Daily Comment (May 23, 2018)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] It’s looking a bit ugly out there this morning for risk assets. Equities and most commodities are lower, while gold, Treasuries and the JPY are higher. This is a classic pattern of flight to safety buying. Here is what we are watching:

Twin crises: Turkey and Italy are the primary problem areas this morning. Turkey is facing a full-blown currency crisis.

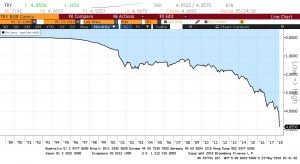

The above is a three-decade chart of the TRY/USD exchange rate in terms of lira per dollar. We are not only making new lows but making them in rapid fashion. The drop in the TRY is a classic example of why leaders shouldn’t undermine the independence of the central bank. The textbook response to this sort of decline is a massive increase in short-term interest rates. This action increases the cost of shorting (the short has to borrow in the shorted currency) and usually arrests the decline. However, President Erdogan is strongly opposed to interest rate increases so we have a showdown between the financial markets and the president. Compounding the problem is that the Turkish private sector has borrowed in foreign currencies, meaning the drop in the TRY is rapidly escalating the cost of debt service. S&P[1] is threatening a downgrade. Turkey is holding national elections on June 24. Erdogan is hoping to solidify his political position to change the nature of the presidency, boosting the executive’s power. A currency crisis that triggers a debt crisis won’t help Erdogan’s popularity.

Meanwhile, the travails of Italy continue. The Five-Star Movement and the League are close to forming a government but have hit two snags. First, their candidate for PM, Giuseppe Conte, a politically unknown law professor, appears to have either lied about or inflated his accomplishments on his resume.[2] Second, the coalition is recommending Paolo Savona for finance minister, an avowed Euroskeptic.[3] President Mattarella, who must approve any government, is not comfortable with either choice for PM or FM. Italian credit markets are showing signs of stress. First, sovereign interest rates are rising.

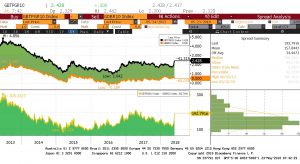

This chart shows the Italian vs. German 10-year sovereigns. The spread is widening out rapidly; what is worrisome is that while Italian yields are rising, German yields are declining (albeit modestly). This suggests we may be seeing capital flight out of Italy into German paper. Second, Italian bank bonds, especially those with elevated levels of non-performing loans, are coming under pressure.[4]

OPEC: Oil prices slipped yesterday afternoon on reports that OPEC may boost output to offset declines in Venezuelan production.[5] The cartel probably does not want to see the U.S. gain market share due to Venezuela’s woes. If it actually occurs, we don’t see this change in OPEC as necessarily bearish but it will tend to cap some of the recent enthusiasm. Oil prices have mostly ignored the recent rise in the dollar, but eventually the stronger greenback will tend to adversely affect oil prices.

Facebook (FB, 183.80): Mark Zuckerberg was given kudos for coming to testify in Europe; that’s where the praise ended. The apology was more in the vein of, “I’m sorry you were upset,” and it was apparent that the company has no interest in changing its advertising-driven business model. At this point, social media’s greatest threat comes from Europe.

[1] https://www.reuters.com/article/us-turkey-ratings-s-p/turkeys-woes-could-quickly-sour-governments-finances-sp-idUSKCN1IN1WB

[2] https://www.cnbc.com/2018/05/23/conte-italy-populists-face-setback-on-their-new-leader.html

[3] https://www.ft.com/content/360dc63a-5dd3-11e8-9334-2218e7146b04

[4] https://www.ft.com/content/0ed87bcc-5e6f-11e8-9334-2218e7146b04

[5] https://www.reuters.com/article/us-global-oil/oil-dips-as-market-eyes-possible-easing-of-opec-supply-curbs-idUSKCN1IO01M?il=0