Daily Comment (February 6, 2018)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EST] Equities remain under pressure around the world. We are seeing lots of swings in other markets, with Treasuries flipping from higher to lower prices and the dollar is volatile as well. Here is what we are watching:

Algos and risk parity: Innovation is always a factor in markets, including financial ones. Most of the time, new things are an improvement. Sometimes this isn’t the case and, even with good things, overdoing it or becoming overly reliant upon a new, untested product can cause problems. Early in my career, portfolio insurance was the rage; buying equities and offsetting part of the risk by being short futures (or having stops under the market in futures) gave investors the impression they were protected from market declines. In 1987, that proved to be a false assumption. In our times, risk parity has the potential to be the new version of portfolio insurance. At its most basic level, both portfolio insurance and risk parity are nothing more than portfolio diversification. In other words, holding an asset in a portfolio that moves in the opposite direction to other parts of the portfolio is basic modern portfolio theory. Finding that diversification asset is the trick; it must (a) not be overly costly, and (b) work consistently. Finding instruments that always move opposite to stocks is easy; finding ones that don’t offset most of one’s equity gains is hard.

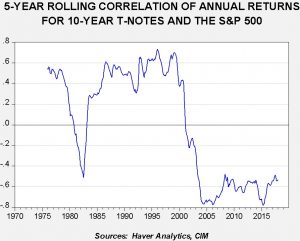

Simple risk parity models usually use bonds to offset portfolio risk. Although that hasn’t always worked, it has been effective in this century.

This chart shows the rolling five-year correlation between returns for 10-year T-notes and the S&P 500. Until around 2000, returns for these two asset classes were positively, or directly, correlated. They are now negatively, or inversely, correlated. There are probably a myriad of reasons for this flip, including confidence that inflation would remain controlled. Declines in long-term interest rates seem to have an impact as well (when the 10-year yield fell under 6%, the correlation switched), and consistent and transparent Fed policy also likely played a role. Recently, we have seen both Treasuries and equities come under pressure. Heightened inflation fears seem to be behind this market action. This is an issue we are monitoring closely because asset allocation would become much more challenging if this relationship between bonds and stocks were to change to the pre-2000 relationship.

Risk parity can be much more than the simple addition of bonds to a portfolio. One of the more popular strategies in recent years has been to use volatility instruments to diversify portfolios. And, for every buyer of insurance, someone has to be a provider. Selling volatility has been a very profitable strategy in recent years. With every popular strategy, the financial services industry will create a product to facilitate demand. Inverse volatility ETPs, which are usually ETNs,[1] have done quite well in recent years. Volatility has steadily declined, in part due to easy and transparent monetary policy, slow economic growth and low inflation.

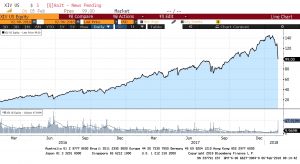

This is a two-year chart of the XIV (CS VELOCITYSHRS DLY INV VIX SHRT ETN, 99.00). Two years ago, this ETN was trading at 20; it peaked last month at 140. The current after-hours indication is 15.43 (see below for more on this issue).

To some extent, what we are seeing in the financial markets is a normal late-cycle environment where the economy expands to capacity constraints, inflation begins to rise, interest rates move up and monetary policy tightens. There is nothing too unusual in what we are seeing. Now, we can quibble about all of these elements. First, we are not convinced that hitting capacity constraints is relevant in a globalized world. As long as excess capacity exists in the global economy, inflation can be contained by a wider trade deficit. Second, the rise in inflation we are contemplating, to maybe 2.5% for core CPI in the coming 12 to 18 months, isn’t so earth-shattering as to force the Fed to slam on the money brakes. Third, we are not convinced that the recent rise in wages is material; although overall wages rose by 2.9%, wages for the majority of workers, shown by non-supervisory and production workers, remain stagnant at 2.4%. Still, there is little doubt the FOMC will continue to lift rates unless the recent break in equity markets destroys enough wealth that it affects the economy. That isn’t likely, simply because significant equity ownership isn’t broad enough to have that effect.

What is causing the market turmoil is a repricing of the outlook coupled with vulnerabilities caused by volatility products and algorithms. As holders of short volatility products take losses and try to exit products, they are likely selling other parts of their portfolio to gain liquidity. It should be noted that trading was halted yesterday on several of these ETNs and they remain halted at the time of this writing. As the chart below shows, the NAV on XIV has plunged to 4.22.

According to reports, some of these ETNs may be liquidated due to their price action.[2] If that occurs, it may end this product’s availability to average investors.

Algorithms are the other innovation that affects the financial markets. These pre-programmed trading strategies are designed to use speed to succeed. Thus, when various conditions are met, these programs begin rapid trading. The sharp drop seen in the last hours of trading yesterday were likely triggered by such programs.[3] These programs can make financial markets temporarily unstable but really don’t affect long-term investors…as long as they don’t pay close attention to such swings. To some extent, algorithms are not doing anything humans don’t usually do, but they do them faster and they seem impossible to stop once triggered. That feature is what makes them a bit worrisome.

So, where does all this leave us? We view this pullback as a buying opportunity. The real worry is a recession that brings a broader bear market, and the economy is doing ok. Insofar as this correction rids the market of some of these activities that rely on conditions that are probably unsustainable, it will make equities less vulnerable to shocks. The bigger picture is the repricing of stocks that we are seeing; in other words, are we going to see a broader downward shift in market multiples that will lead to lower prices this year? It’s possible, but if inflation doesn’t begin to accelerate significantly and the FOMC remains on a steady path, a dramatic repricing isn’t likely. At the same time, we think there is probably more market turmoil in the short run. We haven’t seen a real panic yet and usually these sort of events don’t end without fear returning to the markets.

Bitcoin hit again: While bitcoin continues to come under pressure, another voice calling for regulation has emerged. The Bank of International Settlements (BIS), the “central banker’s central banker,” is calling on central banks to “clamp down” on these instruments, calling them a “threat to financial stability.”[4]

[1] Exchange Traded Products (ETPs) is the broad definition; Exchange Traded Notes (ETNs) are subsets of ETPs (the broader cousins of ETFs, or Exchange Traded Funds) which are bank notes issued to replicate an index.

[2] https://www.bloomberg.com/news/articles/2018-02-06/volatility-jump-has-traders-asking-about-poison-pill-in-vix-note

[3] https://www.bloomberg.com/news/articles/2018-02-05/machines-had-their-fingerprints-all-over-a-dow-rout-for-the-ages

[4] https://www.ft.com/content/78bf5612-0b1a-11e8-839d-41ca06376bf2