Daily Comment (August 19, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Today’s Comment begins with a discussion concerning central bank policies and how they may help foreign currencies to appreciate against the dollar. Next, we review whether the U.S. and China’s power struggle in Asia could benefit U.S. firms with domestic operations. We end the report with our thoughts about the latest developments in the Russia-Ukraine conflict.

Central Bank News: Mixed messages from the Fed regarding whether it will keep raising rates next year could allow foreign currencies to appreciate against the dollar.

- There is a split among Fed members about whether the central bank should raise rates until inflation is firmly under control or raise rates into restrictive territory and pause. In the former camp, Minneapolis Federal Reserve Bank President Neel Kashkari, the most hawkish member of the Fed, asserted that the central bank needs to urgently bring down inflation and has hinted that a recession may be necessary in order to restore price stability. Kansas City Fed President Esther George stated that the pace of hikes is debatable but that ending tightening before inflation has fallen is not. In the latter camp, San Francisco Fed President Mary Daly and St. Louis President James Bullard argued that the bank should raise rates but be cautious not to overdo it.

- If the U.S. falls into a recession, the Fed could be pressured to back off on raising rates. As a result, some policymakers may be uncomfortable with committing to raising rates in 2023 for fear of political backlash.

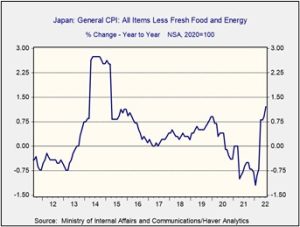

- The Bank of Japan will maintain its ultra-loose monetary policy even as inflation rises above its target of 2 percent. In July, headline CPI rose 2.61% from the prior year, its fastest pace in almost eight years. The bank’s insistence on maintaining an accommodative policy is due to the country’s excessive debt burden. If it allowed rates to rise by lifting its yield cap, the government would have more difficulty servicing its interest payments. Additionally, the drop in energy prices has allowed the yen to slightly appreciate against the dollar from its yearly low in July. As a result, the central bank will likely not change its monetary stance anytime soon.

- Despite the strong reading, inflation in Japan is still relatively low compared to the rest of the world. As the chart below indicates, Inflation rose 1.2% from the prior year when energy and food are excluded.

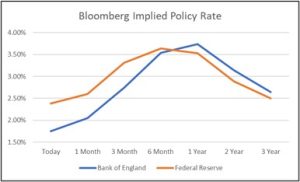

- Speculators predict that the policy rate of the Bank of England will surpass that of the Federal Reserve in one to three years. In July, U.K. headline CPI rose 10.1% from the prior year, while U.S. inflation was 8.6% in that same period. The increased inflation rate suggests that the BOE will need to become more hawkish in order to control inflation. The Bloomberg implied market rate shows that the BOE could lift its rate to 3.75% and cut after that.

The U.S. dollar value surged against other currencies throughout 2021 and 2022 due to the country’s relatively strong economic growth and hawkish monetary policy. This dollar strength could ease, however, as the American economy slows, and the Fed relaxes policy tightening. This outcome will benefit commodity-reliant countries like Japan and provide a tailwind for firms with significant foreign revenue exposure.

Asia News: The U.S. and China’s power struggle continues to play out in Asia.

- The U.S. and China continue to bicker over access to the Taiwan Strait. South Korea and the U.S. will participate in joint military exercises next week. During these activities, the countries will navigate their ships through the strait. China considers movement within the Taiwanese waters as a provocation, claiming the body of water represents Chinese territory. The dispute over transit routes is an example of escalating tensions between the two major powers. As a result, we suspect that the decoupling between the U.S. and China will continue and could be detrimental to U.S. firms with revenue and supply chain exposure in China and Taiwan.

- Against U.S. wishes, Russian President Vladimir Putin will attend the G-20 meeting in Bali. The White House has pushed Indonesia to exclude Russia due to its invasion of Ukraine. Indonesia’s decision to allow Putin to participate in the summit is another example of how countries are attempting to remain neutral in the rivalry between major powers. In the short term, the nonaligned countries may benefit from competition from major powers trying to win over their support. Indonesia, for example, recently secured wheat supply from Russia while maintaining U.S. military presence in the Pacific. However, this strategy isn’t perfect. During the cold war, nonaligned countries could not prevent proxy battles from breaking out in nearby regions. Therefore, the neutrality of countries could lead to more instability in Asia.

- On an unrelated note, Indonesia is considering an export tax on nickel. The levy will weigh on automakers’ profit as the commodity is essential for EV batteries, and Indonesia is the largest producer of this metal. By imposing a tax, the government hopes to convince car companies to build factories in Indonesia.

- The U.S. warned North Korea against performing another nuclear test. The warning came soon after North Korea launched two cruise missiles off its west coast. The country’s rapid improvement in its military capabilities raises the prospect of a war on the Korean peninsula. Although China does not support the nuclearization of North Korea, it has improved its trade relationship with Pyongyang in light of recent weapons tests. The conflict in Korea is likely the second most significant geopolitical event in Asia and threatens to add to the global supply chain worries on the continent. We will be monitoring this situation closely.

Competition between the U.S. and China threatens firms’ ability to operate in Asia. As tensions continue to rise throughout the continent, firms could also struggle to find ways to make both sides happy. Although nonaligned countries appear to be a haven for firms looking to remain neutral, relocating to these areas will be risky. This outcome could benefit American companies with operations solely in the U.S.

Russia-Ukraine update: The cost of the war is rising, but a reshuffling in European governments could pave the way for an end to the war.

- Russian officials may shut down the main nuclear plant in Ukraine on Friday. Russia has warned that it needs to switch off the power plant to prevent a human-made disaster due to the war. However, Ukrainian officials argued that the plant shut down is related to Russia wanting to stage a large-scale provocation that could lead to a nuclear disaster. Such an incident could threaten to create an international crisis.

- Italians expect Russian interference in the upcoming parliamentary elections in September. Russian officials have urged Europeans to push out elected officials that support Ukrainian war efforts. The possibility of interference will likely undermine the election’s credibility and could lead people to stay home. That said, Italy’s right-wing bloc appears to be in a prime position to take over the government after the election. Although the leader of the most popular party, Giorgia Meloni, supports Ukraine, other parties within the right-wing bloc, such as the Forza Italia and the League, do not. As a result, it is possible that Italy could weaken its support for Ukraine after the election.

- Ukraine needs the support of the West to maintain its war effort. If European countries begin to pull their support of Ukraine, it may be forced into accepting an unfavorable peace deal with Russia. The end of the war would be favorable to risk assets.

Wars are unpredictable and the conflict in Ukraine is no different. The potential of a nuclear disaster may force an international response and hurt global economic growth. The Chernobyl nuclear disaster not only impacted people but also contaminated forest and farmland and led to deformed livestock. That said, political shifts in Europe may help Russia change the tide of the war in its favor. At this time, we still view Europe to be a risky place to invest.