Asset Allocation Weekly (September 28, 2018)

by Asset Allocation Committee

Since late August, interest rates have been steadily rising. The 10-year T-note yield made its recent low at 2.82%[1] on August 4th. Since then, yields have moved above 3.00%.

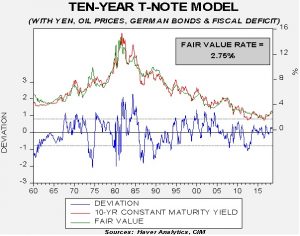

Our 10-year T-note model suggests rates are a bit elevated.

This model includes fed funds and the 15-year moving average of inflation (a proxy for inflation expectations) as the core variables. These two variables explain more than 90% of the variation in the interest rate on this T-note. The additional variables, the yen, oil prices, German bund yields and the fiscal deficit, are all statistically significant but have much less explanatory power than the core variables. Based on the core variables alone, the fair value yield is 3.45%. The weak yen and low German rates (currently around 42 bps) are mostly responsible for the lower fair value reading in the full model.

In the short to intermediate term,[2] the two variables we are watching most closely are fed funds and German yields. Fed funds expectations have been increasing due to robust economic growth and expectations that the FOMC will contain any potential inflation threat.

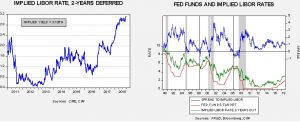

The chart on the left shows the implied three-month LIBOR rate two years into the future. It has recently ticked higher to 3.135%. The chart on the right shows that FOMC policymakers tend to use this rate as a policy target.[3] In a tightening cycle, the FOMC tends to raise rates until fed funds reach the aforementioned implied LIBOR rate. The vertical lines on the right chart show when inversion occurs. Policy tightening usually stops at that point. Given the current implied rate, this would lead to a terminal fed funds target of 3.25%.

If we assume a 3.25% rate and no other changes, the fair value for the 10-year yield rises to 3.28%. Thus, it is reasonable to assume that much of the rise in yields over the past month has been due to the market preparing for future rate hikes. The low level of German yields is also a concern but even taking bunds to 1.00% only raises the fair value yield to 3.40% (assuming a fed funds rate of 3.25%).

The long-run concern is inflation expectations. A modest rise to 3.00% (from the current 2.10%) and a 3.25% fed funds rate would take the fair value yield to 3.86%. Major bear markets in long-duration assets are mostly a function of unanchored inflation expectations. Although the Federal Reserve has limited capabilities to restrain actual inflation (inflation control is mostly a function of the supply side of the economy), central banks are critical to managing inflation expectations. If investors, households and firms conclude that the central bank won’t raise rates in the face of rising inflation, their behavior will likely change to adapt to steadily rising prices. Alan Greenspan’s definition of inflation control is when economic actors no longer take inflation into account when making consumption and investment decisions. If inflation fears emerge, these actors will tend to increase inventories, rush to purchase before prices rise and set the stage for a price spiral. The control of inflation expectations is one of the reasons modern central banks are given policy independence. Anything that infringes on this independence runs the risk of un-anchoring inflation expectations. To date that hasn’t occurred but the rise of populism increases the odds that central banks will lose their independence, which increases the risk of higher long-duration yields.

[1] Using the constant maturity T-note yield. See: https://fred.stlouisfed.org/series/DGS10

[2] Three months to two years

[3] We don’t know for sure if this is overt or coincidental, although we suspect the latter.