Daily Comment (March 23, 2017)

by Bill O’Grady, Kaisa Stucke, and Thomas Wash

[Posted: 9:30 AM EDT] Yesterday, there was a terrorist attack near Parliament in the U.K. Five people were killed (including the terrorist) and around 40 injured. Although reports suggest the attacker, who hasn’t been named yet, acted alone, eight others have been arrested. This attack followed the pattern where the terrorist uses a vehicle to attack pedestrians in a busy area and then uses a weapon in an attempt to escape or expand the attack. This mode was recently used in France and Germany. We suspect this method is being used because security in Europe has been tightened. For example, it may be more difficult to gather materials commonly used in bomb making because they are being tracked more closely. However, cars and trucks are ubiquitous and it’s hard to see how security forces can stop their use. It is noteworthy that many important public venues have been hardened; for instance, the number of barriers around Washington would tend to thwart vehicle attacks. But, hardening all areas would be almost impossible.

PM May did say the unnamed attacker had been known to MI-5, Britain’s internal security service (roughly equivalent to the FBI). However, being known and being stopped are clearly two different things. So far, all indications suggest this attacker was inspired, but probably not directed, by foreign jihadists.

What we found interesting about the attack was the market reaction, which was quite mild. Financial markets tend to follow a pattern where the first time an event occurs, it’s a huge deal, while each successive event becomes less significant. Although one could argue that the scale wasn’t all that big in this attack (relative to 9/11, for example), the act was still designed to terrorize. That part probably worked. But, financial markets are viewing these events in the proper context—they are something that one hopes shouldn’t happen but the single event doesn’t threaten the stability of the Western world.

There are reports that the American Health Care Act (AHCA) has been changed enough for the majority of the Freedom Caucus to vote for the bill. According to reports, senior members of this caucus will meet with the president at 11:00 EDT today. We believe that these changes make it almost certain to have no hope of getting through the Senate. If the bill fails in the House, we will likely see a knee-jerk decline in equities on fears that this loss will scotch tax reform. We tend to disagree with this assessment; instead, the president and Congress can simply move on to taxes. Health care is a quagmire; it would have made more sense to focus on tax reform first. We realize that there were hopes that some of the savings from health care reform could have been used to fund tax cuts, but that was always a long shot. If Ryan and Trump pivot to taxes after the AHCA passes the House but dies in the Senate, or simply dies, the drop in equities will probably be more of a welcome correction.[1]

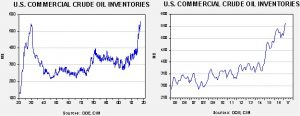

U.S. crude oil inventories rose 5.0 mb compared to market expectations of a 3.0 mb build.

This chart shows current crude oil inventories, both over the long term and the last decade. We have added the estimated level of lease stocks to maintain the consistency of the data. As the chart shows, inventories remain elevated.

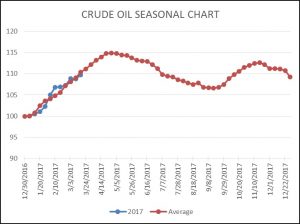

As the seasonal chart below shows, inventories usually increase into April before rising refinery operations for the summer driving season lower stockpiles. We did see refinery activity rise this week, which is a welcome sign. This week’s rise puts us just below normal. We saw a sharp rebound in crude oil imports that boosted inventories, reversing last week’s import weakness. So far, the numbers continue to indicate that we have about another month of inventory accumulation before oil inventories start their seasonal decline.

Based on inventories alone, oil prices are overvalued with the fair value price of $27.59. Meanwhile, the EUR/WTI model generates a fair value of $39.81. Together (which is a more sound methodology), fair value is $34.96, meaning that current prices are well above fair value. The data does show that the bullish case for oil mostly rests on a weaker dollar. If the dollar continues to soften, oil may be able to overcome the inventory overhang which should be approaching its seasonal peak.

_____________________________________

[1] Or, to use the parlance of a former colleague, a “pause to refresh.”