Daily Comment (January 19, 2018)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EST] We are seeing continued strength in equities this morning and a modest decline in Treasuries. Here are some things worth noting today:

Shutdown looming: Although a continuing resolution passed the House rather easily, it looks like a long shot for the Senate to pass a similar measure. The Senate needs 60 votes to pass the measure and it’s not clear if it has unanimity among Republicans. Wars usually start because both sides overestimate the odds of success. Both parties believe the other party will take the blame for a shutdown. What we suspect will happen is (a) there will be a brief shutdown, (b) blame will be equally shared, with partisans blaming the other side loudly and often, and (c) financial markets won’t be all that concerned. We are seeing a modest decline in Treasury yields this morning but, given the recent rise, this may be nothing more than short covering. We doubt equities will be harmed significantly.

Davos: The Davos meeting is next week and President Trump is scheduled to make an appearance. The major media is anticipating an “Al Czervik” type of appearance, but we expect a more low-key event. We would look for the president to make his America First policy well publicized, which is in direct opposition to the Davos ethos. This will likely be a media event but not a market-moving event.

Trade wars: Two reports today suggest the administration is becoming increasingly agitated on trade. First, Bloomberg[1] is reporting that U.S. negotiators are “losing patience” over NAFTA talks and want Mexico and Canada to offer concrete proposals on major issues. Of course, neither nation has an incentive to make changes because the trade deal has been very positive for both. CNBC[2] is reporting that President Trump is anxious to sanction China on trade as well. Equity markets are clearly marching higher, boosted by the tax bill, which will lift corporate earnings this year and generate strong economic growth. However, a trade war could derail this trend. Our base case is that the president talks like a populist but governs like an establishment figure and we expect that to continue. But, if the president does start trade wars, equities would be adversely affected.

Japan upgrades: The Abe government raised its assessment of the Japanese economy for the first time in seven months due to a lift in consumer spending. If Japan continues to improve, we would expect the JPY to appreciate further. An improving economy and perhaps rising inflation will likely move the BOJ to reduce its very accommodative policy stance.

John Williams for Vice Chair? The WSJ[3] reports that the White House is considering John Williams, currently the president of the San Francisco FRB, for the position of Vice Chair. We rate Williams a “2” on our “hawk/dove” scale, meaning he is moderately hawkish on policy. The administration has also floated Mohammad El-Erian, Larry Lindsey and Richard Clarida for the job, although the latter is said to no longer be under consideration. The fact that Williams’s name has surfaced suggests the White House remains uncertain about this selection. All the candidates under consideration would be qualified; El-Erian would be the most dovish pick of this group, and we would rate him a “3” on our 1-5 scale, with “5” being most dovish.

Russia’s broke? During the oil boom years, Russia built a Reserve Fund, a sovereign wealth fund for “rainy days.” Apparently, the Putin regime is experiencing Seattle-like conditions because what was left of this Reserve Fund has been moved to the National Wealth Fund, which backs Russia’s pensions. Russia has faced a spate of bank failures over the past year and has apparently drained its sovereign wealth funds to fill the gaps caused by bailouts. This is occurring despite attractive oil prices. On the one hand, Russia will be tempted to cheat on its supply restrictions to raise revenue; on the other, doing so could lead to lower oil prices and exacerbate its precarious financial position. We expect Russia to hold the line on output and hope that U.S. output fails to grow as fast as expected (see below) and that problem states, like Venezuela, see continued declines in output.

Energy recap: U.S. crude oil inventories fell 6.9 mb compared to market expectations of a 2.9 mb draw.

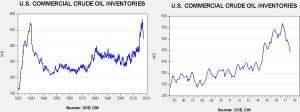

This chart shows current crude oil inventories, both over the long term and the last decade. We have added the estimated level of lease stocks to maintain the consistency of the data. As the chart shows, inventories remain historically high but they have declined significantly since last March, by 120 mb. This decline doesn’t take into account the withdrawal from the SPR, which added an additional 31 mb to supply. Taking the SPR into account, inventories fell a whopping 152 mb.

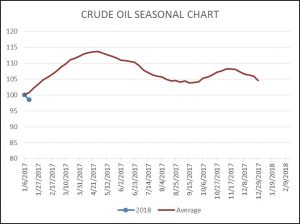

As the seasonal chart below shows, inventories fell this week. We are now at the beginning of the Q1 seasonal build season. The fact that oil inventories fell this week is quite bullish. If this pattern continues (and one week doesn’t make a trend), we could see stockpiles drop below 400 mb later this year, which would be at the high end of normal.

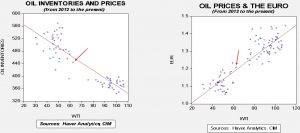

Based on inventories alone, oil prices are undervalued with the fair value price of $69.94. Meanwhile, the EUR/WTI model generates a fair value of $69.62. Together (which is a more sound methodology), fair value is $69.65, meaning that current prices, although elevated, are below fair value. The weak dollar and falling oil inventories are bullish for oil prices and suggest there is more upside, especially if inventories fail to rise in their normal seasonal fashion.

In the face of this bullish data, the IEA is projecting a major increase in U.S. oil output this year which has pushed oil prices lower this morning. In fact, the group is expecting production outside of OPEC to increase by 1.7 mbpd this year. Although this is possible, we have some doubts. Neither rig counts nor hiring levels have moved significantly higher. Although productivity has been increasing, a boom of this magnitude would need at least some increase in productive resources. As our analysis above suggests, oil prices are low relative to inventories and the dollar. The fact that there are a plethora of bears isn’t necessarily a bearish sign.

[1] https://www.bloomberg.com/news/articles/2018-01-18/u-s-said-to-be-losing-patience-as-key-nafta-issues-unresolved

[2] https://www.cnbc.com/2018/01/19/trump-is-determined-to-bite-somebody-and-china-is-the-most-likely-target-trade-expert-says.html

[3] https://www.wsj.com/articles/white-house-considering-san-francisco-fed-president-john-williams-for-feds-no-2-job-1516317905