is in trouble.

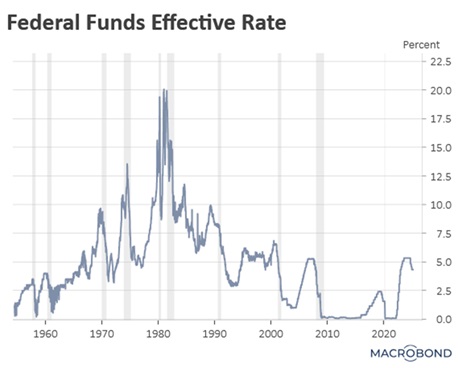

- As expected, following its two-day meeting the central bank kept its federal funds target range steady at 4.25%-4.50% and maintained the current pace of balance sheet reduction. The decision to delay policy easing underscores officials’ beliefs that, despite economic uncertainty, growth remains resilient. They also noted that uncertainty surrounding the scope and scale of potential tariffs could prolong the pause until there is greater clarity on their economic impact.

- During the press conference, Fed Chair Powell reaffirmed the central bank’s commitment to a patient policy stance. He underscored that future policy actions would be primarily determined by the extent to which tariffs affect employment and inflation. While preserving optionality, Powell appeared to dismiss the possibility of rate increases, signaling that the Fed’s subsequent move would likely be either a continuation of the current rate or a reduction.

- Despite Powell’s moderately hawkish tone, the 10-year Treasury yield fell following the policy announcement — a sign that markets remain confident in the Fed’s commitment to its inflation target, even amid growing political pressure for rate cuts. In recent weeks, the president has repeatedly urged the Fed to lower rates, though he has explicitly denied any intention to dismiss Powell should the central bank maintain its current stance.

- While the Fed has maintained its stance that it will not raise rates unless necessary, the market still anticipates at least three rate cuts this year, with the first potentially arriving in July. This optimism stems partly from expectations that an economic slowdown could force the Fed to act. However, we maintain that without substantial evidence of a weakening economy, aggressive rate cuts this year remain unlikely.

New AI Standards: In a policy shift from the previous administration, the White House aims to make its AI restrictions more inclusive of nations interested in investing in the United States.

- Just one week before their scheduled May 15 implementation, the Trump administration has rescinded Biden-era regulations on AI-related semiconductor exports. This move addresses criticisms from both international allies and technology companies. The timing is notable as US officials are poised to engage in high-level discussions with the United Arab Emirates and Saudi Arabia, focusing on American AI infrastructure investments and bilateral trade.

- The “AI Diffusion Rule,” a late-term Biden administration regulation, restricts the sale of high-performance chip technology to certain nations. This framework compels countries to comply with US standards or face losing access to critical technology. It further segments the global market into three tiers: top priority is given to US allies, who receive unfettered access to advanced semiconductors, while Russia and China — effectively barred from importing key technologies — are relegated to the lowest tier.

- The rule has drawn significant criticism from foreign governments dependent on US technology to achieve their strategic ambitions. This is particularly true for Middle Eastern nations placed in the second tier, despite their growing AI aspirations. Saudi Arabia, for instance, has made AI investment a cornerstone of its Vision 2030 initiative to reduce oil dependence. Similarly, the UAE aims to establish itself as a global AI leader by 2031.

- The semiconductor industry stands to benefit from the AI regulation rollback, though the Trump administration has already signaled plans for revised rules, suggesting any relief may be temporary. Officials aim to craft a lighter-touch framework, while still preserving US AI leadership. The policy shift could accelerate investment in domestic AI infrastructure, which appears central to the administration’s tech strategy.

UK Trade Deal: As noted in yesterday’s report, the US and UK are poised to announce a trade deal that could serve as a blueprint for other nations willing to align with Washington’s trade priorities.

- The White House is expected to announce the deal this morning as the president seeks to demonstrate progress in his push for trade agreement negotiations. While details of the arrangement remain undisclosed, sources indicate it will likely include reduced tariffs on US automobiles and agricultural products, along with the elimination of British taxes targeting American tech firms. However, the agreement is expected to serve as a framework for future talks rather than a finalized deal.

- The agreement to begin formal talks is significant as it may reveal what concessions the US is prepared to make in negotiations with its trading partners. Unlike most other nations, the UK already faced minimal tariff rates before their temporary suspension and maintains a trade deficit with the US, making widespread tariff reductions unlikely. Consequently, the focus of US-UK negotiations is expected to shift toward addressing tariffs on specific products rather than pursuing broad, economy-wide cuts.

- Facing the dual headwinds of weak global demand and steep 25% US steel tariffs, the UK is aggressively pursuing relief. The impact of these tariffs is clear: British steel exports to the US plummeted by nearly 30% in 2023, falling from 235,000 to just 165,000 metric tons. As a potential point of negotiation, the Trump administration has indicated it will push for stricter monitoring of transatlantic steel shipments to address concerns about the distortion of Chinese overproduction on global markets.

- Automobiles represent another critical sector affected by product-specific tariffs. As the US serves as the largest export market for British vehicles, these tariffs pose a significant threat to the UK automotive industry. This substantial economic vulnerability explains why securing tariff relief has become a key priority in negotiations.

- However, certain red lines remain firmly in place — most notably, the UK’s refusal to accept US agricultural standards. A key sticking point is chlorine-washed chicken, which Britain has explicitly rejected due to concerns it could jeopardize ongoing efforts to secure a trade deal with the EU.

- Progress in US trade negotiations is expected to bolster risk assets as markets focus on potential easing of trade restrictions. While this development may provide near-term support for equities, sustained gains will ultimately depend on the economy’s ability to demonstrate resilience amid ongoing trade changes.

Growing EU-US Friction: The EU is prepared to impose its own tariffs on the US if a mutually agreeable trade solution cannot be reached.

- The EU plans to impose $108 billion in tariffs on US goods, including cars, planes, and bourbon, starting Thursday. This retaliatory measure follows previously administered US tariffs and comes as both sides prepare for upcoming talks.

- This announcement likely represents strategic posturing by the EU to strengthen its negotiating position. Key areas the US administration seeks to address include reform of the EU’s VAT system and an end to the bloc’s scrutiny of digital services, which predominantly affects large US tech companies.