Asset Allocation Weekly (September 9, 2016)

by Asset Allocation Committee

Milton Friedman postulated that inflation expectations are established through a lifetime of experience. To some extent, the issue of inflation expectations is similar to other market gauges in our lives, such as the level of financial markets, interest rates and home prices. What we have experienced is considered as “normal” in our lives. Behavioral economists call this anchoring; it’s where we believe levels “should be” based on our experience.

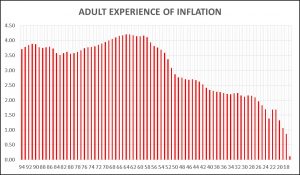

To get a feeling for this, we calculated the adult experience of inflation, looking at ages 16 to 94.

We have presented the “lifetime” experience of inflation on several occasions in the past. However, on this chart, we omit the data related to the first 16 years of an individual’s life on the assumption that children are less aware of inflation than adults. The difference is interesting. Essentially, Americans with the highest experience of inflation are in their late 50s and early 60s. By age 50, which is 34 years of inflation experience, the average inflation experience falls below 3%. And, by age 26, the average falls under 2%.

It makes sense that current policymakers are concerned about inflation. Vice Chairman Stanley Fischer is 73, while the youngest member of the FOMC, Neil Kashkari, is 43.[1] The allocation of hawks and doves doesn’t seem to follow an age pattern. In fact, the most important factor to determine policy stance is permanent voting members versus rotating voter members. The NY FRB president and the five governors, all permanent voting members, are moderates to doves. All the hawks are other regional FRB presidents who are rotating voters. But, the fact that the “dots” chart mostly shows high future rate levels does suggest that nearly all the FOMC members expect some degree of normalization. This is consistent with the adult inflation experience for the ages of the members.

The other factor this chart highlights is the expectations of investors. Older investors are likely more concerned about inflation because they have experienced it. As time wears on, the odds of inflation-inducing policy become lower because fears of it should decline. However, we would not expect this to become an issue for at least another decade. Thus, fears of rising long-term rates and duration risk are probably overestimated, for now.

________________________

[1] The current age breakdown for FOMC voting and alternate members is as follows: ages 40-44: 1 member, ages 45-49: 0 members, ages 50-54: 3 members, ages 55-59: 5 members, ages 60-64: 4 members, ages 65-69: 0 members, ages 70-74: 2 members.