Daily Comment (March 29, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning and happy Monday! We are down to the elite eight in NCAA men’s basketball, and opening day is just around the corner! U.S. equity futures are a bit lower this morning but off their worst levels of the overnight session. Coverage starts today with reports that a large family office is facing massive margin calls, which have led to aggressive selling of select equities. We look at who is behind the situation and its potential impact. Up next is the latest on the Suez situation. International news follows, with Myanmar and Germany’s supreme court featured. China news is next; economics and policy follow, and we close with the latest on COVID-19.

Who is Bill Hwang? He comes out of Tiger Management, a hedge fund of yesteryear run by Julian Robertson. He was one of Robertson’s “tiger cubs,” fund managers who spun out of Tiger Management to start their own hedge funds. Hwang took an initial stake of $23 million at the turn of the century and turned it into $8.0 billion by the end of 2007. His firm is called Archegros Capital Management, and it is a “long/short” hedge fund. Since 2007, his fortunes have been mixed. He was caught in the massive short squeeze of Volkswagen (VWAGY, USD 32.53), which rose 82% in one day after Porsche (POAHY, USD, 10.29) announced it had purchased shares. He also paid the SEC $44 million in fines over insider trading of Chinese bank stocks. Hong Kong exchanges banned him from trading for four years in 2014. In response to these legal challenges, as well as market issues, Hwang converted his hedge fund into a family office.

On Friday, Goldman Sachs (GS, USD, 327.39), Credit Suisse (CS, USD 12.87), and Morgan Stanley (MS, USD, 79.98),[1] who acted as prime brokers for Archegros, issued margin calls on the family office. Nomura (NMR, USD, 6.61) and Credit Suisse have warned they may “incur substantial losses.” Reports indicate that banks liquidated at least $30 billion (yes, with a “B”) of positions. Hwang tends to run a concentrated portfolio with leverage, which accentuates both gains and losses. His holdings appear to be weighted toward U.S. media companies and Chinese tech stocks. It appears the brokers initiated the stock sales, meaning this was a forced margin liquidation.

Here is the “known/known”—the sales are massive and were done in blocks, suggesting the bankers were worried about losses and wanted to move quickly to get as much out of the collateral as they could. This sort of action with a trader of this size isn’t common. Here are the “known/unknowns”—first, hedge fund managers often participate in the same ideas, and thus the sharp declines in selected stocks may also have ramifications for other managers. Second, the leverage may have been larger than one would expect. Margin loans are fixed at 50%, but traders can increase their leverage through derivatives, e.g., options, swaps, single stock futures, etc. We suspect Hwang’s positions were highly leveraged, which triggered the unified response. Third, and perhaps most important, we don’t know yet if the selling is nearly complete or if there is more to come. The initial weakness in stock index futures suggests worries were elevated; so far, it looks like we may be close to completion, and this event is just another tale of hubris and leverage. It is also possible that we aren’t finished yet, and wider selling may still be possible.

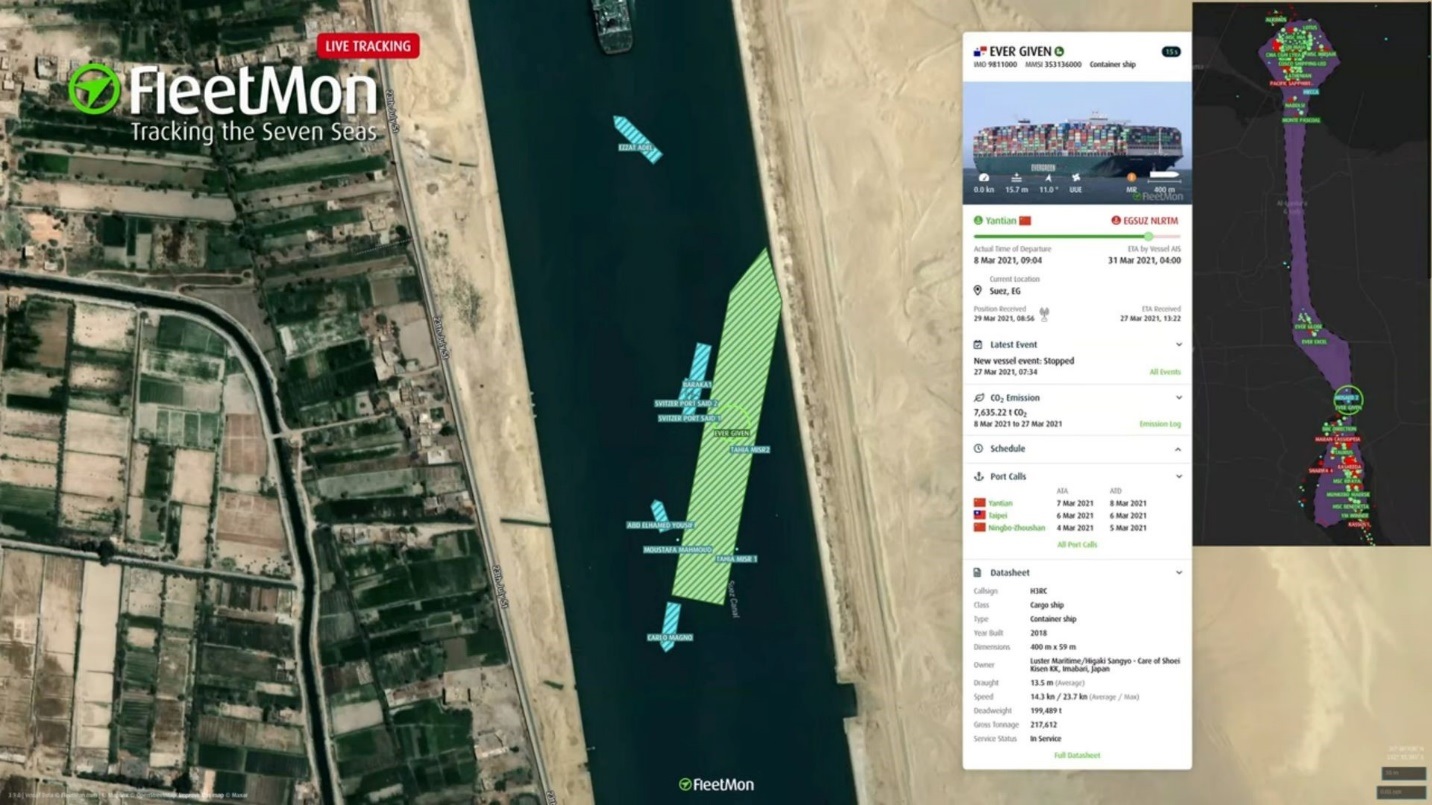

Suez: There is some good news on this front. The combined efforts of tugboats and excavators, along with the moon (from high tide), have partially refloated the stuck container vessel.

(Source: FleetMon)

The ship’s bow has been freed from the eastern bank, and the stern has been shifted into the channel. However, even if the boat is freed, it will take weeks for traffic to normalize completely. This is leading shippers to consider alternative routes. Security of supply concerns are leading consumers to reconsider just-in-time inventory methods. Insurance firms are also facing a raft of claims.

International news: Myanmar increasingly looks like a civil conflict, and the German Supreme Court throws a potential spanner into the Eurobond.

- On Saturday, the Myanmar military celebrated Armed Forces Day, and on Sunday, funerals were held for those who recently died in the violence. Both events triggered protests and attacks by security forces, leading to a bloody weekend where over 100 people perished in the violence. U.S. and EU officials have condemned the violence, but given China’s support for the regime, there is little that can be done from the U.N. The army appears to be following a path that it can rein in the protests by escalating the attacks. So far, the rising death toll doesn’t seem to be reducing the scale of the protests. There are reports that Thailand is seeing an influx of refugees from the fighting. China has made large investments in Myanmar to create a land bridge to the Indian Ocean, allowing it to avoid various chokepoints closer to the South China Sea that are ostensibly controlled by the U.S. Navy. A breakdown in civil order will put these investments and plans at risk. We continue to watch to see if China attempts to intervene directly.

- The German Supreme Court has raised questions about German participation in the €750 billion Eurobond scheme. Although this doesn’t scotch the deal, it does raise a potential risk that we will need to monitor closely. Politically, the potential ouster of the conservative coalition from power would tend to bring a more Eurocentric political group to power. But the courts could still pose a problem.

- Slovakia’s PM, Igor Matovic, has stepped down after his government faced defections over his unilateral decision to import the Sputnik V vaccine.

- Protests emerged in Turkey over the weekend in response to Erdogan’s decision to pull out of a treaty that specifically protected women from violence.

- Alex Salmond, a major figure in Scotland’s SNP, who was recently acquitted of sexual harassment charges, has announced the creation of a new political party. Although it will support independence for Scotland, the division will make it more difficult to actually build momentum for separation.

China: The EU and China are engaging in dueling sanctions, and China and Iran formalize ties.

- In light of EU sanctions on Chinese officials for human rights violations, Beijing has replied in kind. The CAI investment deal between China and the EU remains in the balance. There are also worries that the application of sanctions may have misfired to some degree.

- China has also sanctioned U.S. and Canadian officials.

- China, in a direct threat to U.S. policy in the Middle East, has inked an investment and security deal with Iran. The move will complicate the U.S. attempts to create a policy response with Iran.

- Industrial profits in China surged in January and February.

- As part of its “belt and road” project, China has made inroads into the Balkans. Its behavior in Serbia has recently been profiled; local leaders like the investment, and local people seem to be bearing the cost of adjustment.

- USTR Tai held her first interviews over the weekend; the bottom line, the Biden administration appears to be using Trump-era tariffs as leverage in negotiations.

- On the security front, China is challenging the Philippines, and U.S. officials are sounding the alarm over the vulnerability of Taiwan.

Economics and policy: Infrastructure, taxes, and inflation lead the headlines.

- The Biden administration continues to float a massive infrastructure package. Tax hikes are also being considered. Although there is much talk, we still think the path to getting both done is fraught with risk. One factor is that tax hikes are not universally popular with centrist Democrats.

- China has been a deflationary force on the global economy for decades. That may be starting to reverse as costs rise in China to the point where Chinese firms are no longer willing to absorb them. At the same time, China’s recent pullback from stimulus is adversely affecting commodity prices. We don’t expect this situation to persist, but it is leading to price consolidation.

- Amazon (AMZN, USD, 3052.03) should know within the next week or so if its Alabama facility will approve a union.

- We are seeing a developed world surge in home prices, partly due to the pandemic. Although U.S. housing markets are clearly “hot,” lending behavior is much more responsible compared to the “naughts.”

- Farmland prices are also soaring due to elevated grain prices.

COVID-19: The number of reported cases is 127,285,692 with 2,785,365 fatalities. In the U.S., there are 30,262,717 confirmed cases with 549,335 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 180,646,465 doses of the vaccine have been distributed with 143,462,691 doses injected. The number receiving at least one dose is 93,631,163, while the number of second doses, which would grant the highest level of immunity, is 51,593,564. The FT has a page on global vaccine distribution.

Virology

- First, the bad news: Brazil is facing a public health crisis. Cases are surging, and the hospitals are overwhelmed. The government refuses to engage in lockdowns, so we expect continued elevated infection rates. India is also facing a new surge in cases with new variants

- Now, the good news: So far, vaccines appear to be very effective. Older people are showing signs of being protected from the disease, and few health care workers are reporting infections after inoculations.

- It appears that vaccine passports are going to be part of our lives. The development of proof of vaccination or immunity is fraught with risk but is probably necessary for the reopening of the economy.

- Full herd immunity probably won’t be possible until children are vaccinated.

- Russia is quietly importing vaccines to deal with shortages.

[1] UBS (UBS, USD, 16.04) and Deutsche Bank (DB, USD, 12.35) also are listed as prime brokers, but we haven’t seen a direct mention that they were involved in margin sales.