Daily Comment (May 2, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with a Chinese government statement confirming that it is considering a request for trade talks from the Trump administration. We next review several other international and US developments with the potential to affect the financial markets today, including a new trade offer from the European Union and news that President Trump today is releasing his proposed budget for the upcoming federal fiscal year.

China-United States: The Chinese commerce ministry today confirmed that US officials have “conveyed messages to China, through various channels, expressing a desire to engage in discussions” about President Trump’s tariff policy. Moreover, the ministry said Beijing is “evaluating” the US request. Investors appear to be taking the statement as a sign that the two sides could soon start talks to end their trade war. In response, global stock prices and the values of other risk assets are rallying so far this morning.

- However, despite today’s market optimism over the statement, investors should probably keep in mind that General Secretary Xi may have interpreted the US approach as a sign of weakness or of sufficient kowtowing to China.

- If Xi does believe the US has blinked, he could be emboldened to strike a hard negotiating stance against Trump. It is therefore probably much too early to expect an end to the trade tensions in the near term.

European Union-United States: In an interview with the Financial Times, Trade Commissioner Maroš Šefčovič said the EU will offer to hike its annual purchases of US exports by €50 billion to stave off Washington’s 20% “reciprocal” tariffs, which are currently paused until early July. However, he suggested the EU offer would only apply if the US also drops its 10% baseline tariff against the EU.

- Although the Trump administration is focused heavily on the US trade deficit in physical goods, the country typically has a sizable surplus in service exports, such as tourism and digital services. According to Šefčovič, the US trade deficit with the EU is only about €50 billion when considering the US’s big service surplus with Europe.

- In his interview, Šefčovič argued the EU could fairly easily make up the total imbalance by buying more liquefied natural gas, agricultural products, and other items from the US.

- Coupled with the Chinese statement about evaluating talks with the US, the statement from Šefčovič adds to evidence that Washington has indeed had some success in forcing negotiations over its bilateral trade imbalances. All the same, the progress is likely to be slow, meaning the current tariffs in place will remain a threat to the economy in the near term, even if they are lowered to more sustainable levels in the future.

United States-Iran: To increase his pressure on Iran to force it into a deal restricting its nuclear program, President Trump yesterday said he will impose “secondary” sanctions on Iranian oil. Under the sanctions, any entity buying Iranian crude or petrochemicals would be frozen out of the US financial system. If implemented, the sanctions would theoretically reduce the amount of oil on the global market, potentially boosting prices and exacerbating consumer price inflation.

India-Pakistan: India and Pakistan today stand on the brink of war after New Delhi said Islamabad was responsible for last week’s terrorist attack on its Kashmir region. The two nuclear-armed neighbors have been trading small arms fire over the last week, and reports yesterday said India may be preparing a major attack on Pakistan. Any large-scale war between the countries would likely spark fears of a potential nuclear conflict and could send global risk markets into a tailspin.

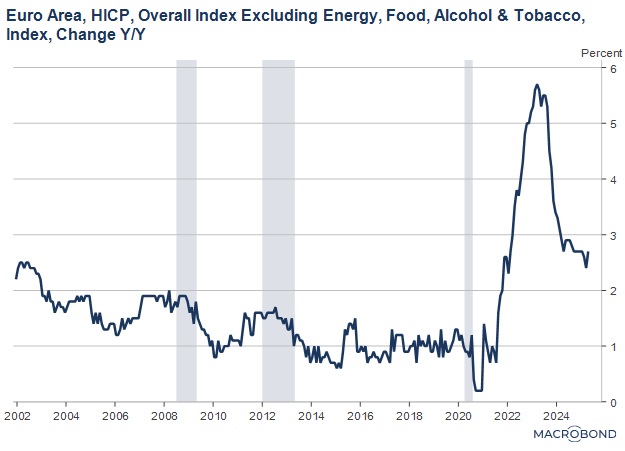

Eurozone: The March consumer price index was up 2.2% from the same month one year earlier, matching the annual increase in February but exceeding expectations that inflation would ease to just 2.1%. Excluding the volatile food and energy components, the March core CPI was up 2.7% on the year, exceeding both the 2.4% rise in the year to February and the expected increase of 2.5%. The hotter-than-expected inflation print raises the chance that the European Central Bank may not cut interest rates at its June policy meeting.

US Politics: President Trump yesterday named embattled National Security Advisor Mike Waltz to be his ambassador to the United Nations, deftly “kicking him upstairs” over the recent Signalgate scandal and other controversies within the White House. The move also facilitates keeping New York Rep. Elise Stefanik in her House seat after Trump asked her to give up her previous nomination to the UN job.

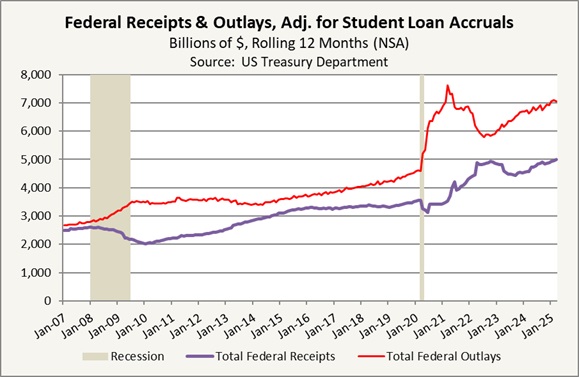

US Fiscal Policy: President Trump today will release his proposed budget for federal fiscal year 2026, which begins October 1. The proposed budget includes far-reaching tax cuts and big reductions in nondefense discretionary expenditures related to environmental, renewable energy, education, foreign aid, and other programs. However, the proposed budget will be heavily amended as it works its way through Congress, so at this point it is largely just a signal of the administration’s fiscal priorities and goals.

US Treasury Market: In a television interview today, Japanese Finance Minister Kato admitted that Tokyo considers its holdings of $1.3 trillion in US Treasury obligations to be a “card” that can be played in its current trade negotiations with Washington. According to Kato, “It does exist as a card. Whether or not we use that card is a different decision.” The statement is likely to increase concerns about foreign capital fleeing US securities, either as a negotiating ploy or as a reflection of increased worries about US stability and friendliness to foreign capital.

- On a related note, the Financial Times today carries a long read looking at how the Chinese government is deliberately diversifying its foreign exchange reserves away from US Treasurys.

- The article includes a number of useful graphs showing that Beijing has gradually been reducing its exposure to US Treasurys for at least a decade.