Weekly Energy Update (November 30, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Crude oil prices have retreated from their early October highs.

(Source: Barchart.com)

(Source: Barchart.com)

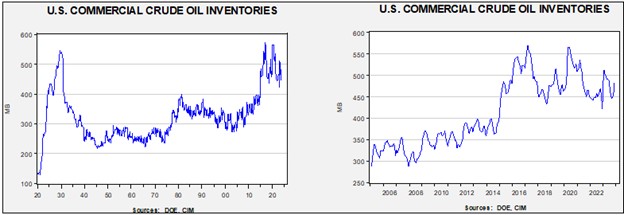

Commercial crude oil inventories rose 1.6 mb compared to forecasts of a 1.7 mb draw. The SPR rose 0.3 mb, which puts the net build at 1.9 mb.

In the details, U.S. crude oil production was steady at 13.2 mbpd. Exports were unchanged while imports fell 0.7 mbpd. Refining activity rose 1.9% to 89.8% of capacity. Refinery activity has started its seasonal recovery which should last into December.

(Sources: DOE, CIM)

(Sources: DOE, CIM)

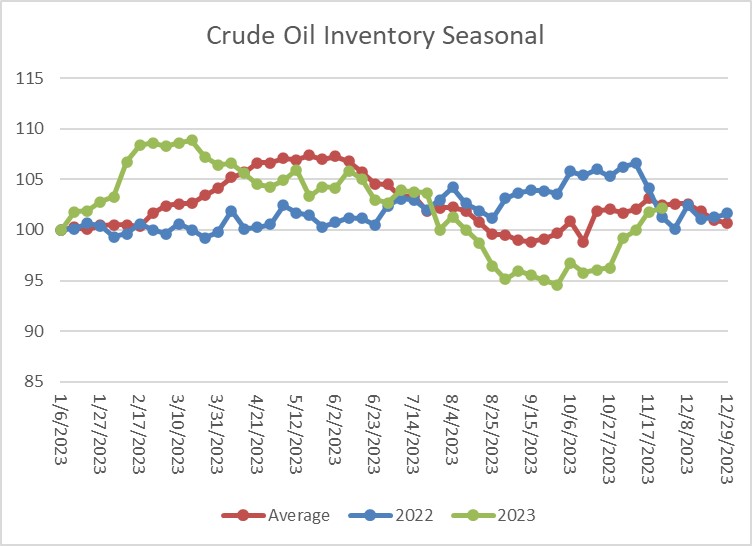

The above chart shows the seasonal pattern for crude oil inventories. Inventories have now risen to seasonal norms.

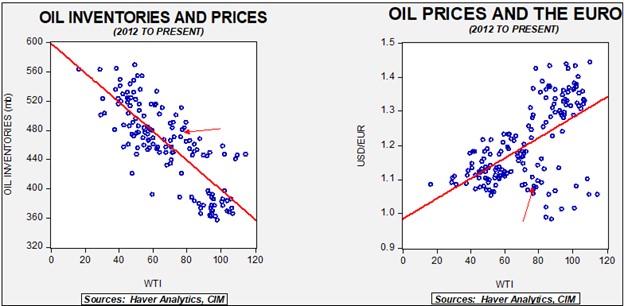

Fair value, using commercial inventories and the EUR for independent variables, yields a price of $63.71. However, given the level of geopolitical risk in the market, we are not surprised that oil prices are well above this model’s fair value.

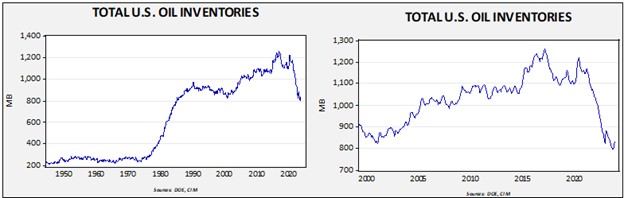

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels last seen in late 1984. Using total stocks since 2015, fair value is $90.25.

Market News:

- OPEC+ is meeting this week. So far, the Kingdom of Saudi Arabia (KSA) is pushing members for deeper production cuts, but it is facing resistance. The key to holding current prices is OPEC+ cuts. In the past, the KSA, when thwarted on its goal of reducing supply, has reacted by flooding the market with oil to punish “free riders.” We don’t expect such an action in the near term, but investors and traders should be aware that there is a risk that Saudi Arabia will react in this manner at some point. Our expectation is that the odds of something like this happening increase if Riyadh can get a security guarantee from the U.S.

- It’s COP28 week. We have been giving this meeting only modest coverage because we doubt much will come of it. In international law, there is no singular body that enforces rules. Without an enforcement mechanism, any agreements from meetings such as these rely on moral suasion; or, to paraphrase Fernando, it is better to seem good than to be good. In further evidence that this meeting isn’t weighty, President Biden has decided to skip it. We expect promises and projections but little else.

- Oil and gas companies are facing criticism over their investments in future production. The companies are banking on carbon capture to make the investments viable under stricter regulations. This is a controversial decision.

- U.S. oil production has been rising despite modest rig counts. Essentially, the industry has been increasing productivity and efficiency. However, there are concerns that additional productivity may become increasingly costly, which could weaken company profits.

- Storms have disrupted oil flows from the Russian port of Novorossiysk. We expect the flows to resume when the weather improves.

- High European energy costs are threatening to doom Germany’s industrial sector.

Geopolitical News:

- The Hamas/Israeli conflict is on hold due to a ceasefire that has facilitated the exchange of hostages and prisoners. Each day the ceasefire is extended reduces the odds that the conflict will spread, but we doubt that this ceasefire will hold much longer.

- A Houthi hijacking team attempted to take control of an Israeli-related oil tanker. The U.S. Navy was able to thwart the hijackers. However, the action does suggest that shipping in the region is at risk due to the Hamas/Israeli conflict.

- Over the past several months, there has been a lot of reporting about oil sales being transacted in currencies other than USD. In particular, India has been paying for Russian oil with INR. Russian oil companies are finding that the Russian Central Bank has no interest in converting INR into RUB, meaning the oil companies are essentially “stuck” with a near worthless currency. Of course, if Russia were not under sanction, the bank could exchange the INR for USD or some other currency, but because sanctions have excluded Russia from the dollar system, there is no obvious way to liquidate the currency. It has reached the point where Russian oil companies are threatening to divert shipments to other nations. Russia is encouraging India to pay in CNY but given that the Chinese have a closed capital account, it may not be easy for India to acquire CNY easily. Overall, the dollar system works pretty well, while abandoning it is hard.

- Although the U.S. has tied the easing of sanctions on Venezuela with running free and fair elections, Caracas is moving to invite oil companies into development licenses in a clear sign that it expects Washington to ease sanctions regardless of its behavior.

- Another worrying development is that Venezuela is claiming a large part of Guyana. Although Venezuela claims the Essequibo region as part of its territory, no one else does nor has for well over a century. Venezuela’s claims are massive:

(Source: Washington Post)

(Source: Washington Post)

-

- The problem is that the western border has been disputed since 1814. In 1895, President Cleveland established a commission to establish a border. Because Guyana was a British colony, the U.K. initially rebuffed the effort but quickly realized it couldn’t enforce its claim. At that point, Venezuela, the U.S., and the U.K. agreed to international arbitration, which established the current borders. Venezuela was not pleased, and evidence that surfaced after WWII suggested that a Russian member of the arbitration board had conspired with London to expand the border in Guyana’s favor. In the wake of this news, the Kennedy administration quietly looked at allowing either Venezuela or Brazil to expand their claims to prevent communism from gaining a foothold as independence loomed. Guyana became independent of Britain in 1966. New talks between Venezuela and Guyana began but never reached a conclusion.

- President Maduro announced a referendum in the disputed territory to determine where the border should sit. Given that Venezuela isn’t recognized as being in control, it isn’t obvious how the vote will take place.

- Until recently, there wasn’t much interest in pursuing claims. Guyana was desperately poor. But as we have documented this year, Guyana is rapidly becoming a major oil producer. Fearing Venezuela will take military action, the Brazilian army has been put on high alert. Although we don’t expect this event to come to “blows,” Maduro is mercurial and may believe that the U.S. is in such need of oil that he can move with impunity, not just against his domestic opposition, but also to reclaim areas of Guyana. If war breaks out, it would be hard for the U.S. not to become involved. And, it would bolster oil prices.

- Iran postponed a leader visit with Turkey. It was not clear why the visit was delayed.

- Although Russia and China are “friends,” it is worth noting that Beijing is pressing hard on Moscow about the Siberia 2 pipeline project.

Alternative Energy/Policy News:

- China has been establishing bureaucratic “gates” on exports of various minerals. The procedures will give Beijing a mechanism to control the supply of several key minerals. Although the development of gates doesn’t necessarily mean supplies will be restricted, in reality, it would be naïve to expect China not to use these to their advantage. Already, some critical mineral exports have been restricted.

- China’s dominance in EVs has Western nations in a dilemma. On the one hand, the EV industry could expand rapidly in a nation by either importing Chinese EVs or licensing the technology. On the other hand, this decision could mean that the West becomes a mere assembler of Chinese EVs and wouldn’t develop the technology domestically. So far, the EU seems to be leaning more towards the first “horn” of the dilemma, while the U.S. is still trying to develop an indigenous industry.

- A similar problem exists in solar panels. China is the low-cost producer, and in the West, installers want to import panels, whereas domestic producers want protection.

- EVs and hybrids now represent 18% of new U.S. light-vehicle sales.

- Malaysia is attempting to build out a rare earths industry, angering both local environmentalists and China.

- The demand for lithium is leading to a land grab in Australia. One risk is that a new battery technology could emerge that would exclude this sought-after mineral.

- Tighter monetary policy is crippling the energy transition. That’s partly due to the low return on investment from solar and wind; higher interest rates also make these projects less attractive.