Weekly Energy Update (August 19, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

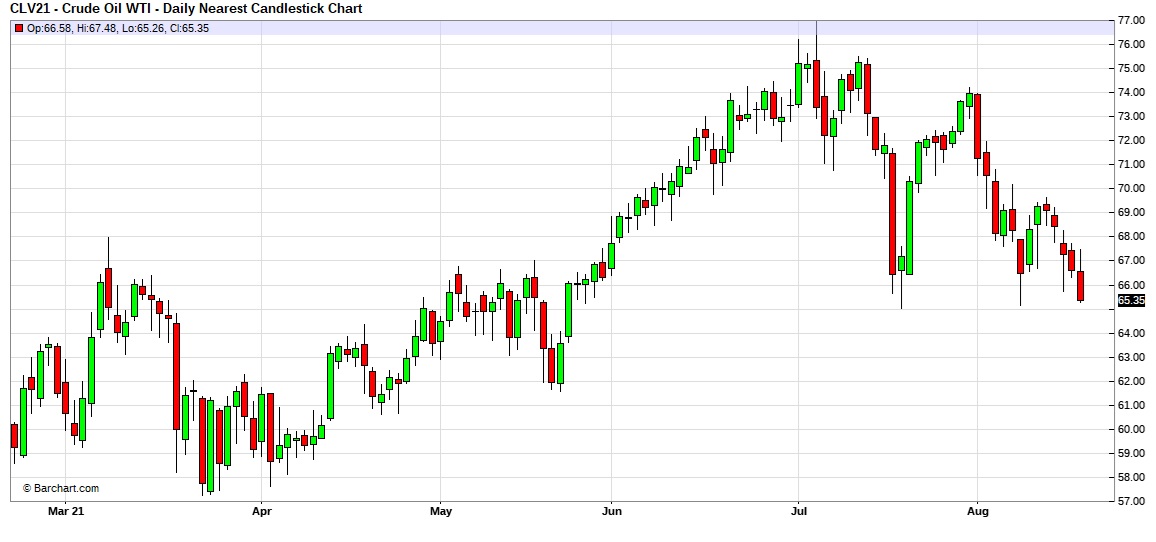

Oil prices remain under pressure as concerns over the Delta virus and seasonal factors press prices lower.

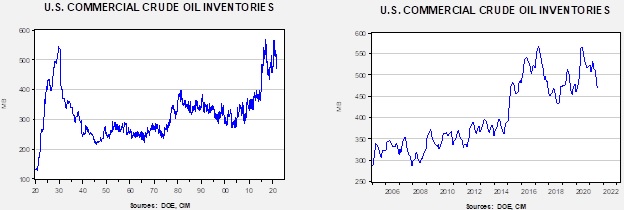

Crude oil inventories fell 3.2 mb compared to the 1.5 mb draw forecast. The SPR was unchanged this week.

In the details, U.S. crude oil production rose 0.1 mbpd to 11.4 mbpd. Exports rose 0.8 mbpd, while imports were unchanged. Refining activity rose 0.4%.

(Sources: DOE, CIM)

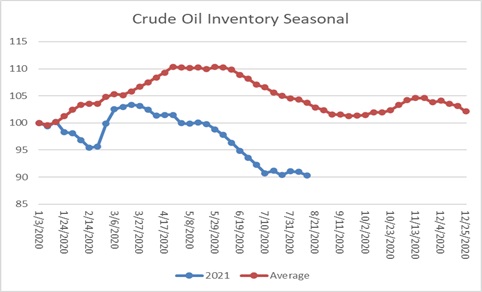

This chart shows the seasonal pattern for crude oil inventories. We are well into the summer withdrawal season. Note that stocks are well below the usual seasonal trough seen in early September. A normal seasonal decline would result in inventories around 550 mb. Our seasonal deficit is 69.0 mb. Since early July, inventory levels have stabilized. As the chart indicates, seasonal inventory stabilization usually occurs in September, so if this pattern continues, the seasonal deficit should narrow.

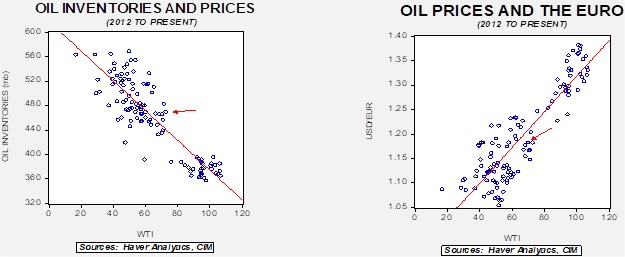

Based on our oil inventory/price model, fair value is $62.67; using the euro/price model, fair value is $62.09. The combined model, a broader analysis of the oil price, generates a fair value of $62.09. Continued dollar strength is weighing on oil prices.

Market news:

- Oil prices have come under pressure due to the impact of the Delta variant. This variant is leading to limited lockdowns in parts of the world and raising fears of weakening oil demand. Complicating matters are calls from the administration for OPEC+ to raise output. The fear of weakening demand coupled with higher potential supply is bearish for crude oil.

- Although environmentalists would like to reduce coal usage, strong natural gas prices are fostering more coal-burning for electricity production.

- Although Alberta’s oil production hit a record, the future of tar sands looks bleak.

Geopolitical news:

- The new Iranian administration has named a hardliner to the position of foreign minister. Hossein Amirabdollahian is said to be very close to the Quds Force of the Iranian Revolutionary Guard Corps. His appointment further dims the likelihood of a resumption of the nuclear deal with Iran.

- Iran’s new president is weighing on whether to enter into talks with Saudi Arabia.

- A private group is said to be the source of a major hack of Iran’s railway system.

Alternative energy/policy news:

- Although fracking and some onshore oil projects can be based on short-term outlooks for oil, deepwater projects take years to develop and need years of demand to justify. We may be seeing the last Gulf of Mexico project, with nations projecting zero carbon emissions by 2050.

- Economists of all stripes generally agree that a key part of addressing climate change is establishing a proper price for carbon. Once the cost of burning fossil fuels includes the cost of environmental harm, market incentives will encourage conservation and help pay for mitigation efforts. Carbon capture is one technology that might allow for the continued use of hydrocarbons if the carbon can be stored and not allowed into the atmosphere. However, without a realistic price, it’s hard to justify the cost of such projects. The EU has a carbon market, and prices are reaching a point where investing in carbon capture projects is starting to look feasible.

- As we have noted, although electric vehicles remain the most likely replacement for cars and light trucks, large trucks and buses may use hydrogen instead. Delivering hydrogen may be too difficult for retail use, but in concentrated depots, it might work well. We are starting to see some cities experiment with hydrogen buses.

- MIT is experimenting with a process that can generate hydrogen from scrap aluminum.

- Poland, a heavy coal user, is strongly considering moving to nuclear power.