Daily Comment (April 19, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning, and happy Monday! Global equity markets are mixed this morning, with U.S. equity futures taking a breather. Our coverage this morning starts with bitcoin, which had a rather wild weekend. Russia news follows and includes several items. China news is next, followed by an update on German politics. There is an economic roundup, and we close with the pandemic update.

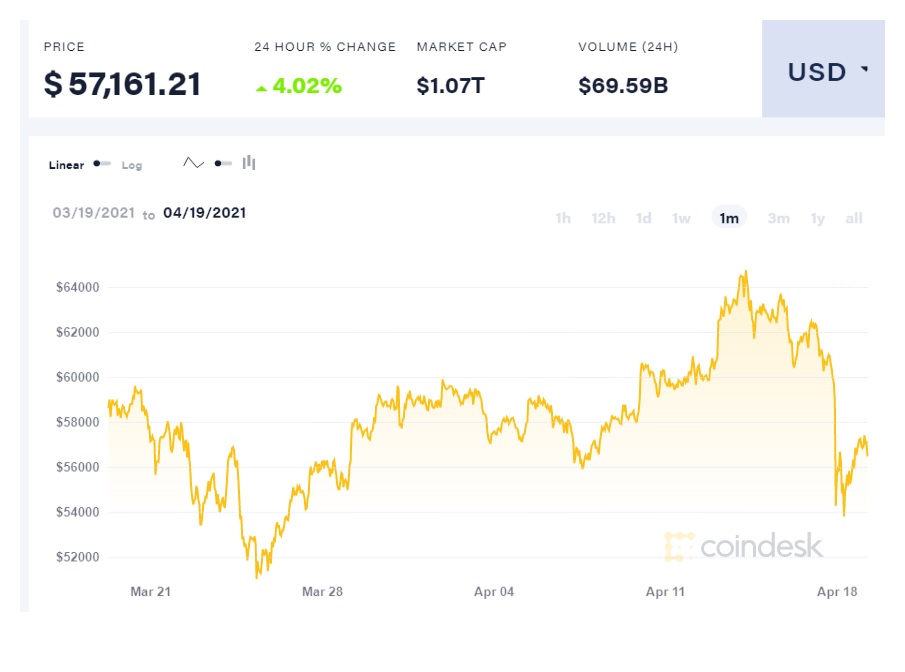

Bitcoin: Prices fell hard over the weekend.

(Source: Coindesk)

Although the plunge over the weekend isn’t all that unusual, the reasons behind the pullback are unclear. There are reports that the Treasury is contemplating a crackdown on digital assets, which are often used for money laundering. We note that Turkey’s central bank has banned cryptocurrency payments as well; one of the greatest dangers to cryptocurrencies could come from government regulation. This decline could also be part of the post-market Coinbase (COIN, USD, 342.00) IPO. As the chart above shows, prices had rallied into the IPO, and thus some of this decline could be profit taking. Although China has made it more difficult to mine bitcoin because of the drain on electricity, the PBOC has taken a rather sanguine position on cryptocurrencies. We doubt this will last; General Secretary Xi tends to take a dim view on things he can’t control.

We comment on market action this morning in part because bitcoin and other cryptocurrencies have siphoned off liquidity from the financial markets. If prices reverse, that liquidity could look for a new home.

Russia: Navalny’s health, Czech Republic expels Russian diplomats, and the Ukraine’s military buildup are raising concerns.

- Alexei Navalny, on the 19th day of a hunger strike to receive the medical treatment of his choice, is said to be near death. He is likely still dealing with the aftereffects of his poisoning last year, and tuberculosis is common in Russian prisons. Navalny’s allies are calling for protests. The U.S. is considering its options should Navalny die in Russian custody. Although the Kremlin has moved him to a prison hospital due to his condition, there doesn’t appear to be much concern in the government if he dies.

- For weeks, the Russian military has been building up its forces around Ukraine. Speculation has been rising about what Putin is doing. One possibility is that he could engineer an incursion to open a canal that brings fresh water to Crimea. Or it could be to send a signal to NATO that Russia remains a threat. There is even speculation that Putin could cause an incident to disrupt the U.S. climate summit this week; reducing greenhouse gases is an existential threat to Russia’s hydrocarbon-based economy. The general worry is that anytime there is a buildup of troop strength, there is always the potential for a mistake, leading to an unintended escalation.

- The Czech Republic has blamed Russia for an explosion at an ammunition dump in 2014. The unit responsible for poisoning Sergei Skripal is being blamed for this attack. The Czechs have expelled 18 Russian diplomats over the incident. Russia has countered by expelling 20 Czech Republic diplomats. The Czech Republic has been on good terms with Moscow; this incident has clearly cooled relations.

- The Russian media is touting a coup plot in Belarus, claiming U.S. involvement.

China: U.S. and China agree to cooperate on climate issues, and Japan and the U.S. agree to counter Chinese coercion.

- Relations between the U.S. and China are at a low ebb. The Trump administration ended the policy of accommodation, applying sanctions, and the Biden administration has not only maintained the trade tariffs but is working to build a coalition to isolate China. Despite these difficulties, the two countries have vowed to work together on climate issues. Although such agreements are welcome, we doubt China will actually do much on this issue without a broader group of nations involved and higher levels of coercion.

- Japan and China have close economic ties; these relations have tended to keep Tokyo from making aggressive statements toward Beijing. But, we note that, after the Biden/Suga meetings, the Japanese PM clearly stated the U.S. and Japan would oppose China’s aggression in the region.

- Chinese authorities appear to have extracted their penalty for Jack Ma’s position on financial regulation of Ant Financial. It appears he is being forced out of his controlling stake in the company.

- We have viewed China’s belt and road project as a thinly veiled return to 18th century imperialism. Like the European powers of that era, China has excess capacity and needs a captive economy to absorb its production. The latest nation to find itself facing excessive debt to China is Montenegro. The country accepted Chinese financing for a massive road project that the EU was critical of when it was announced. In a twist, the EU and NATO member is asking for help from the EU to service the debt; Brussels is not inclined to do so. After all, if small European countries can accept lending from Beijing and then rely on the EU for bailouts, the moral hazard problem will simply worsen.

- The Biden administration is targeting rare earths for industrial policy in a bid to loosen China’s hold on that market.

- The Treasury is warning Taiwan that it is manipulating its currency. Given the geopolitical importance of Taiwan, we would not expect the U.S. to move aggressively to resolve the manipulation.

- The CPC is pushing a traditional “family values” role for Chinese women. This is being done to address a serious demographic problem. We doubt Chinese women will be swayed by party messages.

Germany: Germany will hold national elections in the fall, and the CDU/CSU is struggling to agree on a leader in the midst of a slump in the polls. Meanwhile, the Greens, who are seeing their poll numbers rise, have selected Annalena Baerbock as party chair. If the party wins in the upcoming elections, she would become Chancellor. The Greens are an environmental party, but over the years have become increasingly centrist. Perhaps more important for the U.S., the Greens are much more strongly opposed to Russia and China compared to the CDU/CSU, who loath to harm business relations. The conservatives are more closely aligned with the “metal banging” part of the economy. The Greens are closer to the technology and services sectors. It is notable that the Greens oppose the Nord Stream 2 project.

Economics and policy: Tax negotiations continue, and the economy starts to emerge from the pandemic.

- It looks increasingly like centrist Democrats are not going to support a 28% corporate tax rate. Media reports suggest that the highest they will accept is 25%. Meanwhile, the high income tax state members are pressing to end the cap on “salt” deductions, which mostly affect affluent taxpayers.

- The pandemic has reportedly led to the closure of 200,000 businesses. Although we don’t doubt the reports (a casual drive around our area shows lots of storefront space for rent), it should also be noted that many of the industries affected have few barriers to entry. Thus, we would expect a rapid recovery to develop in the coming months. One key unknown is how rapidly hiring will follow.

- We have been documenting the high level of household liquidity in the U.S. Reports suggest this is not just an American phenomenon. Globally, savers are sitting on $5.4 trillion.

COVID-19: The number of reported cases is 141,499,661 with 3,021,912 fatalities. In the U.S., there are 31,670,706 confirmed cases with 567,217 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 264,505,725 doses of the vaccine have been distributed with 209,406,814 doses injected. The number receiving at least one dose is 131,247,546, while the number of second doses, which would grant the highest level of immunity, is 84,263,408. Half of U.S. adults have received at last one dose of a COVID-19 shot, and 25% are fully vaccinated. All adults are now eligible for a vaccination. The FT has a page on global vaccine distribution.

Virology

- It is expected that the Johnson and Johnson (JNJ, USD, 162.24) vaccine will return to use later this week, although it may be restricted to older patients.

- On the international front:

- Turkey is seeing a new surge in cases. Gatherings for Ramadan are probably helping spread the virus. New cases appear to be the more contagious strains.

- Chile is discovering that the Sinovac (SVA, USD, 6.47) vaccine was not all that effective. After a mass vaccination campaign and the easing of lockdown constraints, the country is facing a surge of infections. In fairness, it appears Chileans began circulating after one dose, which doesn’t confer high levels of immunity.

- Another country facing a crisis is India. The most recent wave of infections is tied to new variants. The economic impact is hitting India’s middle class and has sent its currency lower.

- The U.K. is undertaking challenge trials. Previously infected but unvaccinated volunteers will be deliberately exposed to the virus to see if their previous infections grant immunity. The U.K. is the only nation in the world conducting official challenge trials.