2018 Outlook: Addendum (January 4, 2018)

by Bill O’Grady & Mark Keller | PDF

Summary:

When we wrote our 2018 Outlook, we were unable to take into account the Tax Cuts and Jobs Act of 2017[1] because the legislation had not been signed by the time we published our report. This Addendum will address the impact of the tax bill on our forecasts.

Our analysis suggests the impact will be significant. The legislation reduced the highest marginal corporate rate from 35% to 21%.

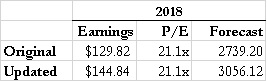

This table shows our updated forecasts[2] for the S&P 500.

Although the tax bill will likely affect other parts of the financial markets and the economy, we expect those effects to be minimal. We do not expect any major change in economic growth nor do we anticipate that the rise in the fiscal deficit will seriously affect the fixed income markets. A rising deficit might also affect the dollar, but the historical pattern is mixed; if the deficit leads to more aggressive monetary policy tightening, it would be bullish for the dollar. This scenario characterized the early 1980s. However, the fiscal surpluses of the late 1990s also boosted the greenback. A rising fiscal deficit that does not trigger a monetary policy response is likely dollar bearish but, since our outlook already calls for a weaker dollar, we won’t make any formal changes to our forecast there, either.

[1] The official name is the Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018; it has this unwieldy name to meet the strict parts of the Byrd Rule, which allowed the bill to pass through budget resolution by a simple majority.

[2] This is a Standard and Poor’s operating number, not a Thomson/Reuters operating number. If our forecast is correct, the latter operating forecast will rise to around $150 per share.