Daily Comment (January 18, 2018)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EST] We are seeing a modest retreat in equities this morning after a major rally yesterday. The dollar is weakening after rising yesterday as well. Here are some things worth noting this morning:

China’s GDP: Although a highly manipulated number, last year’s GDP rose 6.9%, a bit faster than forecast. It appears that China did “goose” growth last year, ostensibly to make the CPC October meeting go smoothly. The great known/unknown with China is this—will Chairman Xi use his exalted position to implement a painful restructuring of the economy, which will reduce China’s debt level and push economic power away from the CPC elite and toward average households, or will he maintain current policies? Taking the hard road is unavoidable; at some point, China will need to address its debt problem. On the other hand, China still has debt capacity. One way it could continue to borrow would be to open up its capital markets to foreign buyers. The yield on Chinese 10-year sovereigns is 3.97%; with a stable exchange rate, we suspect foreign buyers would flock to buy Chinese debt. Now, going this route would be a “9th inning” signal because the introduction of foreign participation into China’s financial markets will bring market volatility, which is the primary reason China hasn’t made this move yet. We think odds favor Xi taking the hard road but, to date, Chinese leaders have known the debt is a problem and have backed away from reducing debt after numerous false starts. If they take the hard road, global growth will slow and commodity demand will decline as well.

Bond bear market: We will have more on this issue in next week’s Asset Allocation Weekly (which will be published on Friday in this report), but we have seen the 10-year move above 2.60% this morning.

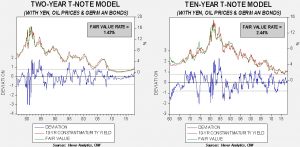

These charts show our basic interest rate model for the two- and 10-year Treasuries. The two-year is “cheap”; current yields are over 60 bps above fair value. Meanwhile, the 10-year yield is a bit higher than fair value. What we are seeing is a dramatic flattening of the yield curve. In general, the two-year is much more sensitive to fed policy whereas the 10-year is more sensitive to inflation expectations and oil prices. The rise in oil prices and the uptick in German yields is lifting the long end but the short end is also seeing a rise in yields. Usually, during periods of policy tightening, the two-year approaches its standard error line (the upper parallel line on the lower part of the graph). Thus, we expect continued weakness in the short end. Our expectation for 2018 was continued flattening of the yield curve because of depressed inflation expectations. We continue to monitor the rise in the long end but expect it to be gradual unless inflation surprises to the upside.

Government shutdown: Policymakers continue to struggle to make a deal to extend the government’s spending authority. We would not be surprised to see a temporary closure of the government, simply because the White House and party leaders are assuming the other side will take most of the blame for any dislocations. But, we expect any potential shutdown to be short and thus not a major market problem.

Cryptocurrencies: South Korea is considering closing exchanges and Bitconnect, an exchange platform, has closed on reports that it was running a Ponzi scheme.[1] Since mid-November, we have seen a definite inverse pattern between bitcoin and gold.

On the above chart, the black line is gold and the orange line is bitcoin. We view cryptocurrencies as similar to gold and this chart tends to confirm that belief.

Although we doubt this is the primary reason, one factor involved in the decision by South Korea and China to crack down on cryptocurrency exchanges may be to undermine North Korea’s economy. The latter has been accused of ransomware and money laundering activity which cryptocurrencies are famous for; perhaps China and South Korea see weakening the value of bitcoin as a way to weaken the Kim regime.

[1] https://techcrunch.com/2018/01/16/bitconnect-which-has-been-accused-of-running-a-ponzi-scheme-shuts-down/