Daily Comment (October 12, 2017)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT]

Fed minutes: The Fed minutes didn’t have a lot of surprises; we would characterize them as modestly dovish. Going off the terms used, “several” members were uncertain about inflation and wanted more data to improve their confidence, while “a few” believed that additional increases should be delayed. On the other hand, “many” thought another increase in the target before year’s end was warranted. That would suggest a rate hike in December is probably likely, but the decision may not be as unanimous as the market seems to think. Here are the current odds of a December hike in fed funds futures.

Current expectations call for an 80% probability of a December hike. The odds didn’t decline after the minutes were released.

The Chair race: Politico[1] is reporting that Treasury Secretary Mnuchin is promoting Jerome Powell for the Fed chair job. The secretary has worked with him on issues in the past and sees him as a safe pick that he will have some influence over. At this point, we believe the two front-runners are Powell and Kevin Warsh and, of these two, we would wager that Warsh gets the nod. However, Mr. Trump has a history of surprises. Although his name isn’t on any lists, we would not be shocked to see the president appoint an überdove like Minneapolis FRB President Kashkari. Kashkari is a Republican, which would make him acceptable to the GOP establishment. President Trump has also indicated he prefers low interest rates. We think Warsh is the front-runner because he will likely be beholden to the White House. The president’s comments suggest he may be more Nixonian in his stance toward the U.S. central bank and, if so, it would be dollar bearish.

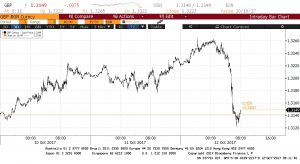

Brexit talks stall: EU Chief Negotiator Barnier indicated this morning that the two sides have not made any “great steps forward” and that talks are “deadlocked.” Britain wants talks to shift to trade, but the EU wants the U.K. to inform the EU what it intends to pay to honor its EU commitments as the price of exit. Naturally, the May government has no interest in spelling out the costs but it appears that the EU won’t negotiate on trade until the U.K. makes an offer. Although talks are not doomed, there was some market impact from the announcement of a deadlock.

The GBP tumbled on the deadlock news but has started to recover.

Is NAFTA in trouble? Although negotiations continue, reports indicate that talks are contentious and negotiators are struggling to save the agreement. The impact of a repeal would be significant. U.S. agricultural exports would be harmed; Mexican tariffs on agricultural goods are steep and thus U.S. exports of grain and meat would likely decline. U.S. manufacturing is deeply integrated with Canada and Mexico, so production dislocations could be significant if trade flows are disrupted. For example, if trade barriers prevent auto parts from flowing across borders, auto production could cease for a period until new arrangements are created. More than 310 state and local Chambers of Commerce have sent letters to the White House urging the president to keep the U.S. in NAFTA. On the other hand, leaders of the AFL-CIO are supportive of the president’s efforts. Although we generally expect inflation to remain low, our position is that mild inflation is mostly a function of globalization and deregulation. If either is disrupted, supply constraints and higher prices will result. If such an outcome accelerates, it will have a significantly negative effect on financial markets. Inflation lifts interest rates and lowers P/Es. It is quite possible that NAFTA falls and is followed up with bilateral agreements that mimic NAFTA. However, the shift would not be frictionless and, in the interim, an inflation scare could prompt tighter monetary policy and increase the odds of recession. We are watching this issue closely.

Austrian elections: If current polls are correct, Austrian voters are going to side with the center-right People’s Party and its young leader, Sebastian Kurz. At 31, he would be the youngest head of government in the world. Usually, Austrian governments are grand coalitions of center-left and center-right parties. However, Kurz is expected to form a government with the xenophobic Freedom Party. Kurz has tried to limit the number of asylum seekers in Austria, opposing the German refugee policy. The anti-immigrant policy has been popular; when Kurz became party leader, People’s Party polling rose 10%. One of the other interesting elements of this election is that consultants for the Social Democrats apparently made fake Facebook (FB, 172.74) pages that purported to be from racist groups suggesting Kurz planned to open Austria’s borders at the behest of George Soros. The campaign appears to be rather nasty by European standards but, in the end, Austria appears to be turning rightward which will raise worries for Germany and France.

[1] http://www.politico.com/story/2017/10/11/jerome-powell-federal-reserve-chair-243679