Asset Allocation Weekly (July 29, 2016)

by Asset Allocation Committee

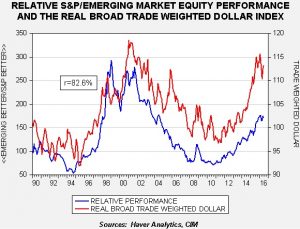

In the most recent rebalance of our Asset Allocation portfolios, we maintained an allocation to emerging market equities in the Aggressive Growth portfolio. As we have noted in the past, there is a positive relationship between the dollar’s exchange rate and the relative performance of developed market equities and emerging market equities.

This chart shows the relative performance of the S&P 500 and the MSCI emerging market index (denominated in dollars). A rising blue line on the chart signals stronger S&P performance relative to emerging markets and vice versa. Using the JPM dollar index, we note the dollar bottomed in late 2011. As the dollar appreciated, the S&P began to consistently outperform emerging markets.

The most important factor boosting the dollar was monetary policy divergence. The Federal Reserve ended its balance sheet expansion in December 2014. It raised its policy rate in December 2015. This tightening occurred while the European Central Bank (ECB) and the Bank of Japan (BOJ) both continued to implement aggressively accommodative policies. The dollar’s strength clearly accelerated in the 2014-15 period, although the rally has stalled this year. We believe the stall has occurred because of uncertainty surrounding U.S. monetary policy. Initially, the FOMC signaled four rate hikes this year. Currently, fed funds futures are suggesting no rate hikes this year and perhaps only one hike next year. If this does become the path of policy, the dollar bull market may be coming to a close unless the ECB and BOJ become even more aggressive in policy easing. If we are reaching the point where further accommodation isn’t possible, a stronger dollar is less likely and thus, emerging market equities become attractive given their recent relative weakness.

However, due to the uncertainty over the direction of policy, as noted above, the asset allocation committee has judged emerging market equities as only appropriate for aggressive investors. If the FOMC tightens policy sooner or to a greater degree than expected, developed markets could begin to sharply outperform emerging markets again. Given that market expectations are leaning heavily toward steady Fed policy, there is the potential for a bearish surprise for the emerging equity sector. Thus, in our judgement, only the most risk tolerant investors should be considering emerging market equities at this time.