Daily Comment (January 16, 2018)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EST] Welcome back from the long weekend! In a sense, not much has changed—equity markets continue to move higher. Here are the news items of note:

Germany’s political turmoil continues: The EUR has dipped this morning, a pause in a torrid appreciation, as two items are raising concerns about the recent SDP/CDU-CSU coalition agreement. First, the rank and file of the SDP must approve the agreement and it isn’t clear if the agreement will have enough votes. If the SDP members reject the deal, the coalition is dead and Chancellor Merkel will either have to run a minority government or call snap elections, both unprecedented in the postwar era. It should be noted that Merkel has ruled out a minority government, so we may be looking at new elections if the SDP fails to approve the coalition. The second problem is that the official opposition traditionally gets the budget committee chair in the Bundestag. If the SDP joins the government, the populist AfD will become the official opposition party and thus would gain control of this important committee. This committee is especially important because it approves funding for bailouts; in other words, if another EU crisis develops, this committee is key to establishing German support. The AfD is anti-EU and would likely oppose such measures. Although the EUR has lifted recently for a number of reasons, clarity on German governance has been a contributing factor to the rally. If Merkel does call new elections, it isn’t obvious that a more workable outcome will emerge—in fact, the AfD might do even better and push the SDP into political oblivion. Thus, we expect the SDP to approve the coalition but Germany may have to live with the AfD in a position of power.

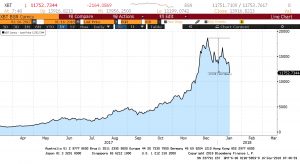

Cryptocurrencies tumble: The major cryptocurrencies fell over 20% overnight on growing concerns that governments are moving to crack down on this market.

This chart shows the daily close for bitcoin, the best known of the cryptocurrencies. We are down over 37% from the peak in mid-December. South Korea is considering a full ban on trading cryptocurrencies and two exchanges in the country were raided by authorities. The AP reports that France is considering tougher rules on bitcoin, primarily to prevent its use by criminals.[1] As governments become more aggressive in regulating the use of cryptocurrencies, maintaining valuations will become more difficult.

Government shutdown? It’s beginning to look like lawmakers may not be able to avoid a shutdown as government spending authority expires on Friday. The White House and Congressional Democrats have been trying to work out a deal on immigration for a funding bill. Those negotiations appear to have stalled which may lead to a government closure. We view this issue as political posturing on both sides. We suspect the White House believes a short-term shutdown over immigration will be seen as positive by right-wing populists, and Congressional Democrats probably feel that a shutdown over defending DACA is worth it as well. As long as the shutdown is very short (a weekend, perhaps), it isn’t a big deal. But, if it becomes longer, it will become a “spin war” as to who takes the blame. The rally we are seeing in Treasuries this morning may be due to ideas of a shutdown, which tends to support flight to safety buying.

Middle East news: There were a number of interesting news items out of the Middle East. Although none were market-moving outside local equity bourses, they show the degree of turmoil in the region. First, late last week, 11 Saudi princes were arrested for protesting the king’s decision to suspend state subsidies for utility bills for the royal family. This action was one of several austerity measures as the Kingdom of Saudi Arabia (KSA) tries to get spending under control. The KSA has also implemented a value added tax (VAT) and fuel price increases. The princes reportedly staged a “sit-in” at the palace in Riyadh last week, refusing to leave. We doubt the princes have garnered much public sympathy and, if anything, this move may bolster public support for the crown prince, who is seen as being behind these austerity measures. Second, we also note that the Riyadh Ritz (MAR, 139.78) has reopened to the public after the government requisitioned the facility as a high-class prison for royal family members and others who were accused of corruption in the November purge.[2] This probably means that those caught up in the purge have made deals with the government (expensive deals, most likely) to gain their freedom. In related news, Qatar has denied claims by the UAE that Qatari fighter jets intercepted an Emirates passenger aircraft. Last year, Qatar was blockaded by the rest of the GCC over a number of complaints, including the existence of Al Jazeera and its close relations with Iran.[3] The UAE’s accusations could further raise tensions in the region; in fact, they have become elevated enough for President Trump to tell the nations in the region to “cool it.”[4]

[1] https://apnews.com/a7126216919e435280356b51ed99e3e1/France-wants-tougher-rules-on-bitcoin-to-avoid-criminal-use

[2] See WGRs: Moving Fast and Breaking Things: Mohammad bin Salman, Part I, 11/20/2017; Part II, 12/4/2017; and Part III, 12/11/2017.

[3] See WGRs: The Qatar Situation: Part I, 8/7/2017; and Part II, 8/14/2017.

[4] https://www.bloomberg.com/news/articles/2018-01-16/trump-to-arab-gulf-countries-cool-your-jets