Daily Comment (November 9, 2017)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EST] We are seeing some equity weakness this morning. There isn’t anything specific weighing on the market other than what looks like profit taking. Here’s the news we are watching this morning:

President Trump in China: The president received $250 bn in trade deals and promised investments. He will call this a win. China, on the other hand, made no promises of structural change in the trade relationship that would be necessary for a sustained decline in the trade account. China has created a situation of persistent oversaving; this was done to build China’s investment base. Although this investment-led development was successful (and has been used at some point by every nation that has achieved developed status), a point is reached where the investment infrastructure is adequate and restructuring the economy away from suppressing consumption is necessary. We actually think that process is already underway. The aggressive consolidation of power in China by Chairman Xi will give him the wherewithal to restructure the economy. How will that look? One way, and, in our opinion, the best way, would be to sell off part of the state-owned enterprises to households at discount prices. This would boost household wealth and lift spending. Another way would be to put in social safety nets, like social security and deposit insurance. But, doing this will directly harm the wealthy and powerful in China; that’s why Xi had to implement the purges he did in his first term. If Xi makes these moves, the Chinese external accounts will move from surplus to at least balanced, if not deficit. However, Xi cannot be seen as doing this because of demands by the U.S. And so, in place of real reform, which may be coming, Xi gave “baubles” to President Trump so Xi can reform at his own pace.

China and North Korea: There’s not much new here. U.S. policy continues to hold that North Korea is China’s problem to solve when China has no interest in solving it. China would be more worried if the U.S. engaged in direct negotiations with Pyongyang. As we noted recently,[1] China and North Korea are not really allies. A North Korea aligned with the U.S. would give Beijing its worst nightmare—a hostile power on its border.

More trouble for May: PM May has lost her second minister in a week. Priti Patel, May’s international development secretary, resigned after it was revealed she held up to a dozen unauthorized meetings with Israeli officials during a summer vacation. This follows on the heels of the resignation of May’s defense minister, Michael Fallon, on charges of “inappropriate conduct.” The GBP has been struggling on fears that May’s government will fall and new elections will be held. The weakness of May’s position has undermined her ability to negotiate Brexit, which has also pressured the currency.

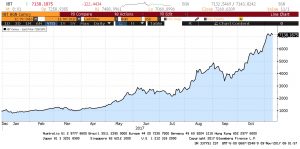

Saudi crackdown continues: Bloomberg[2] is reporting that the wealthy in Saudi Arabia are fearful of additional asset freezes and are trying to move money out of the country. Although bitcoin reportedly jumped yesterday after a plan was shelved that would have created an offshoot of the popular cryptocurrency,[3] we suspect Saudi capital flight might be behind the rally and may support further upside to bitcoin. Cryptocurrencies have proven effective in evading capital controls and bitcoin could have another leg up if Saudi subjects begin to use the tool to move money away from the kingdom.

This is a year-to-date chart on the XBT/USD exchange rate.

Venezuela may avoid default…for now: Russia has apparently agreed to restructure $3.0 bn of Venezuelan debt it holds. This isn’t anything new; over the past three years, Moscow has given the country $10 bn of assistance. In return, Rosneft (MCX: ROSN 334.10) was given 49% of CITGO, which is PDVSA’s refining arm in the U.S. Russia is using Caracas’s woes to gain further control of Venezuela and will likely try to use this foothold in the Western Hemisphere to weaken U.S. influence in the region. Still, it appears highly unlikely that Venezuela will avoid restructuring its debt.

Merkel is struggling: Chancellor Merkel has been trying to cobble together a coalition after her party’s weak showing in the September elections. She has attempted a “Jamaica” coalition, consisting of her conservative CDU/CSU party, the Free Democrats, a libertarian-leaning party, and the Greens, the environmental party (the party colors are green for the Greens, yellow for the Free Democrats and black for the CDU/CSU, the Jamaican flag colors). These parties are not natural allies, but political leaders fear that another election may lead to further gains for the AfD. This weakness in Germany comes at a time of a growing global power vacuum and raises the dangers for further drift in Europe. At the same time, distraction in Germany may lead Merkel to be soft on Brexit negotiations, which would benefit the U.K.

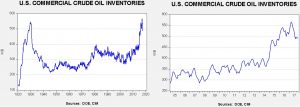

Energy recap: U.S. crude oil inventories rose 2.2 mb compared to market expectations of a 2.5 mb rise.

This chart shows current crude oil inventories, both over the long term and the last decade. We have added the estimated level of lease stocks to maintain the consistency of the data. As the chart shows, inventories remain historically high but have declined significantly this year. We also note the SPR fell by 0.7 mb, meaning the net build was 1.5 mb.

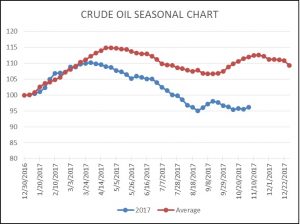

As the seasonal chart below shows, inventories rose modestly this week. It appears that we are “skipping” the usual autumn inventory rebuild period. Usually, inventories would peak in two weeks. After that, stockpiles would decline into year’s end and then start their largest build from early January into early April.

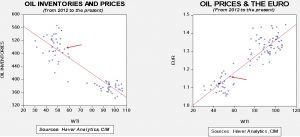

Refinery operations continued to rise last week, in line with seasonal norms. If this continues, and we expect it will, it should be bullish for oil prices.

Based on inventories alone, oil prices are undervalued with the fair value price of $53.22. Meanwhile, the EUR/WTI model generates a fair value of $59.70. Together (which is a more sound methodology), fair value is $56.99, meaning that current prices are very close to fair value. Dollar strength and the rise in oil prices have mostly addressed the recent undervaluation. Oil prices should continue to benefit from turmoil in the Middle East, but we would look for a period of consolidation in prices unless geopolitical conditions deteriorate significantly.

[1] See WGRs: North Korea and China: A Difficult History, Part I (10/16/17); Part 2 (10/23/17); and Part III (10/30/17).

[2] https://www.bloomberg.com/news/articles/2017-11-09/saudi-billionaires-are-said-to-move-funds-to-escape-asset-freeze

[3] https://www.bloomberg.com/news/articles/2017-11-08/bitcoin-surges-to-record-on-speculation-possible-split-avoided