Daily Comment (April 29, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are on hold awaiting key tech earnings reports. In sports, the Cleveland Cavaliers are poised to sweep the Miami Heat in their NBA playoff series. Today’s Comment will cover the economic impact of Trump’s first 100 days in office, implications of the upcoming Canadian elections, and other market-moving developments. As always, we’ll also include our regular summary of international and domestic economic data releases.

Trump’s 100 Days: President Trump is preparing to celebrate an incredible milestone as he looks to highlight his accomplishments.

- The president demonstrated his commitment to the auto industry by offering tariff concessions as carmakers adapt to evolving market conditions. Ahead of his visit to Michigan, he announced the lifting of levies on certain foreign-made parts used in US-assembled cars and trucks. The administration is also preparing to exempt imported vehicles from existing steel and aluminum tariffs, providing additional relief to the sector.

- Additionally, the president plans to highlight recent economic wins by showcasing major new domestic investments. Representatives from companies like Nvidia, Eli Lilly, and SoftBank are set to attend a White House event announcing expanded investment plans totaling $1.6 trillion — a spending surge projected to create over 426,000 jobs. The gathering will spotlight how corporate commitments align with the administration’s economic priorities in Trump’s “Invest in America” initiative.

- The president is urging his party to expedite passage of new legislation on tax cuts. While Republicans approved a procedural measure earlier this year allowing tax cuts to pass with a simple majority, internal divisions persist over how to offset the budgetary impact and avoid adding to the deficit. The White House is now pushing to finalize the bill by July 4, though the process will likely take weeks to complete given ongoing negotiations.

- While the president has touted his economic achievements, recent polling suggests his support among voters is slipping, particularly over lingering concerns about tariffs. As his administration shifts focus toward sustaining economic stability, markets are likely to remain in a holding pattern until clearer evidence emerges on whether his policies are helping or hurting growth.

Carney Wins: The Liberal Party eked out a narrow victory, securing a fourth term — one likely to be defined by how it handles a trade war with the US.

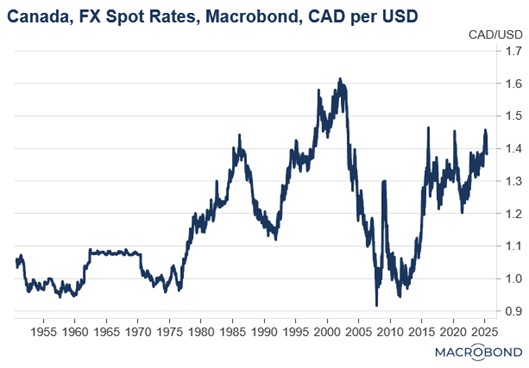

- The election initially gave the loonie a boost as a clear victor emerged, but the currency retreated once it became apparent the result would yield another minority government. The Liberals fell just short of an absolute majority, winning 168 seats, four shy of the 172 needed to govern outright. The Conservatives followed with 144 seats, while the Bloc Québécois took 23, the New Democrats secured 7, and the Green Party won 1.

- While the Conservatives outperformed poll projections, their leader Pierre Poilievre is projected to lose his seat. The party’s failure to translate a 20-point lead at the start of the year into a win may create a leadership crisis. Poilievre’s mishandling of the “Trump factor” due to his inability to counter the US president’s “51st state” characterization and tariff threats will be a defining issue, as the party will look to rebrand itself following the loss.

- In his victory speech, Prime Minister Mark Carney struck a defiant yet pragmatic tone, expressing confidence in Canada’s ability to prevail in its trade dispute with the US, while acknowledging the profound challenges of redefining the bilateral relationship. He particularly emphasized the need for Canada to reduce its economic dependence on American trade and reassess its security arrangements, signaling a historic shift in North American relations.

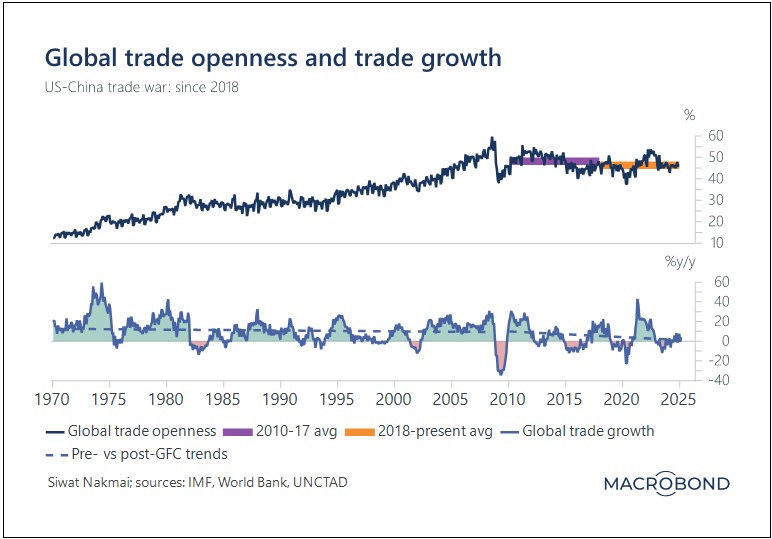

- The global electoral impact of Trump’s trade policies has become undeniable, as evidenced by this outcome. While establishment candidates have benefited from rising anti-American sentiment, sustained political stability will require concrete policy responses. The critical question now facing nations worldwide is how they will reform regulations and implement stimulus measures to achieve growth independent of US markets.

Cloudy Business Outlook: A growing number of firms are reluctant to provide earnings guidance amid heightened uncertainty from the ongoing trade war.

- Automaker General Motors and logistics giant UPS have suspended their financial guidance this quarter as they reassess the evolving business environment. The decisions come as both companies implement strategic changes to strengthen their long-term financial performance. GM has postponed scheduled stock buybacks, while UPS plans to reduce its workforce by 20,000 positions.

- Corporate hesitation in issuing annual guidance underscores the profound uncertainty plaguing trade policy. Although businesses have modeled potential profit impacts since the administration rolled out targeted tariffs, the policy landscape remains too fluid for reliable forecasting. Compounding the challenge, firms must now also predict how shifting price points will reshape consumer demand, a critical variable that could dramatically alter financial projections.

- While corporate earnings continue to show strength this season, with most companies surpassing expectations, the rapidly shifting business environment poses growing challenges for strategic planning. Amid this persistent uncertainty, we believe the ultimate impact on US corporations remains to be seen. In the interim, we advocate a selective, stock-by-stock approach to portfolio management until clearer investment themes emerge.

Lights Back On: Full power was restored across the Iberian Peninsula on Monday, but the unexplained outage has triggered serious questions about the resilience of the region’s energy infrastructure.

- Power has been restored across Spain and Portugal after their worst outage since Europe’s 2021 blackouts. While authorities have ruled out cyberattacks and severe weather, the disruption appears linked to solar power supply failures. The system initially compensated for lost generation in southwestern Spain, but a subsequent failure collapsed the entire grid, including imported power supplies to Portugal at the time.

- The grid failure highlights the challenges of Spain’s ambitious green transition. While renewables now provide a substantial share of energy, they remain less reliable than traditional sources. This vulnerability emerges as Spain has accelerated its phase-out of coal-fired thermoelectric plants and has already decommissioned nuclear facilities that once contributed 20% of the nation’s power mix.

- The power grid concerns could cast a shadow over the economy’s otherwise strong performance. While Spain has been among Europe’s best performers since the Ukraine war began, posting 0.6% growth in the first quarter, this blackout is likely to hinder growth in the current period.