Weekly Energy Update (March 31, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Oil prices remain volatile, moving on news regarding the Russia-Ukraine war.

(Source: Barchart.com)

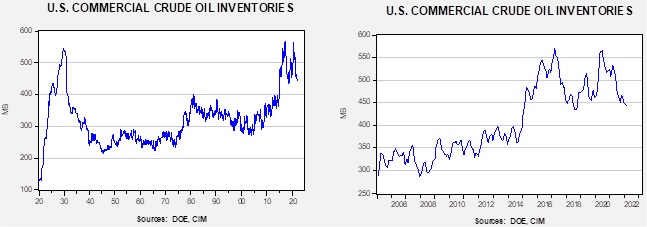

Crude oil inventories fell 3.4 mb compared to a 2.2 mb draw forecast. The SPR declined 3.0 mb, meaning the net draw was 6.5 mb.

In the details, U.S. crude oil production rose 0.1 mbpd to 11.7 mbpd. Exports fell 0.9 mbpd, while imports declined 0.2 mb. Refining activity rose 1.0% and is now 92.1% of capacity.

(Sources: DOE, CIM)

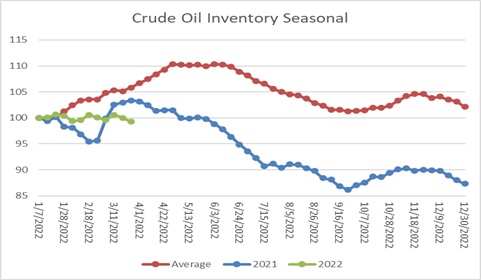

This chart shows the seasonal pattern for crude oil inventories. Last year, oil stocks peaked in early April and fell steadily into September. This year’s pattern hints that we may have already peaked stockpiles, meaning commercial inventories may decline for the next several months. Even though the current oil price far exceeds the level that the inventory model below would indicate, the divergence may narrow in the coming weeks if we see continued seasonal declines in oil stocks.

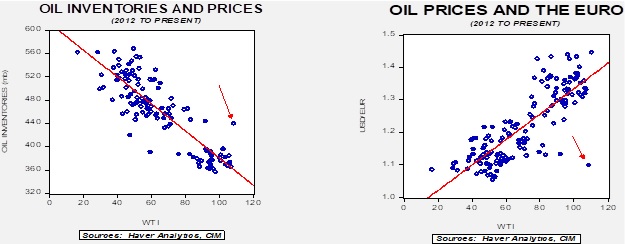

Clearly the relationship between the EUR and oil prices has fallen apart. Just using the oil inventory model, the current fair value is $71.80. To justify the current monthly average of around $180 per barrel, commercial inventories would need to decline to 387 mb. Is that conceivable? Yes. If we see stockpiles decline in a similar fashion to last year, by mid-September, commercial inventories will be around 375 mb. So, at present, the current price has discounted further tightening in supply, but based on last year’s inventory behavior, the current price isn’t unreasonable.

Market news:

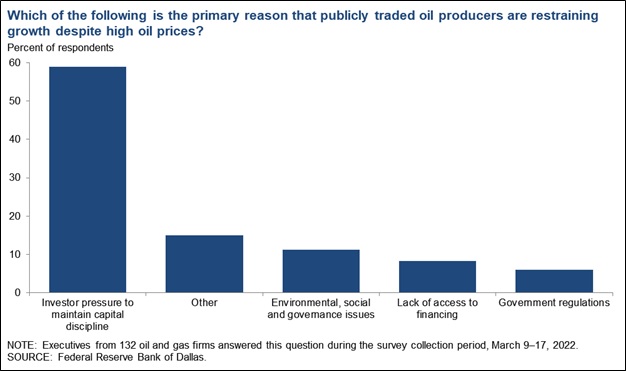

- When studying history, there is a constant tension between simplifying and detailing. In other words, it is rare that a historical event has a single cause, but identifying a large number of causal factors makes it difficult to determine what analysts should focus on when creating a historical analog. Learning the lessons from history is difficult if common factors can’t be isolated. This issue even applies to recent history. On the question of “why aren’t U.S. oil companies pumping more oil,” there are several identifiable reasons. Fortunately, the Dallas FRB has conducted a survey of oil producers in its district, and the clear answer is that the financial industry is pressuring oil firms to maintain capital discipline. Simply put, the hurdle for new production is higher because it makes it difficult to source financing.

Although government regulation does play a role, as does ESG, their investors’ demand for returns is restraining growth. The oil and gas industry has traditionally experienced booms and busts; it appears financial firms are trying to contain that cycle. The shift to encourage expanded oil and gas production is boosting the shares of energy companies. It should also be noted that the survey suggests oil and gas executives do not see a promising future, which is also likely curtailing investment.

- Concerns about the future of the oil and gas industry are affecting human capital as well. Engineering schools report less interest in petroleum engineering.

- Although oil and gasoline prices tend to dominate the news, tightening supplies for diesel could become a much more serious problem. Europe is already reporting record low stockpiles. Diesel is what moves goods around the world, and higher diesel prices will usually be passed along in the form of higher prices for those goods.

- There are reports that U.S. refiners are sourcing fuel oil from the Middle East after the U.S. ban on Russian imports.

- The Austin airport warned it was facing a shortage of jet fuel.

- When gasoline prices rise, households might take steps to address the impact. We are starting to see reports of increasing use of public transportation in a bid to offset the higher gasoline price. A recent study suggests that for every 10% increase in gasoline prices, bus ridership increases by 4% and light rail by 8%.

- A resurgence of COVID-19 cases has led to a shutdown in Shanghai; concerns about the impact on the Chinese economy have been a bearish factor for oil prices.

- One factor causing marked volatility in energy markets is that exchanges are increasing margin requirements. The rise in trading costs often reduces market liquidity, meaning that moving large orders becomes disruptive to markets.

- The increased cost of oil and gas will tend to destroy demand. The Economist discusses how the war will likely accelerate the transition away from fossil fuels.

- Russia has planned on using Arctic shipping routes as the temperatures in the North Pole rise. However, it is finding that it cannot build the LNG icebreakers without access to Western technology.

Geopolitical news:

- The war in Ukraine continues, although there are reports suggesting the Russians may be entertaining a ceasefire. However, even with a cessation of hostilities, the world cannot “unlearn” the events of the past month. The U.S. and EU unveiled a plan to replace at least some Russian natural gas with American LNG. The U.S. is promising to send an additional 15 bcm (5.3 tcf) of LNG over the next 12 months over and above the current 22 bcm. That represents about 24% of Russian supplies. Since the U.S. is near full capacity for LNG exports, the increased supplies would come at the expense of other consumers, mainly from Asia. For years, most LNG supplies were tied to long-term contracts. Since the investment costs of building infrastructure for LNG are high, producers would not start projects without reliable demand. The EU is expected to provide long-term contracts to buy U.S. LNG to facilitate expanding production in America. However, securing supplies won’t come cheap, even though the EU is planning to purchase gas jointly in the future, which will increase the group’s buying power.

- Commodity trading houses are facilitating Russia’s oil trade. The traders say they are fulfilling long-term contracts and have not made new agreements.

- Germany has rejected calls to embargo Russian oil and gas, suggesting that doing so would trigger a recession. However, financial sanctions may end up triggering a de facto The G-7 has rejected Russia’s demand to pay for Russian gas with RUB. However, this decision creates a problem for Russia. If they sell natural gas to Europe and get paid in either EUR or USD, there are limits to what they can do with the funds. Since the Russian banking system is essentially embargoed, the EU is effectively not paying for the gas they receive. In response, Russia wants to get paid in RUB, which would force Europeans to trade with Russia to acquire their currency. The currency issue has the potential to lead Russia to cease exports of fossil fuels to Europe. Germany announced it has activated an emergency law that will give the government power to ration natural gas supplies.

- There are reports that natural gas flows through the Yamal-EU pipeline have ended.

- Russia is signaling that it is considering requiring RUB for ALL key exports, which would presumably include key metals.

- Although the Ukraine war is deepening Chinese and Russian relations, Sinopec (SNP, USD, 49.56) has suspended investments in Russia due to sanctions.

- There is a growing likelihood that Central Asia oil that uses Russia’s pipeline network could be impeded at some point.

- As Iranian nuclear talks stall, the KSA and UAE are calling for military support from the U.S.

- The Houthis have announced a ceasefire after a wave of drone attacks on Saudi oil installations. It is unclear how long the ceasefire will remain in effect.

- Trailing in the polls, Brazilian President Bolsonaro has fired the head of Petrobras (PBR, USD, 14.49) due to high petroleum product prices. It is the second time in the past year that Bolsonaro has relieved the head of the state oil company.

Alternative energy/policy news:

- As lithium demand soars, scientists are working on ways to lift production. A new method of evaporating brine pools holds promise to boost output.

- Tesla (TSLA, USD, 1099.57) plans to build a new battery factory in Arizona.

- The world’s low-cost producer of solar panels is China. U.S. manufacturers were given tariff protection due to concerns the Chinese government was subsidizing production to capture market share. U.S. manufacturers are concerned Chinese firms are avoiding tariffs via transshipments through other nations. Installers in the U.S. are trying to keep the Commerce Department from extending tariffs because they prefer lower-cost panels.