Daily Comment (March 21, 2018)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] It’s Fed day! Here is what we are watching this morning:

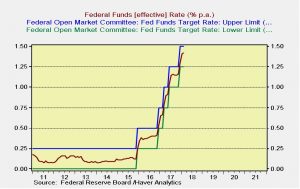

Powell speaks: The Fed meeting concludes today with virtual certainty of a 25 bps rate hike, taking the target to 1.75%. It should be noted that the target is actually the upper target rate; in reality, the rate that banks are actually charged is the effective rate, which runs in a 25 bps range with the target as the upper end of that band.

This chart shows the upper band, lower band (target -25 bps) and the effective, or actual, fed funds rate. After the rate increases today, we expect the effective rate, currently around 1.42%, to rise to 1.67%.

This is not the most important issue for today, however. The two most important issues are (a) what do the dots chart project for this year, and (b) how will Powell do in his first press conference? Powell is not an economist. He can’t use technical terms to provide a non-answer to a question. Our position is that transparency is not a virtue for the Fed. A Fed chair wants to maintain optionality and clarity works against that. Therefore, the potential for an unexpected market-moving event is elevated. Thus, we have been seeing what looks to us as position-squaring in financial markets. So, this afternoon we will see how Powell does.

Trade: The WSJ[1] is reporting that although the Trump administration is planning on unveiling tariffs on China this Friday, the reality is that nothing will be implemented immediately. The president clearly wants to use tariffs as bargaining chips. As we have mentioned before, if he simply wants to narrow the trade deficit through direct action, he should have supported the border adjustment tax. That would have been effective but it also would have restricted his ability to negotiate because he would have had nothing to use as “carrots and sticks.” For the financial markets, the trend in trade policy is not helpful, but the specifics are, for the most part, rather benign. In related news, the G-20 was unable to agree on a trade consensus; most nations wanted the U.S. to commit to a multilateral trade regime which the administration rejects on principle.

[1] https://www.wsj.com/articles/trump-to-ramp-up-trade-restraints-on-china-1521593091