Daily Comment (March 21, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an update on the U.S. banking crisis and how investors’ concerns appear to be dissipating, at least so far today. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including a few words on Chinese President Xi’s continuing visit with Russian President Putin as well as some items touching on U.S. labor tensions.

U.S. Banking Crisis: Now that investors’ attentions has shifted toward ailing regional lender First Republic Bank (FRC, $12.18), reports indicate that Jamie Dimon, CEO of JPMorgan Chase (JPM, $127.14) is leading an effort to convince a number of major banks to invest in the firm beyond the parking of some $30 billion in deposits there last week. Coupled with the moves by government officials to stem the crisis, the effort by Dimon appears to be helping to quiet investor concerns. Although First Republic’s stock price fell 47% yesterday, it has rebounded approximately 15% so far this morning, while bigger banks and the overall market continue to rise.

- The market action may look like the crisis is passing, but we would urge caution, as other stressors in the financial markets could still come to light. In addition, since much of the nation’s bank lending is done by mid- and small-sized banks, any pullback in lending by those banks in response to the crisis could have a noticeably negative impact on U.S. economic growth.

- Investors are particularly worried about big, new headwinds for agency mortgage-backed securities (MBS). Those securities are widely held by mid-sized banks such as the one that touched off the crisis, Silicon Valley Bank (SIVB, $106.04). Now that the government owns the bank, it is expected to sell off the roughly $78 billion of MBS on Silicon Valley’s books. To the extent that other banks fail and are taken over by the government, similar sales could add to the supply of MBS and drive down their value.

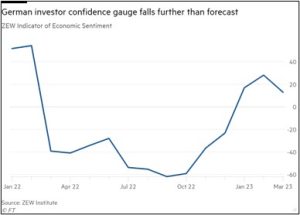

Germany: Responding to the banking crises in the U.S. and Switzerland, the ZEW Institute’s index of investor sentiment fell to 13.0 in March, coming in short of both the expected reading of 16.4 and the February reading of 28.1. The index, which is considered a leading indicator of German economic activity, now stands at its lowest level since January. The index is designed so that readings over zero indicate greater optimism than pessimism.

France: Despite the continuing mass protests against President Macron’s decree last week to boost the pension system’s retirement age, opponents in parliament yesterday narrowly failed to win a no-confidence vote against his government. As a result, the reform of the pension system will stand, lessening the strains on the French budget over time and potentially giving a boost to the economy. However, as Macron faces even more no-confidence votes, his political position is weakening.

Russia-Ukraine War: As the Russian invasion continues to disrupt Ukrainian agriculture, Kyiv said the country’s grain harvest this year will likely fall by another 15% from 2022. On top of that, Russia warned it could pull out early from the UN-sponsored agreement under which Russia is allowing Ukraine to export food products from its Black Sea ports, despite the fact that Moscow agreed to renew the deal last Friday. The news highlights how the war continues to threaten global commodity supplies and could keep global food prices and inflation high.

Russia-China: Russian President Putin continues to host Chinese President Xi in Moscow, with much of the discussion today reportedly focused on the China-Russia economic relationship. One key topic is likely to be the planned Power of Siberia 2 natural gas pipeline, which will help Russia shift its gas exports to China now that it has largely been cut off from Europe.

- As we wrote in our Bi-Weekly Geopolitical Report on January 9 and March 6, China is likely to manage its evolving geopolitical and economic bloc in a largely neo-colonial fashion, where it uses the other members of its bloc, such as Russia, as sources of cheap natural resources and basic commodities, and in return China sends them its higher-value manufactured goods.

- One Financial Times report on today’s China-Russia meetings contains a quote from an unidentified Russian official that drives home our point: ‘“The logic of events dictates that we fully become a Chinese resource colony,” the person said. “Our servers will be from Huawei. We will be China’s major suppliers of everything. They will get gas from Power of Siberia. By the end of 2023, the yuan [renminbi] will be our main trade currency.”’

Venezuela: Oil Minister Tareck El Aissami announced that he is resigning his position amid a government corruption probe that has already led to the arrest of multiple officials. Reports suggest El Aissami was pushed out in a political purge, perhaps related to massive graft in the country’s oil sales. However, we would also note that El Aissami oversaw the negotiations that led to U.S. energy giant Chevron (CVX, $154.58) receiving a license last year to restart its operations in Venezuela. El Aissami has also been under U.S. sanctions for drug trafficking. It therefore would not be a surprise if his resignation also involved his relationship with the U.S.

U.S. Monetary Policy: The Federal Reserve begins its latest policymaking meeting today, with its decision due out on Wednesday afternoon. Despite the strong economic data for January and February, we suspect the recent banking crises in the U.S. and Europe will discourage the policymakers from hiking their benchmark fed funds rate by anything more than a modest 25 basis points. Many investors and observers are even expecting them to hold rates steady.

U.S. Labor Market – West Coast Ports: According to the Pacific Maritime Association (PMA), which represents shippers and port operators, West Coast dockworkers have begun to slow port operations to protest the lack of progress in negotiations for a new contract to replace the one that expired last July. The workers have reportedly stopped staggering work shifts during mealtimes, forcing terminals to shut down every day for an hour in the afternoon and another hour at night.

- Federal officials have been pressuring the PMA and the dockworkers to come to an agreement, but talks have recently stalled.

- The rising labor tensions are a reminder that the economy could still face disruptive supply chain issues at the West Coast ports.

U.S. Labor Market – LA Schools: Some 30,000 bus drivers, custodians, special education aides, and other school staff in Los Angeles are beginning a three-day strike today in search of a 30% increase in wages and better working conditions. In addition, a union representing some 35,000 teachers will also go out on strike in support. The strike illustrates how low unemployment and high inflation continue to prompt workers to agitate for better pay and conditions, despite growing layoffs in technology and some other sectors.